How To Build a Financial Model for a Day Care

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your day care, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a child care facility with 50 children.

1. Forecast Children

The first step of any financial model is to forecast the main driver to your revenue: what moves up or down revenue? For day care, it’s either pricing or the number of children.

Let’s first forecast the number of children, it is the result of:

- The number of rooms (classrooms) you have; and

- The capacity per room (say, 5 children per classroom); and

- The occupancy rate of each room. For example, if a room is at 75% occupancy rate, it means there are only 4 children in a room with a maximum capacity for 5 children.

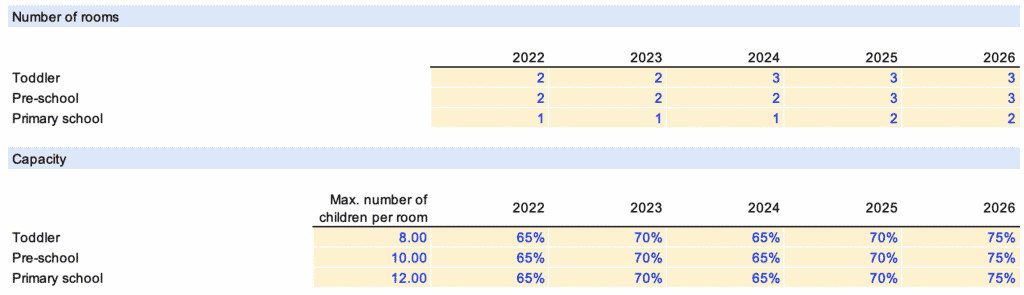

All these parameters can either be set for the day care business as a whole, or instead we can have separate assumptions for each child category (e.g. toddler, pre-school, primary school) and over time (over the next 5 years). See an example below:

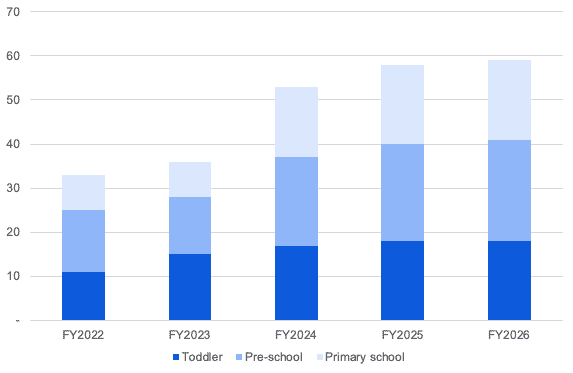

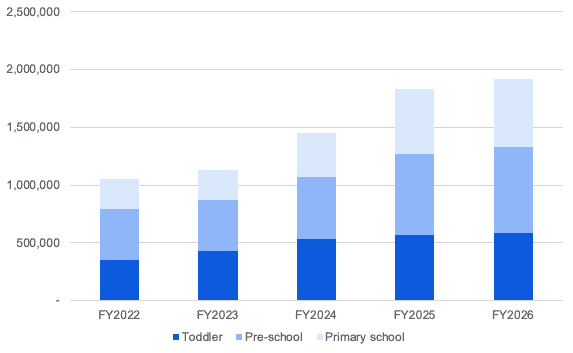

With these assumptions set, we can now forecast the number of children over time as shown in the chart below:

2. Calculate Revenue

Now that we have estimated the number of children we expect to take care of in the future, let’s now look at how much revenue we can generate for the business.

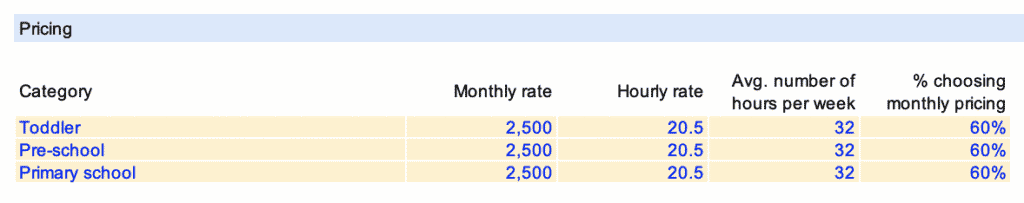

As explained earlier, the 2nd driver to revenue is pricing. For day care businesses there is usually 2 different prices:

- Price per hour for families who need more flexibility (e.g. $20 an hour)

- Price per month for families who prefer a fixed rate for taking care of their children the whole month (say $2,500 a month)

With that in mind, we also need to set 2 additional assumptions here:

- The average number of hours per week for those who choose a price per hour ; and

- The percentage of families who pay monthly vs. hourly

Pricing assumptions can be set as shown in the example below:

Now, we can easily calculate revenue from the 3 different segments we have set up earlier (toddler, pre-school and primary school):

4. Forecast Expenses

Apart from the one-time startup costs you need to pay before opening your day care center, you should also budget the recurring or operational costs you’ll pay monthly to run your business.

The operating costs will vary slightly depending on the size of your child care center and the amenities (indoor and outdoor playground, sleeping area, etc.). We have outlined below a brief overview of the operating costs you can expect for a 7,000 sq. ft. child care facility with 50 children:

For more information on how much it costs to start and run a day care business, read our complete guide here.

| Operating Cost | Amount (per month) |

|---|---|

| Rent & utility bills | $9,000 |

| Caregivers salaries | $35,000 – $40,000 |

| Management & admin salaries | $7,500 – $10,000 |

| Supplies (food, beverage, etc.) | $20,000 – $33,000 |

| Other (bookkeeping, security, housekeeping, etc.) | $4,000 – $8,000 |

| Total | $75,500 – $100,000 |

Rent & Utility Bills

If you’re leasing your child care center, you’ll have to pay a monthly rent which will vary according to the size and location of the real estate.

Using the above example, you’ll have to pay for $7,500 in rent each month for a 7,000 sq. ft. facility.

Besides the rent, you also have to pay utility bills (gas, water, electricity, phone). These utilities would cost around 25-30% of your rent, so an additional $2,000.

Caregivers Salaries

Staff costs are the largest expense for a child care center. To provide the highest quality of care and life to the children, you need to hire an adequate number of efficient staff who care for your residents regularly without failing or negligence.

The average annual gross salary for Day Care caregivers is $30,520 in 2022. Day care teachers instead were paid an average annual salary of $52,000.

Assuming you keep a ratio of children / caregivers or 5:1, you will need to hire 10 employees. This translates to about $35,000 – $40,000 in salary costs each month (including 20% for taxes and benefits).

Management salaries

In addition to the caregivers, you will need to hire a manager as well as a support team for operations (human resources, finance, etc.). Of course, the number of management & administrative roles depend on the size of the day care facility and the children you have.

For a 50 children facility, you should be fine with 1 manager and 1 assistant manager.

Day care managers earned on average $45,000 per year. So you should set aside $7,500 to $10,000 for management roles salaries.

Of course, you can also hire 1 cleaning operators if you take care of housekeeping in-house and don’t outsource these functions to a 3rd party company.

Supplies

Supplies are one of the most important expenses for a child care center. There are 2 types of supplies: food & beverage and essential supplies.

a) Food & beverage supplies

You must provide fresh, nutritious, delicious, and healthy food to the children. On average you should spend $350 to $600 per children per month.

So assuming that your facility has 50 children, you should expect to spend around $17,500 $30,000 on monthly food & beverage supplies.

b) Essential Supplies

Besides the big equipment costs which you’ll pay while starting your child care center, you’ll also need to budget for the continual supplies every month.

On average, essential supplies cost $60 per child, therefore you should keep aside $3,000 per month here assuming your day care facility accommodate 50 children.

4. Build your P&L And Cash flow

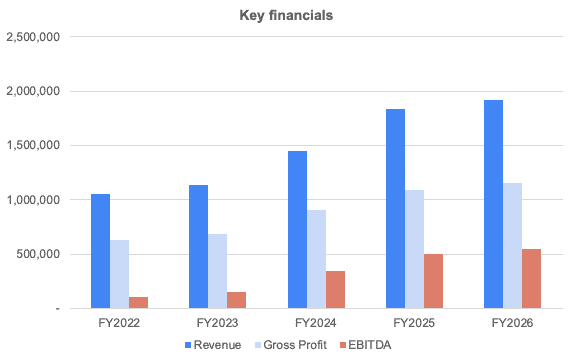

Once we have forecasted revenues and expenses, the last step to complete our day care facility financial model is to build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own day care.

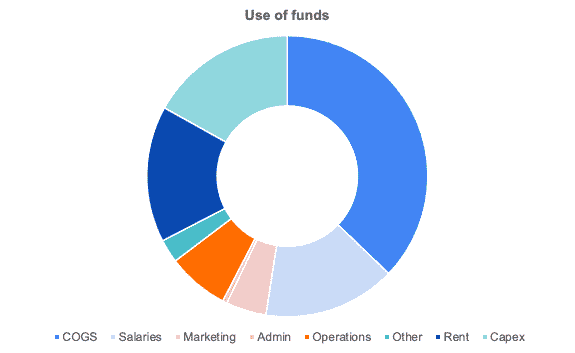

In this chart below, we're showing you an example of a typical cost structure a standard day care for 50 children would incur. Unsurprisingly, COGS (supplies, food, etc.), salaries and rent represent more than 65% of total expenses.