How to Forecast Customer Acquisition for a Startup?

For a startup, forecasting revenue is probably the most challenging part of financial planning. Indeed, revenue is a function of customers and price. Whilst price is straightforward, the number of customers you will acquire over time (customer acquisition) is always a difficult thing to do.

If you already have some historical performance, forecasting future customer acquisition will probably be easier. New businesses in comparison, with none or limited data, often find it very difficult to estimate the number of customers they will acquire in the future. It shouldn’t be.

This article is a step-by-step tutorial on how to forecast the acquisition of your customers over time, whatever business model you have. Whether you are using one of our templates or want to build your own financial model, this article is for you. We also provide you with a free Excel template below so you can use it for your business. Read on.

How to forecast revenue

Before we dive into customer acquisition, let’s just have a quick look on how revenue can be forecasted. Whatever the business you are in, revenue is the result of the following simple function:

Revenue = customers x price per customer

Whether you have a subscription, ecommerce, service, marketplace of even retail business, the formula is always the same.

What actually changes is how we forecast customers. Let’s see how to do it below.

So, how do we forecast customers?

The number of customers a business has over time is calculated differently based on the type of business. In general, there are 3 types of businesses, each with a different way to calculate customers:

- Retail: customers each month are often considered to be new. Indeed, it is often very difficult to track repeat customers orders (or “purchases”, “conversions”) hence we typically do not differentiate new vs. repeat customers

For instance, a clothing shop will forecast orders based on factors such as historical data and seasonality. All new orders are considered to be from new customers, and there is only one customer profile, with the same purchasing profile

Note: repeat customers are customers who already made a conversion (“order” or “purchase”) in the past. This is a very common concept these days which companies are increasingly tracking to improve customer retention. Investors also ask for these details more often than not

- Ecommerce, marketplaces: customers each month are the sum of new and repeat customers. These digital businesses have options to track each new conversion and check whether it comes from a new or repeat customers

For instance, a clothing online shop would forecast future orders based on factors such as paid ads spending and organic traffic. Also, it would consider repeat customers data: for example 10% of orders typically come from already registered repeat customers (who signed up for instance)

- Subscription (e.g. SaaS): customers each month are the sum of new acquired customers minus churn (customers who cancel their plan and leave)

For instance, let’s assume a SaaS business with 1,000 customers in a given month. For instance, if management expect to acquire 40 new customers next month minus a 20% annual churn (based on historical data), next month total customer count is 1,023.

How to forecast customer acquisition

We have seen previously revenue is calculated the same across all industries. What changes is how we calculate the number of customers, within the revenue equation.

Now let’s see how we calculate new customers, in other words how to forecast customer acquisition.

For tech startups and other digital businesses, there are 2 types of acquisition strategy: inbound and outbound acquisition.

It is very important to understand the different between the 2 and which one is relevant for your business. Indeed, your acquisition strategy will define how you should forecast customer acquisition.

Inbound acquisition

With inbound acquisition, businesses acquire customers via visitors. Visitors can be in-person traffic (in a retail store for instance), but for most tech businesses visitors are traffic on a website, landing page, mobile app, etc.

Traffic is two fold: paid and organic:

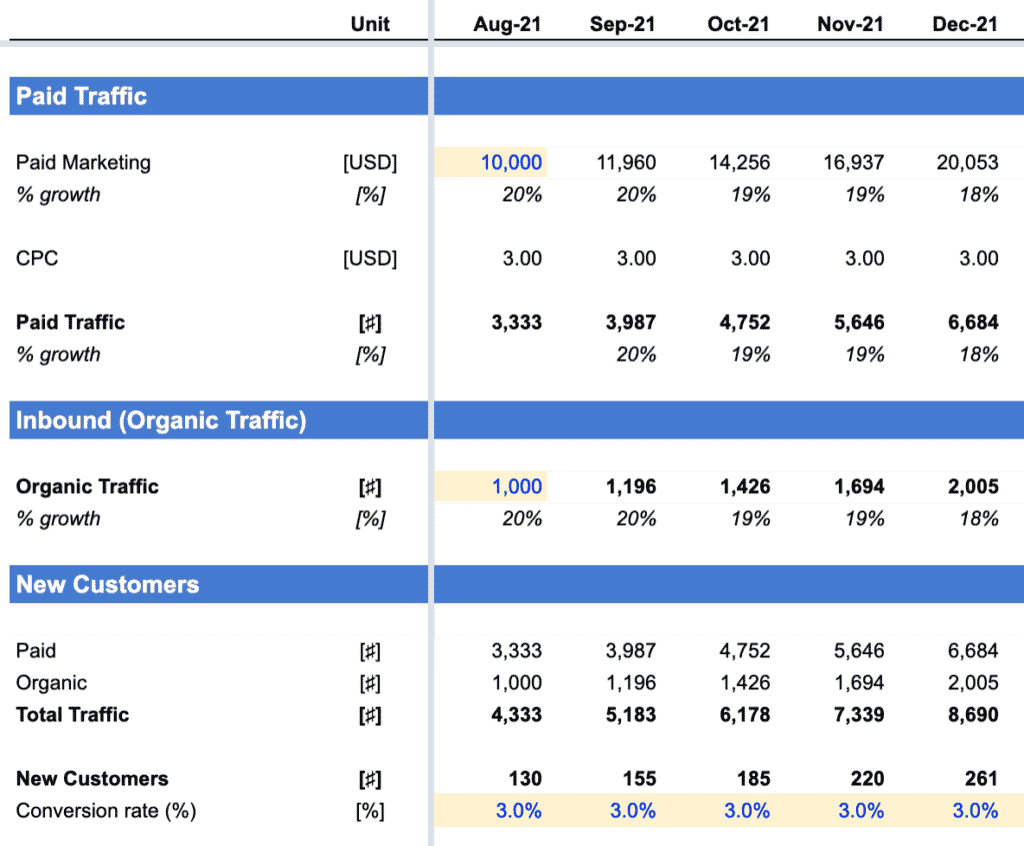

- Paid traffic: all visitors coming from paid marketing channels (Google Search, Facebook Ads, etc.). You are either paying for clicks, or impressions.

- Organic traffic: all visitors landing on your landing page(s) organically (either via a referral link, direct search, social media post, blog article, etc.)

Paid marketing is the easiest way to generate traffic. Yet, because you are paying for each paid visitor, you will need to monitor your Return on Ad Spend (ROAS) to make sure your paid marketing campaigns are profitable.

In comparison, whilst you do not directly pay for each organic visitor, organic traffic is not free. Organic traffic is earned from investment into SEO and content. Whilst investing into your SEO for instance does not pay immediately, the returns can far outweigh those of your paid marketing in the long run.

Therefore, inbound customer acquisition is the sum of:

- Organic traffic: the previous period (usually month or year) number of visitors times a percentage growth

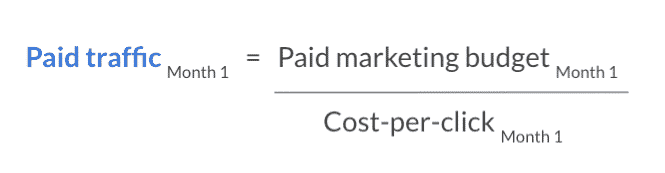

- Paid traffic: the paid marketing budget, divided by the cost-per-click

Naturally, your paid marketing budget also vary over time, you can forecast paid marketing budget as follows:

Once we have calculated total traffic (paid and organic), simply apply a conversion rate to forecast customer acquisition.

Outbound acquisition

With outbound acquisition, a business acquires customers through its sales team. Whether it is via phone, email, Linkedin or even in-person, the number of acquired customers is a function of the number of sales people.

Outbound acquisition is very common for business-to-business (B2B) companies. For example, Enterprise SaaS and B2B marketplaces use outbound acquisition to acquire their customers.

Outbound customer acquisition is therefore easier to forecast vs. inbound. The simple formula to estimate new customers over time is:

Closings per sales person is also referred to as the efficiency of your sales team = the number of customer one sales person acquire (or “close”) each month, in average.

For example, lets’ assume you have 20 sales people. Historically, your sales team has closed (“acquired”) in average 2 B2B clients per month per sales person. Therefore, you can assume you acquire 40 customers each month. You can logically assume you would acquire 50 instead if you hired another 5 more sales persons, right?

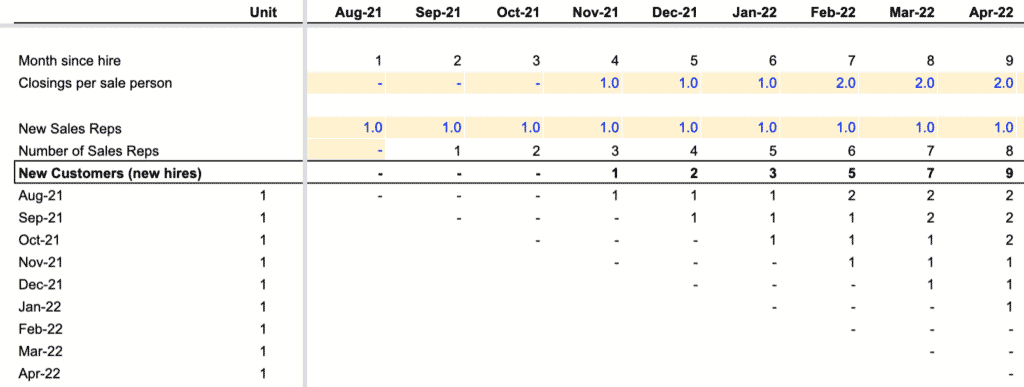

Outbound acquisition: Forecasting sales team efficiency

Businesses who rely on sales team to acquire customers know very well that their efficiency isn’t as straightforward as explained above. Indeed, you cannot really assume the new 5 sales people will acquire 2 new customers per month day 1. In other words, we can’t really assume new hires will be as efficient as the current sales team.

Instead, new sales hires will likely go through an onboarding for a weeks. Also, their efficiency will grow over time as they get better. That’s why you should use a cohort model instead: for each new hire, we take into consideration its seniority to obtain efficiency.