How To Build a Financial Model For a Gym

Every business needs a budget. Whether you want to understand what’s your breakeven, your valuation or create a financial model for your gym or fitness club business plan, you’ve come the right way.

In this article we’ll explain how to create powerful and accurate financial projections for a gym business.

For more information on gyms & fitness clubs, make sure to read our guides below: How to Open a Gym or Fitness Club in 10 Steps? How Much Does It Cost To Open a Gym? 8 Strategies To Increase Your Gym Revenues The Business Plan Template You Need For a Fitness Club

1. Forecast active members

The first thing you must do is to estimate the number of active members. They are a function of the members you acquire and retain over time. The number of members that leave is also known as churn:

Active members = new members – churn

We strongly recommend you create monthly forecasts. That way, you will be able to take account seasonality (customers tend to sign up to gyms more pre than post summer).

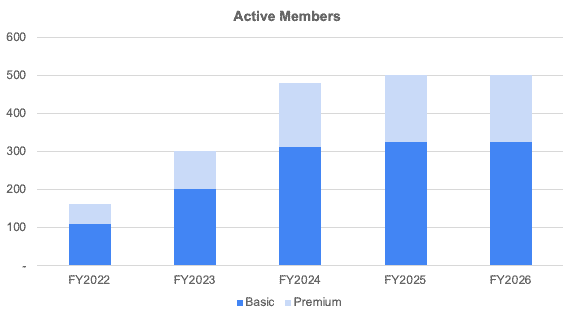

Also, if you have different memberships instead, make an assumption on the breakdown between the different plans. For example, 80% of members would choose the “Basic” plan in average, and 20% the “Premium” plan.

Finally, you should assume a maximum number of active members as the gym is constrained in capacity.

Assuming a gym with 500 maximum members capacity, this is what you could obtain:

2. Forecast revenue

When it comes to fitness clubs, there are 3 main types of revenue streams:

- Membership revenue

- Classes revenue

- Merchandising

Membership revenue

If you offer subscriptions (instead of classes-only gyms), you should forecast membership revenue simply by multiplying the number of active customers by the respective monthly fee.

Classes revenue

If you offer classes, whether in addition or included within the membership you sell, you must first forecast the number of classes (and the students). This can be done by:

- Setting the number of classes per week (say 12)

- The capacity per class (say 20 students per class)

- The capacity rate (say classes are 60% full on average)

Of course, the number of classes taken must be in line with the number of active members. For example, the following wouldn’t make sense:

- 30 classes per week

- 30 students per class

- 100% capacity rate

- 100 active members

Indeed, this would mean that each of the 100 members take in average 9 classes a week which seems unrealistic.

Once you have estimated the number of classes, multiply by the price per class to calculate revenue.

Tip: make sure to take into account any discount that may be part of a subscription. For example, if the "Premium" plan gives 25% discount on classes. This feature is already built in our financial model template.

Merchandising revenue

Most gyms make an extra revenue by selling additional products and services fitness and activewear products (also known as merchandising).

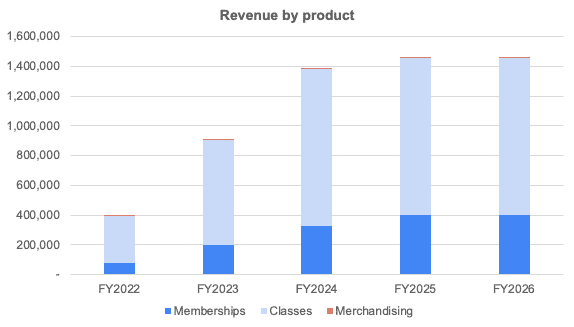

Finally, you should obtain a forecast of your revenues like the chart below. Of course, your revenue streams might be different. For example, you might only offer memberships and your classes are included in the price. Or merchandising might be a bigger part of your income. This is purely for illustrative purposes to give you an idea of how revenue projections might look like.

3. Forecast expenses

For expenses, make sure to include typical expenses incurred by gyms and fitness clubs such as:

Salaries

Unsurprisingly, monthly and hourly salaries are one of most important expenses you’ll have to budget for to run a gym. From the trainers themselves (who are often paid with a mix of fixed salary and variable compensation), to the operations staff and receptionists, make sure you budget accordingly payroll expenses at the outset.

Marketing and advertising

To maximise your gym revenue, you should invest in advertising and marketing. Typically, this includes online and offline marketing.

Typically, marketing will cost more in the first 6 to 12 months of operation. Indeed, as you’re opening up the business, you’ll need a significant budget to promote your fitness club before you can rely on organic growth (word-of-mouth).

Most often, online marketing for fitness clubs is a combination of paid ads (e.g. Google Ads, Facebook, Instagram) and influencers.

In addition to online marketing, offline marketing is also very effective as gyms are local businesses. Indeed, you can reach a large audience by advertising your gym on billboards for instance within a certain radius. In addition to billboards, you can create partnerships with company headquarters, coworking spaces, etc.

Utility bills & janitorial services

You will need to budget for utility bills (electricity & water) as well as janitorial services (e.g. cleaning). It goes without saying that ensuring cleanliness for your customers goes in hand with customer satisfaction and word-of-mouth.

Assuming you’d need to hire a third-party cleaning company every day for 4-5 hours, you could well look at $5,000 to $7,500 a month alone just for cleaning services.

Bookkeeping

Like all other businesses, coworking space business has to ensure proper bookkeeping. This means using a bookkeeping software (Quickbooks for example) as well as an accountant. Typically, you should expect to set aside $250 to $500 a month for bookkeeping.

For example, this is what the breakdown of expenses could look like (from our financial model template):

4. Build your P&L And Cash Flow

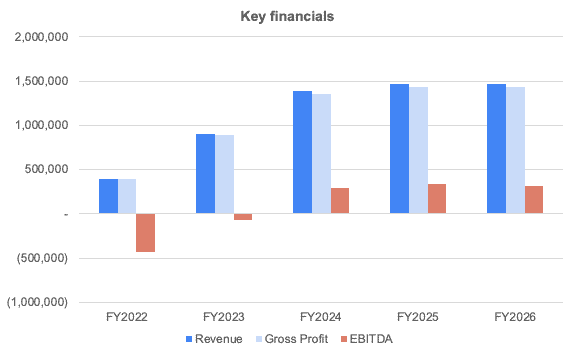

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own gym.

In this chart below, we're showing you an example of a typical costs a gym would incur, from marketing, capex to salaries.