Miracle-Ear Franchise FDD, Profits & Costs (2025)

Established in 1948 by Kenneth Dahlberg, Miracle-Ear, Inc. has risen to prominence in the hearing aid and hearing care sector, with its headquarters located in Minneapolis, Minnesota.

As a part of Amplifon, a leading name in the global hearing care and retail market-based in Milan, Italy, Miracle-Ear has expanded its presence extensively throughout the United States.

The brand embarked on its franchising journey in 1983, quickly earning the reputation as the most recognized hearing aid brand within the U.S. It has dedicated itself to delivering cutting-edge hearing solutions and services aimed at enhancing the quality of life for individuals experiencing hearing loss.

Initial Investment

How much does it cost to start a Miracle-Ear franchise? It costs on average between $120,000 – $403,000 to start a Miracle-Ear franchised center.

This includes costs for clinic build-out, specialized equipment, initial inventory of hearing aids and accessories, and initial operating expenses. The exact amount varies based on factors such as the clinic location, regional requirements, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $30,000 |

| Prepaid Expenses – Franchise | $500 – $2,500 |

| Prepaid Expenses – Location | $1,000 – $5,000 |

| Travel and Living Expenses During Training | $2,000 – $5,000 |

| Real Property, Build Out Costs | $20,000 – $200,000 |

| Furniture, Fixtures and Equipment | $30,000 – $60,000 |

| Signage | $1,500 – $10,000 |

| Inventory | $5,000 – $10,000 |

| Additional Funds – 3 Months | $30,000 – $80,000 |

| Location Total | $88,000 – $367,500 |

| Total Estimated Initial Investment | $120,000 – $402,500 |

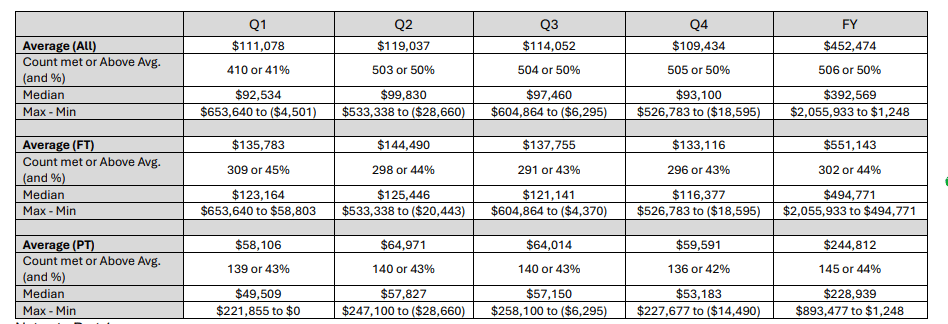

Average Revenue (AUV)

How much revenue can you make with a Miracle-Ear franchise? A Miracle-Ear franchised clinic makes on average $393,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Miracle-Ear locations are there?

As of the latest data, Miracle-Ear operates approximately 1,588 locations across the United States. This includes around 400 company-owned stores and 1,192 franchised outlets. These figures reflect the company’s strategic expansion efforts, including recent acquisitions of franchisee-owned stores to bolster its direct retail presence.

What is the total investment required to open a Miracle-Ear franchise?

The total investment required to open a Miracle-Ear franchise ranges from $120,000 to $403,000.

What are the ongoing fees for a Miracle-Ear franchise?

A Miracle-Ear franchise requires ongoing fees, including a royalty fee of $48.80 per Miracle-Ear hearing aid and $30.15 per AudioTone Pro device.

Franchisees must also dedicate at least 10% of net sales to local advertising, which includes contributions to the National Marketing Fund (NMF) at $25 or $75 per hearing aid, depending on the model. These fees support brand marketing and franchise growth.

What are the financial requirements to become a Miracle-Ear franchisee?

To qualify as a Miracle-Ear franchisee, applicants must meet specific financial criteria: a minimum net worth of $100,000 and at least $50,000 in liquid assets. These requirements ensure that potential franchisees possess the necessary financial stability and resources to establish and operate a Miracle-Ear franchise successfully.

How much can a Miracle-Ear franchise owner expect to earn?

The average gross sales for a Miracle-Ear franchise are approximately $0.39 million per location. Assuming a 15% operating profit margin, $0.39 million yearly revenue can result in $59,000 EBITDA annually.

Who owns Miracle-Ear?

Miracle-Ear is owned by Amplifon S.p.A., an Italian company based in Milan and the world’s largest hearing aid retailer.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.