How to Build a Financial Model for a Nursing Home

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your nursing home, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a nursing home with 30 rooms. Yet you can of course apply the same logic for any assisted living facility of any size (independent or franchise).

Also note that the charts and examples presented in this article come from our nursing home financial model template.

1. Forecast the Number of Residents

The first thing you must do when preparing your financial projections for a nursing home is to forecast the number of residents you will accommodate and care for in the future. This can be done in a few steps:

- First, forecast the number of rooms (you might expand the size of your facility progressively over time)

- Secondly, set the occupancy rate (the percentage of rooms that are occupied vs. empty)

- Finally, calculate the number of residents = number of rooms x occupancy rate

1.1. Rooms

The first step of your nursing home financial model is to forecast the actual number of rooms that are available over time. They may or may not change: for example you could plan to start with 15 rooms, and expand to 25 in 3 years if all goes well by then.

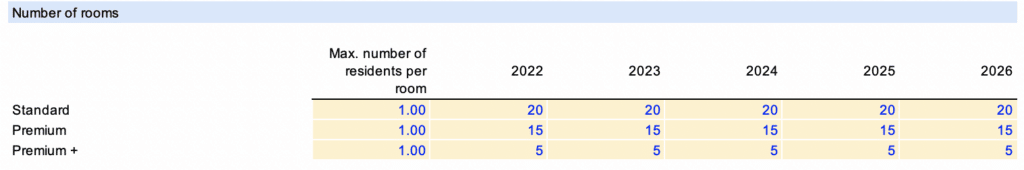

When setting the number of rooms, make sure to segment the rooms by category as shown below (if you have different categories of course). Indeed, as we will see later, each room category will have a different monthly rate and associated costs.

In our example here, we assume there are 3 different categories (standard, premium and premium +) for different levels of service quality and amenities. We assume the number of rooms stays the same throughout the next 5 years.

Tip: we also recommend having for each category a number of residents per room. Indeed, you might offer certain rooms where you accommodate for example couples.

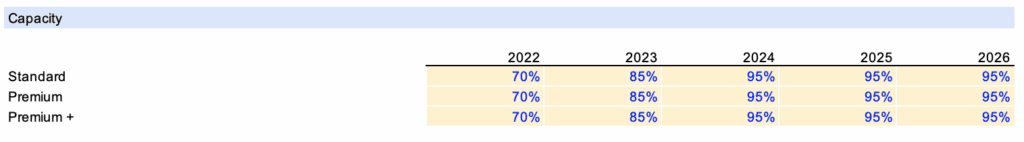

1.2. Occupancy rate

Occupancy rate should be set per month. Indeed, you may not ever be at full capacity, and your occupancy rate will likely increase progressively over time as your nursing home benefits from recommendations and word-of-mouth as well as efficiencies.

1.3. Number of residents

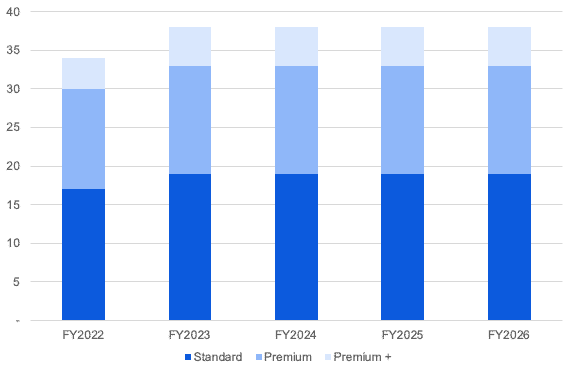

Now that we know both the number of rooms and the occupancy rate over time, the number of residents is simply the result of, for each room category:

Residents = Number of rooms x Occupancy rate

So for example for January 2023:

Nights booked = 70% occupancy rate x 30 rooms = 21 residents

You should now be able to obtain the following chart over the next 5 years:

2. Calculate Nursing Home Revenue

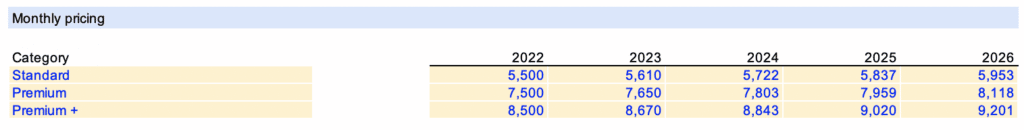

In order to forecast revenue, we first need to set up a few assumptions for pricing. This can easily be done by setting different monthly rates for each room category as shown below.

Finally, we strongly recommend you use a yearly price increase, to factor in inflation over time (2% in our example here).

From there on, revenue simply is the result of, for each room category:

Revenue = Monthly rate x residents

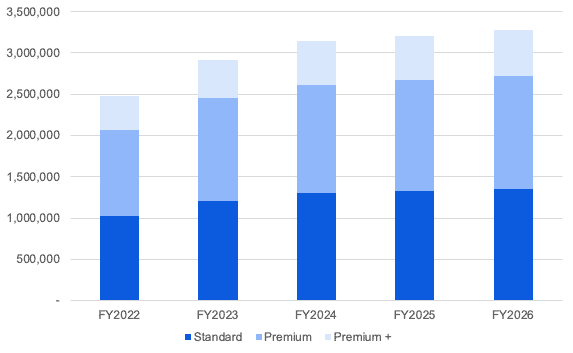

In the end, you should obtain your 5-year revenue projections as shown below:

3. Calculate Nursing Home Expenses

The 3rd step of our nursing home financial model is to forecast expenses.

In addition to the startup costs discussed here, there are a number of recurring (or “operating”) costs that any assisted living facility must budget for.

We have laid out below an example of operating expenses for a standard 14,000 sq. ft. nursing home with 30 units: you would pay around $212,000 to $220,000 per month to run the business.

Note that these costs are purely for illustrative purposes and may not fully apply to your business. For more information on how much it costs to run a nursing home, read our complete guide here.

| Operating costs | Amount (per month) |

|---|---|

| Rent & utility bills | $15,000 – $20,000 |

| Staff costs | $120,000 |

| Food supplies | $36,000 |

| Housekeeping services | $12,000 |

| Security & maintenance | $17,000 |

| Marketing | $12,000 – $15,000 |

| Total | $212,000 – $220,000 |

Rent & Utility Bills

You must pay monthly rent if you’ve leased your nursing home property. The amount you’ll pay as monthly rent will vary depending on factors like location and size of the property, purchase or lease, etc.

So for a 14,000 sq. ft. facility (30 units) you would have to incur $20,000 – $25,000 per month in rent. including utility costs (gas, water, electricity).

Staff Costs (45%)

Lack of nursing staff will affect your nursing home residents negatively. To provide the highest quality of care and life to your residents, you need to hire an adequate number of efficient staff who care for your residents regularly without failing or negligence.

Here is a quick list of the annual salaries that you must consider if you’re opening a nursing home:

- Healthcare Assistant ($45,515)

- Registered Nurse ($89,894)

- Nursing Assistant ($43,978)

- Care Home Manager ($68,446)

You should keep in mind the abide by the staff to residents ratio in your nursing home. The ratio will fall between 1:4 to 1:8 depending on your state regulations and the services offered by your nursing home.

Thus, assuming your nursing home has to attend to 30 residents daily, you’ll need 5 – 8 staff at all times.

So, assuming you need 7 employees at all times (3 in night time), you may spend up around $120,000 to pay the employees’ monthly salaries. This assumes 3 shifts per day, 7 days a week, a $55,000 average gross salary and 20% in taxes and benefits.

Food Supplies (15%)

Food supplies are one of the largest monthly expenses for a nursing home. You should expect to spend around 15% of your sales on food supplies.

Let’s say you’re opening a nursing home facility with 40 units at $8,000 per month each (national average), you generate a revenue of $240,000 per month. Then, you should expect to spend around $36,000 on food supplies.

Housekeeping and Laundry Services (5%)

Your nursing home needs to be hygienic all the time so that your residents are less prone to commonly transmitted diseases. Thus, you need to hire some staff for the housekeeping and laundry services of your nursing home.

You should expect to spend around 5% of your sales on laundry & housekeeping services. Taking the above example, you’ll have to spend around $12,000 on housekeeping and laundry.

Security & Maintenance (7%)

Security guards are highly essential to ensure that your nursing home residents and staff are safe and safe within the premises of your nursing home. You should expect to spend around 7% of your sales on security & maintenance.

Marketing (5%)

Appropriate and well-targeted marketing is essential, especially in the first few months/years to acquire new residents. In average, you should spend about 5% of your revenue in marketing.

Your marketing costs should include the cost of your website, signage, press, online and offline marketing & advertising costs.

4. Build P&L and Cash Flow

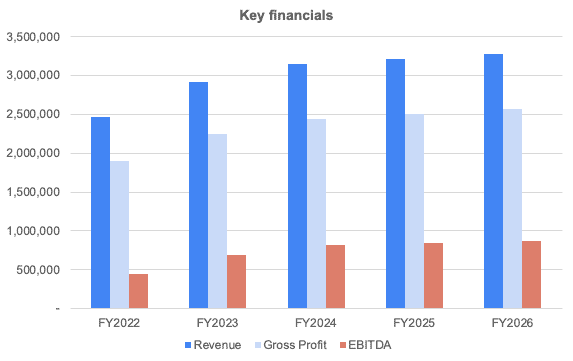

Once we have estimated revenues, expenses and debt, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

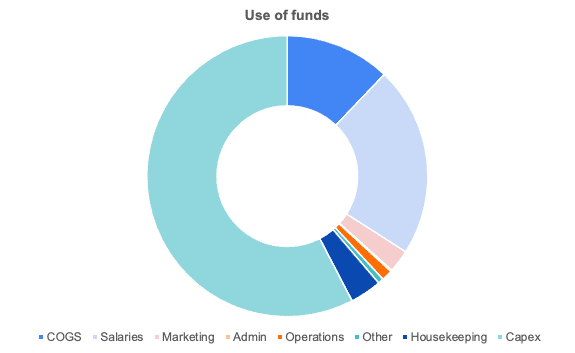

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own nursing home or assisted living facility, which we do in our financial model template with the use of funds chart (see below).

In this chart below, we’re showing you the example of a cost structure a typical nursing home would have (excluding the upfront cost to purchase the building, if you decide to buy the real estate).

Unsurprisingly, Capex (the investment to buy the land and/or the building and construction expenses for example) make up ~60% of total expenses. The 2nd most important cost is payroll (~20%).