How To Build a Financial Model For a Bakery

Whether you want to understand what’s your breakeven, your valuation or create a budget for the business plan of your bakery (or a donut or pastry shop), you will need to build a solid financial model.

In this article we’ll explain you how to create powerful and accurate financial projections for a small bakery with 4 employees. Note that the numbers, charts and financials presented in this article come from our financial model template for bakery and pastry shops.

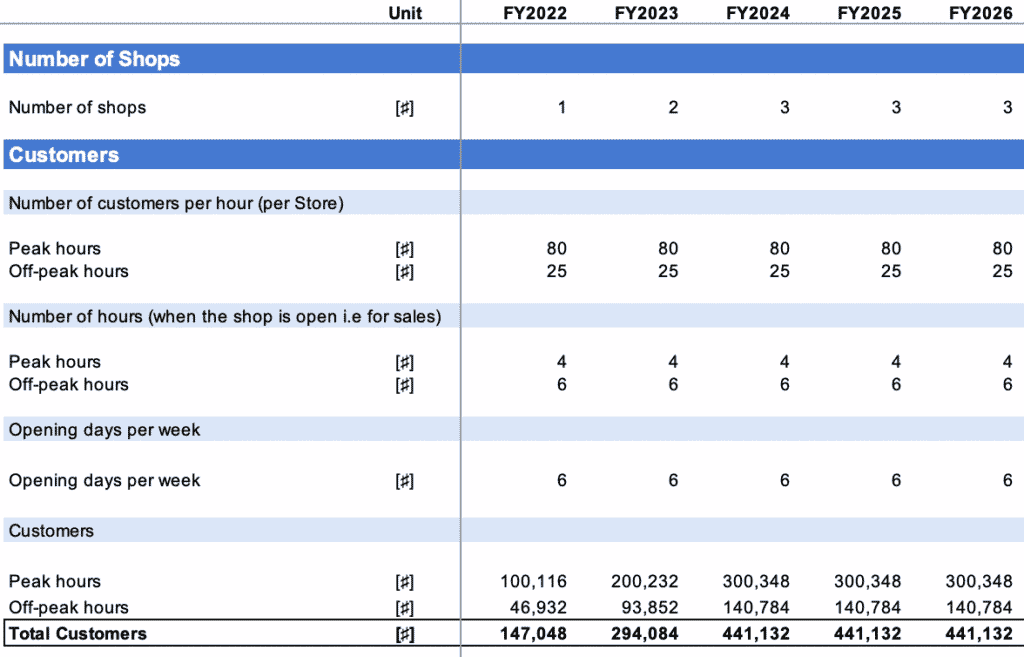

1. Forecast Customers

The first thing you must do to create a financial model for your bakery or pastry shop is to forecast the number of customers you will attract over time. You can do it the easy way or make it more complex based on your requirements.

The guidelines below are our recommendations to create accurate and flexible customer projections for any bakery (or pastry shop). To forecast customers, you must set the number of:

- Customers you expect to serve on average during peak hours vs. off-peak hours instead

- Hours during peak hours (for example 4 hours from 8am to 10am and 12pm to 2pm) vs. off-peak hours (say, 8 hours in between)

- Days you are open in a week on average (for example 4 weekdays and 2 weekend days if you are open Tuesday to Sunday)

The second input you can add to your financial projections are the number of stores you operate. This is very useful if you run a number of franchise bakeries for example. If so, simply multiply the number of stores by the number of customers per store as shown below:

That way, you will be able to forecast accurately the total number of customers you can serve over time, as well as the revenues which we will now see in the next section.

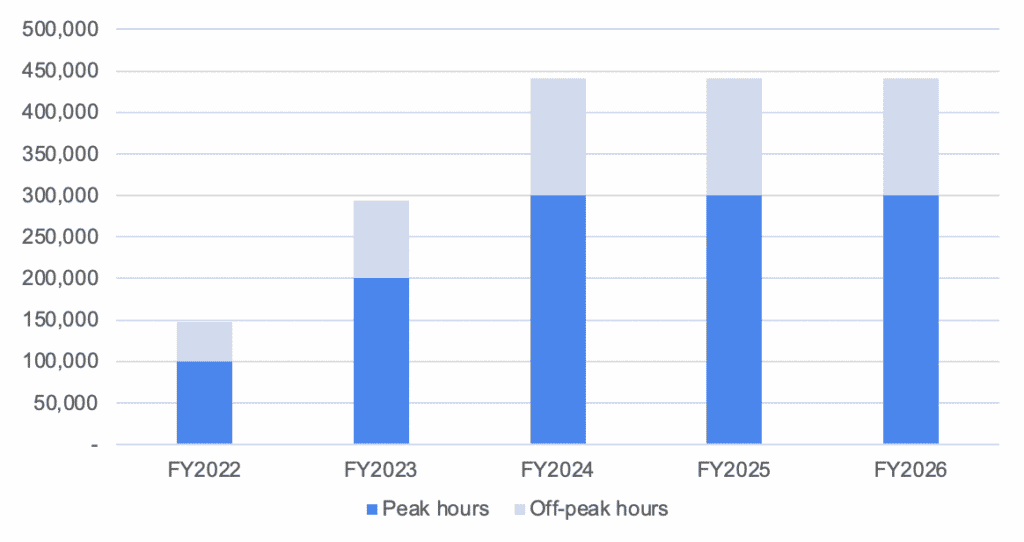

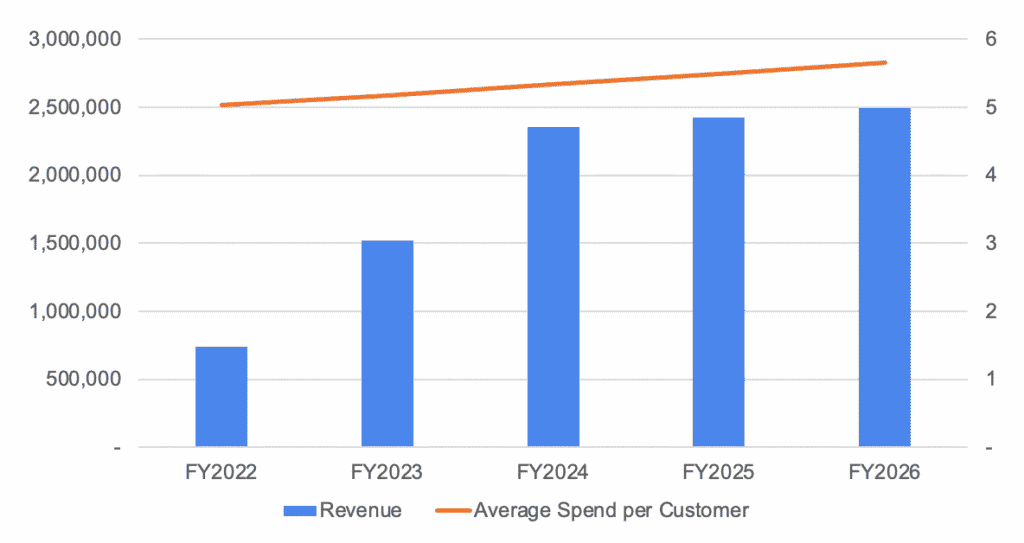

2. Forecast Revenue

Now that we have estimated the number of customers over time, the 2nd step of our bakery (or pastry) financial model is to calculate revenue.

Yet, before we do so, we must break down the number of customers into the different products they may buy. Indeed, most of you customers may buy a baguette at an average price of $2.20, yet some may also buy other products such as bagels & buns for $2.50, snack cakes for $4.50 or even a menu for $12.50, etc.

It’s very important to break it down right. Indeed, as you know all these products have very different unit economics (prices and profit margins) you need to forecast accurately. Let’s see now how.

First, break down the products into a percentage of your total customers. For example:

- 20% of the customers may choose to get a baguette (or a number of baguettes) at an average price of $2.20;

- another 25% buy a bagel or a bun at an average price of $2.50;

- 20% buy snack cakes for $4.50, and so on..

That way, you can now multiply the number of customers for each product by their respective price to obtain revenue as well as the average spend per customer.

3. Forecast Expenses

In addition to the one-time startup costs discussed here, you must also budget for all the operating costs of running a bakery. This is the 3rd step of our bakery financial model.

The operating costs depend on the size of your bakery and the products you offer. Here’s a brief overview of the operating costs which you can expect for a typical 1,500 sq. ft. bakery shop with 4 full-time employees (2 bakery cooks + 2 clerks).

| Operating cost | Amount |

|---|---|

| Raw materials | $13,400 – $16,800 |

| Rent & utility bills | $4,000 – $5,000 |

| Staff costs | $16,000 – $20,000 |

| Marketing | $2,000 – $4,000 |

| Other (tableware, software, bookkeeping etc.) | $2,000 – $3,000 |

| Total | $41,950 – $48,150 |

Raw Materials

The cost of raw materials (the ingredients) and staff are the largest monthly expenses for a bakery shop.

First, let’s start with raw materials: you can expect to pay around 28-35% of your sales in raw materials.

Let’s assume:

- Your team attends to 400 orders per day (breads, pastries, drinks, menus for lunch etc.); and

- An average order value of $5

The total monthly revenue of your bakery would then be $48,000 (assuming 6 days a week). Thus, you would spend anywhere around $13,400 to $16,800 on raw materials.

Rent & Bills

If you have leased your bakery shop, you must pay monthly rent. The amount you pay for monthly rent will depend on various factors like the size of the space, lease or purchase, location, and others.

Using the same Chicago example earlier ($30 per square foot per year), you would be paying around $3,750 per month in rent for a 1,500-square-foot space.

Besides rent, you also need to pay for other utilities & bills like electricity, water, gas and internet service which would be around $1,000 – $2,000. Thus, the total rent and bills which you need to pay would be around $4,750 – $5,750 per month.

Staff Salaries

Payroll and labor expenses are another major expense for all bakery shops.

Assuming you hire 4 employees with yourself as the manager, you should expect to spend around $20,000 per month on salaries (including taxes and benefits). Indeed:

Tip: when forecasting salaries, make sure to take into account hours per shift and total hours per week. For example, if you operate 2 shifts per day 6 days a week (each shift with 2 employees each), your full time equivalent employees will be 4.8 (and not 4 to account for the 6 days a week).

Marketing

You must engage in appropriate marketing and advertising to attract loyal customers and boost your sales in your bakery shop. Your marketing expenses will depend on the media employed and your target audience.

Marketing costs will be expensive during the initial six months of your business. As you launch your bakery shop, you need to put up a sizable expenditure before you start expecting organic traffic & growth.

You should spend around 3-6% of your monthly sales on marketing. Taking the $60,000 gross revenue bakery shop example above, you should typically spend around $1,800 – $3,600 in marketing per month.

Insurance

A bakery shop belongs to the food and beverage industry. According to Insureon, the average insurance costs for the industry are:

- General liability insurance: Median monthly premium – $40

- Workers’ compensation insurance: Median monthly premium – $115

- Business owners’ policy: Median monthly premium – $135

- Commercial auto insurance: Median monthly premium – $165

If you consider buying all types of insurance, you will be paying $455 monthly.

4. Build your P&L and Cash Flow Statement

The final step for our pizzeria financial model is to build the profit-and-loss (P&L) from revenues down to net profit, as well as the cash flow statement.

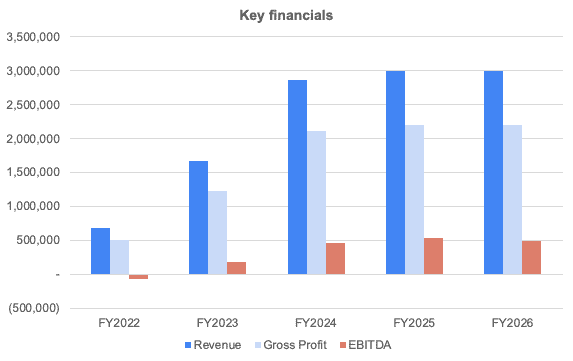

The profit-and-loss (P&L) is rather simple to build once we have future revenues and expenses. Simply take your revenues and subtract all expenses. The P&L will also help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own bakery or pastry shop.

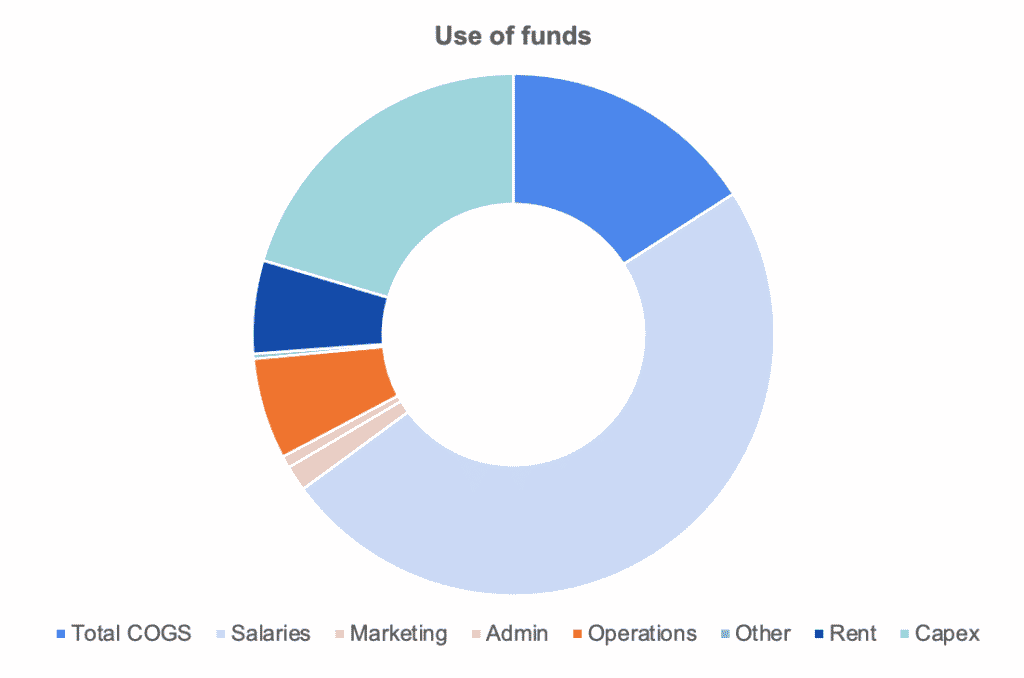

In this chart below, we’re showing you an example of a typical cost structure small bakery shop with 4 employees would have. Unsurprisingly, salaries, rent and COGS represent ~70% of total expenses.