How To Build a Financial Model For a Coworking Space

Every business needs a budget. Whether you want to understand what’s your breakeven, your valuation or create a financial model for your coworking business plan, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a coworking space business.

1. Forecast active members

The first thing you must do is to estimate the number of active members. They are a function of the members you acquire and retain over time. The number of members that leave is also known as churn:

Active members = new members – churn

We strongly recommend you create monthly forecasts. That way, you will be able to take account seasonality (customers tend to sign up to coworking offices more so post summer for instance).

Also, if you have different memberships instead, make an assumption on the breakdown between the different plans. For example, 80% of members would choose the “Basic” plan in average, and 20% the “Premium” plan.

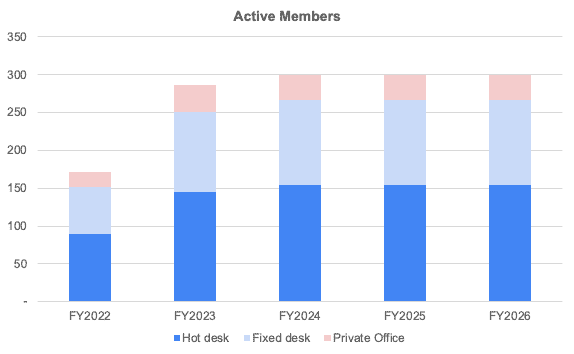

Finally, you should assume a maximum number of active members as the coworking is constrained in capacity (you can’t have too many members or they might have to sit on the floor, which of course can’t happen).

Assuming a coworking space with 300 maximum members capacity, this is what you could obtain:

2. Forecast revenue

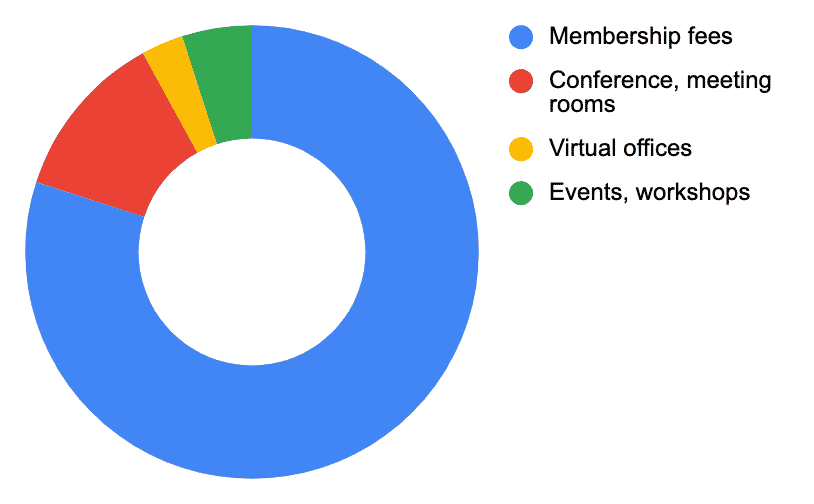

As discussed in our article here, coworking spaces have 4 main revenue streams:

- Membership revenue

- Renting conference and meeting rooms

- Virtual offices

- Events & workshops

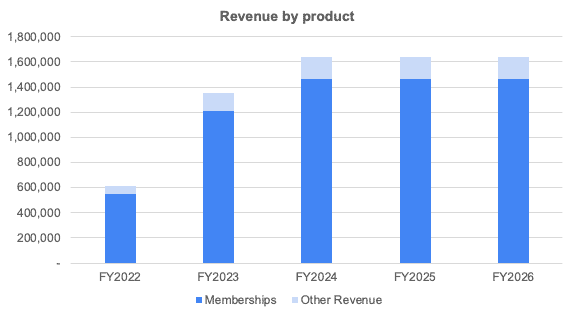

The latter 3 can be grouped into 1 single “other revenue” stream in your coworking financial model. Indeed, it’s often low vs. membership revenue that represents ~80% of coworking spaces revenue in average as shown below.

Membership revenue

Membership revenue is straightforward. Simply multiplying the number of active customers by the respective monthly fee, for each membership plan.

Other revenue

The 3 revenue streams that are conference and meeting rooms, virtual offices and events & workshops can be estimated as follows. For each:

- Make an assumption of the percentage of active members who purchase such product/service in a given month. For example, 10% of “Basic” users in average subscribe to a monthly virtual office service

- Assume a price per service. For example, the monthly virtual office service is $30 extra a month

- Multiply (1) and (2) by the respective active members

Finally, you should obtain a forecast of your revenues like the chart below. Of course, your revenue streams might be different. For example, renting conference rooms might be a bigger part of your income. This is purely for illustrative purposes to give you an idea of how revenue projections might look like.

3. Forecast expenses

In addition to startup costs you pay when you open a new coworking, there are a number of expenses you need to budget for to run the business. They are:

Rent

Premises is often the most substantial cost of owning and operating a coworking space. Like a residential or a commercial property, your initial cost depends on the location and the size of the area. So iIf you plan to rent the premises, you will want to look at the average commercial rent price per square foot. For instance, based on the publicly available commercial real estate leasing data, the average rent for office space in New York is around $80 per square foot.

Salaries

Another considerable expense when setting up the co-working spaces is salaries for your employees. Ideally, the total cost will depend on the number of full-time and the part-time staff you need. As an example, the average WeWork Community Manager earns an estimated $72,945 annually.

Utility bills

Similar to salaries, utility bills will recur each month. The bills include the cost of water, electricity, and internet. Logically, the larger the coworking space, the higher the cost.

Marketing and paid advertising

You need to ensure proper marketing to attract reliable customers. Therefore, make sure you set aside a marketing and advertising budget. The total cost will depend on the medium used and the target audience.

Typically, marketing and paid advertising will cost more in the first 6 months of operation. Indeed, as you’re opening up the business, you’ll need a significant budget to promote your coworking office before you can rely on organic growth (word-of-mouth).

Cleaning services

You have to keep the offices clean to attract and retain customers. The janitorial services will depend on the office space and the additional services like lawn maintenance and kitchen.

Bookkeeping fees

Like all other businesses, coworking space business has to ensure proper bookkeeping. This means using a bookkeeping software (Quickbooks for example) as well as an accountant. Typically, you should expect to set aside $250 to $500 a month for bookkeeping.

Insurance

Coworking spaces need to have a proper insurance in place before they do business.

This includes the standard General Liability Insurance which shall protect you from property damage but also any medical costs that may arise if someone gets hurt in your premises. The average cost for a General Liability insurance for a coworking space is around $500 a month.

4. Build your P&L And Cash Flow

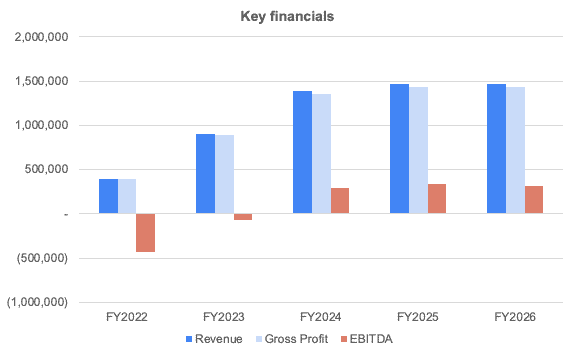

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key metrics from your financial statements as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “CapEx”), fundraising, debt, etc.

A cash flow forecast is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own coworking space.

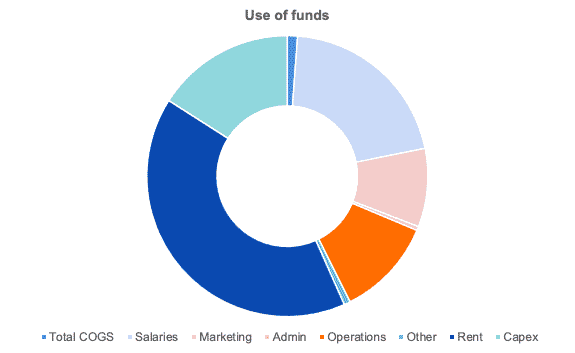

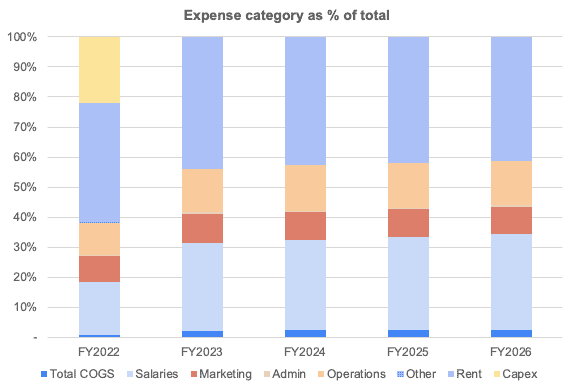

In the chart below, we’re showing you an example of a typical costs a coworking office would incur, from rent to marketing and salaries: