Hi-5 ABA Franchise FDD, Profits & Costs (2025)

Hi-5 ABA is a franchise dedicated to Applied Behavior Analysis (ABA) therapy, primarily supporting children with developmental disabilities such as autism. Established in 2018 and based in Warrenton, Virginia, the franchise began offering opportunities to prospective franchisees in 2019.

The Hi-5 ABA franchise model empowers Board Certified Behavior Analysts (BCBAs) to own and manage their own practices while benefiting from comprehensive administrative support provided by the franchisor.

Key services include credentialing, billing, payroll management, and more, enabling franchisees to focus entirely on delivering exceptional clinical care and achieving positive outcomes for their clients.

This approach not only preserves the clinical autonomy of BCBAs but also facilitates the delivery of high-quality care while building a thriving business. By combining clinical excellence with operational efficiency, Hi-5 ABA distinguishes itself within the ABA therapy field, delivering vital services to communities nationwide.

Initial Investment

How much does it cost to start a Hi-5 ABA franchise? It costs on average between $16,000 – $75,000 to start a Hi-5 ABA franchised center.

This includes costs for office setup, therapy equipment, licensing, and initial operating expenses. The exact amount varies based on several factors, including the size of the practice, the location, and whether the franchisee decides to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $500 – $15,000 |

| Lease/Utility Deposits | $0 |

| Leasehold Improvements/Signs | $0 |

| Technology System Equipment | $600 – $2,500 |

| Technology System Services | $93 – $780 |

| Business Equipment and Supplies | $300 – $500 |

| Business Licenses and Permits | $0 – $375 |

| Insurance | $1,000 – $3,000 |

| Professional Fees | $500 – $2,000 |

| Initial Training Expenses | $0 |

| Marketing | $125 – $575 |

| Additional Funds (6 Months) | $12,500 – $50,000 |

| Total | $15,618 – $74,730 |

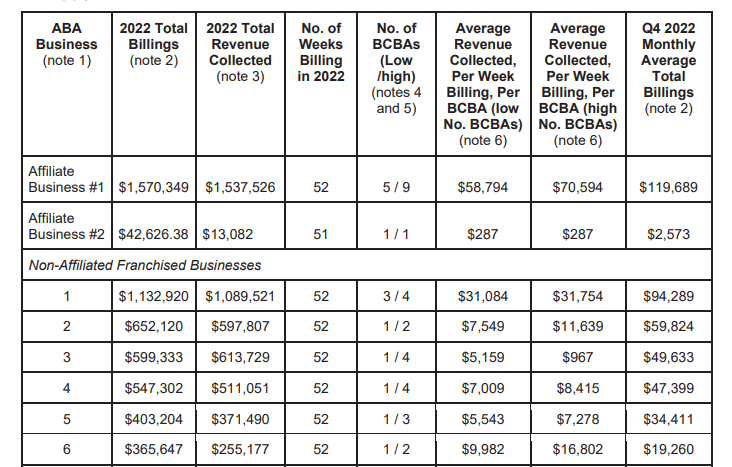

Average Revenue (AUV)

How much revenue can you make with a Hi-5 ABA franchise? A Hi-5 ABA franchised facility makes on average $238,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Hi-5 ABA locations are there?

As of the latest data, Hi-5 ABA operates a total of 29 locations across the United States, comprising 28 franchised units and 1 corporate-owned unit.

These locations span over 18 states, including Virginia, California, and Texas.

What is the total investment required to open a Hi-5 ABA franchise?

The total investment required to open aHi-5 ABA franchise ranges from $16,000 to $75,000.

What are the ongoing fees for a Hi-5 ABA franchise?

Hi-5 ABA franchisees are required to pay an ongoing royalty fee of 8% of their gross revenues. Additionally, there is a 20% fee on billables, which covers various administrative support services provided by the franchisor. This 20% fee decreases as the franchisee’s office reaches certain benchmarks. There is no specified separate marketing or advertising fee.

What are the financial requirements to become a Hi-5 ABA franchisee?

To become a Hi-5 ABA franchisee, you should have a minimum net worth of $100,000 and at least $20,000 in liquid capital. Additionally, Hi-5 ABA offers financing options and a 10% discount on the first territory franchise fee for veterans.

How much can a Hi-5 ABA franchise owner expect to earn?

The average gross sales for a Hi-5 ABA franchise are approximately $0.24 million per location. Assuming a 15% operating profit margin, $0.24 million yearly revenue can result in $36,000 EBITDA annually.

Who owns Hi-5 ABA?

Hi-5 ABA is owned by David Maddox, J.D.who co-founded it.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.