Panera Bread Franchise FDD, Profits & Costs (2025)

Panera Bread was founded in 1987 as the St. Louis Bread Company in Kirkwood, Missouri. In 1993, Au Bon Pain Co. acquired the company and rebranded it as Panera Bread in 1997, although the name “St. Louis Bread Company” remains in use for locations within the St. Louis area.

Panera’s headquarters are in Sunset Hills, Missouri. The company began franchising the same year it was founded and has grown to have an estimated 2,115 units today.

Panera Bread offers a variety of fresh bakery goods, sandwiches, soups, salads, and café beverages. The franchise operates on a multi-unit development model, requiring franchisees to open a series of bakery cafes (typically 15) within six years. This approach ensures consistency in operations and growth.

Panera Bread does not currently offer single-unit franchises; instead, it focuses on area development agreements that require a commitment to open multiple locations. The franchise is actively expanding and is open to well-qualified franchisees who align with its brand values and development strategies.

Initial Investment

How much does it cost to start a Panera Bread franchise? It costs on average between $633,000 – $4,906,000 to start a Panera Bread franchised restaurant.

This includes construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee leases or purchases the property.

| Type of Expenditure | Amount |

|---|---|

| Franchise Fee | $35,000 |

| Leasehold Improvements | $164,000 to $2,873,000 |

| Equipment | $270,000 to $529,000 |

| Optional Technology Systems | $0 to $120,000 |

| Fixtures | $6,700 to $216,000 |

| Furniture | $4,700 to $127,000 |

| Consultant Fees | $47,000 to $328,000 |

| Supplies & Inventory | $19,000 to $25,000 |

| Smallwares | $9,600 to $48,000 |

| Signage | $9,100 to $176,000 |

| Additional Funds (3 months) | $68,000 to $429,000 |

| TOTAL | $633,000 to $4,906,000 |

Average Revenue (AUV)

How much revenue can you make with a Panera Bread franchise? A Panera Bread franchised restaurant makes on average $2,803,000 in revenue (AUV) per year.

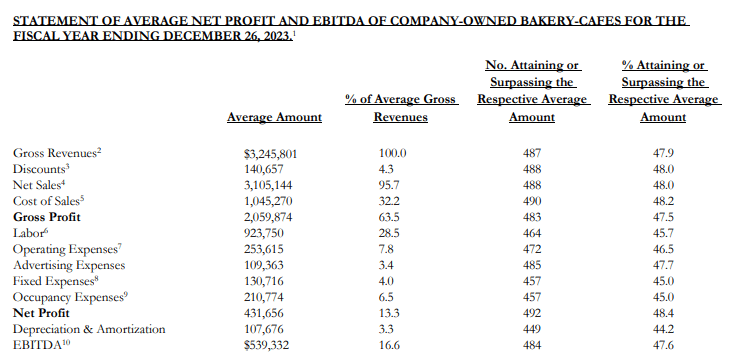

Here is the extract from the Franchise Disclosure Document:

This compares to $799,000 yearly revenue for similar baked goods franchises. Below are 10 Panera Bread competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Panera Bread locations are there?

As of the latest data, there are 2,180 Panera Bread locations across the United States. This total includes both franchise-owned and company-owned bakery cafes. California has the most Panera Bread locations, with 191 locations, accounting for about 9% of all Panera Bread restaurants in the country.

What is the total investment required to open a Panera Bread franchise?

The total investment required to open a Panera Bread franchise ranges from $633,000 to $4,906,000.

What are the ongoing fees for a Panera Bread franchise?

Panera Bread franchisees are required to pay a royalty fee of 5% of gross sales and a marketing fee of 2% of gross sales. These fees support brand operations, advertising, and promotions to help maintain franchise growth and consistency.

What are the financial requirements to become a Panera Bread franchisee?

To become a Panera Bread franchisee, the financial requirements include having a minimum net worth of at least $7.5 million and liquid capital of at least $3 million.

These financial thresholds ensure that potential franchisees have the necessary resources to support the initial investment, ongoing expenses, and operational needs of the franchise.

How much can a Panera Bread franchise owner expect to earn?

The average gross sales for a Panera Bread franchise are approximately $2.8. million per location. Assuming a 15% operating profit margin, $2.8 million yearly revenue can result in $420,000 EBITDA annually.

Who owns Panera Bread?

Panera Bread is owned by JAB Holding Company, a privately held German conglomerate. JAB acquired Panera Bread in 2017, taking the company private in a deal valued at around $7.5 billion.

JAB Holding has a portfolio that includes other well-known brands in the food and beverage industry, such as Pret A Manger, Krispy Kreme, and Keurig Dr Pepper.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.