SaaS Deferred Revenue: What Is It? Why Is It Important?

Deferred revenue, also referred to as “unearned revenue” is a vital accounting concept for SaaS businesses. It relates to revenue recognition.

Whilst it might sound not so important, or even boring at first, one cannot calculate revenue nor cash flow for SaaS businesses without taking into account deferred revenue.

In this article we will explain everything you should know about deferred revenue, even if you have no or limited knowledge in accounting.

Cash-basis vs. accrual accounting

Before we dive into what is cash-basis vs. accrual accounting accounting methods, let’s have a look at what revenue recognition is.

Revenue recognition, in accounting, is a set of rules by which a business recognises revenue in its financial statements. In other words, revenue recognition happens when a business can actually record a sale into revenue in its books.

For instance, a coffee shop would record the $5 cappuccino you just bought from them as revenue as soon as you have made payment, right?

It might sound obvious at first, so let’s have a look at another example: the coffee beans supplier that sells to the coffee shop. Let’s assume the coffee shop makes an order for $500 coffee beans from its supplier and pay 50% upfront, and 50% at delivery. When can the supplier record the $500 revenue? Well it depends:

- With cash-basis, we recognise $250 today, and another $250 at delivery (when payment is made)

- With accrual accounting, we recognise $500 today (assuming the coffee shop already approved the total invoice for $500 it needs to pay) yet the supplier has a liability of $250 towards the coffee shop until the 2nd payment. Only at that point we recognise the 2nd $250 as revenue too, and we cancel the liability altogether

We have seen a simple example of cash-basis vs. accrual accounting. Now let’s see in detail what these 2 methods are and how they compare.

Cash-basis accounting

Cash-basis accounting recognises revenue as soon as cash payment is received. In our coffee bean supplier example above, it only records $250 today as the coffee shop hasn’t made the 2nd $250 payment yet.

We say revenue, but it works for expenses as well: a business recognises revenues and expenses whenever it receives (or pays) cash.

Cash-basis accounting is often used by small businesses with little or no inventory as it is the simplest revenue recognition accounting method.

For instance, our coffee shop would use cash-basis accounting. Think about it, the coffee shop typically provides products immediately upon purchase. As such, we cannot recognise any revenue (or expense) when we receive (or make) payment.

Accrual accounting

With accrual accounting, in comparison, we recognise revenues and expenses regardless of cash movements. Instead, we recognise revenue when revenue is earned and expenses incurred.

In other words, in accrual accounting you only recognise revenue once you have provided the service and/or product. Again, it works for revenues and expenses too: you recognise expenses when you incur them. For instance, you would recognise expenses as soon as you have approved an invoice, even if you haven’t paid it yet.

Because there are many examples whereby payment and receipt of goods or services don’t necessarily happen at the same time, accrual accounting is used by most medium and large companies. Small businesses typically also use accrual accounting if they have inventory. Indeed, inventory movements implies suppliers and customers payments which aren’t necessarily immediate either (think accounts receivable and payable).

SaaS needs accrual accounting

So what does all of this has to do with SaaS? Well SaaS businesses, because of their business model, must use accrual accounting.

Like inventory businesses, SaaS companies cannot recognise revenue as soon as their customers make payment. Indeed, whenever a customer pays subscription for a given period of time (say a year), the full amount of cash she or he pays cannot be recognised immediately. Why? The service they are paying for isn’t fully delivered until the end of the year period they are paying for.

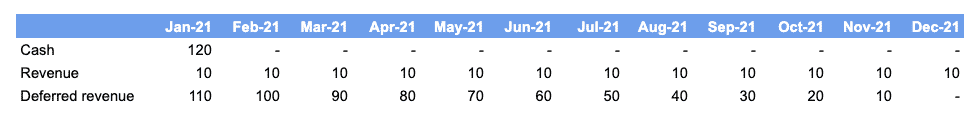

Let’s use a simple example. Let’s assume a $120 annual subscription you pay for in January 2021. The SaaS company, whilst it actually receives $120 in its bank account in January 2021, cannot recognise the $120 revenue yet. Instead, it will recognise revenue over time: 1/12 of $120 for each month. In January 2021 then, the SaaS company records $10 in revenue, yet has received $120 in cash.

The problem that arises from a pure accounting perspective is the balance of the books: how can you earn $120 in cash if you can only recognise $10 in revenue in parallel? There’s a $110 gap in your books which needs to be adjusted somehow. Let’s see how below.

So what is SaaS deferred revenue?

We just saw a simple example whereby using accrual accounting for SaaS sometimes creates a gap in the financial statements. This gap is deferred revenue. Let’s see what it is and how we calculate it.

When a SaaS business collects money from its customers before actually providing the service, as it happens for annual subscriptions for example, it needs to hold onto that cash yet defer revenue recognition until it has fulfilled the service.

The amount of cash it holds until it can be converted into revenue is called deferred revenue (or unearned revenue). It is a liability: the SaaS company owes a certain amount to its customer as it hasn’t yet fully fulfilled the service the customer paid for already.

In our $120 annual subscription example, this is how we calculate deferred revenue over time:

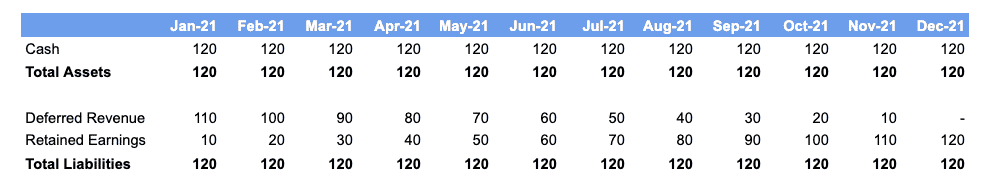

As This new line in your balance sheet, under liabilities, fills the gap we identified earlier. Using the same example, this is how a simplified balance sheet would look like (assuming no corporate taxes i.e. revenue = profits):

Why is deferred revenue important for SaaS?

Financial analysis

Deferred revenue allows us to better understand a SaaS business’ real monthly income and cash flows.

As we have seen it previously, revenue and cash aren’t fully comparable for SaaS businesses. This happens for any annual, multi-annual or quarterly subscription businesses. This is especially true for businesses with few large customers: Whenever a customer comes in cash increases significantly, yet the following months aren’t necessarily as important. This can create some frustration if one doesn’t clearly understand deferred revenue and accrual accounting in general.

Budgeting and forecasting

Beyond understanding revenue and cash flows, deferred revenue is a vital element of budgeting and forecasting.

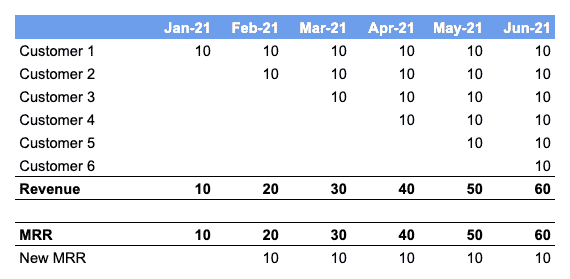

SaaS businesses often use Monthly Recurring Revenue (MRR) as their key revenue driver and metric. MRR measures the monthly revenue that a company expects to receive from the products and services it provides as a subscription to its customers.

MRR help us accurately forecast revenue for SaaS businesses by taking deferred revenue as a starting point. Why does that mean?

Let’s use our example again and assume we forecast revenue growth by assuming we acquire one customer every month for the next 6 months.

Yet, another way to calculate revenue is to use the current MRR and add any new MRR to it. This might not be helpful in our example here, yet it is vital when we include upsell, downsell and churn.

Revenue can be forecasted accurately using the current deferred revenue balance, and from there:

- Adding new MRR from new customers

- Adding expansion MRR from upsells

- Subtracting expansion MRR from downsells

- Subtracting churn MRR from churns

Timing cash flows correctly

Forecasting revenue that way will also give you better visibility on your cash flows. This will allow you to make better decisions with your investments and hires along the way.

Let’s use an example to see how forecasting MRR and revenue helps make better decisions. Let’s assume an extreme example where all your customers pay in January every year. You have 10,000 customers today each paying $120 annual subscriptions. From experience and historical data, you can expect 10% churn. Therefore, assuming there is no upsell and downsell, you can reasonably expect at least $1,080,000 in cash coming in in January next year. Indeed:

9,000 customers (post 10% churn) x $120 annual subscription = $1,080,000

This $1,080,000 excludes any new customers coming in hence can be seen as conservative. As such, whilst revenue for January 2021 will only be $108,000 at least, you know you can right away spend up to $1,080,000 instead should you need to (for hires for instance).

How to forecast deferred revenue?

If you are preparing a set of projected financials for your pitch deck or business plan, you will need to estimate deferred revenue. Indeed, as we saw earlier, deferred revenue impacts the 3 financial statements:

- Profit-and-loss: we recognise revenue over time based on the billing cycle (annual, monthly, quarterly or multi-annual) for the subscription(s)

- Balance sheet: we create deferred revenue whenever a new customers purchases an annual, quarterly or multi-annual subscription. We record it under liabilities in your balance sheet

- Cash flow: we recognise cash as soon as payment is made.

Whilst it isn’t so difficult to forecast deferred revenue as we saw earlier, tying deferred revenue into the 3 financial statements is rather complex. It is all the more complicated that a business has multiple subscription tiers with different billing cycles, and we factor in upsell, downsell and churn.

Any questions on SaaS finance? We have lots of free resources as well, check out our articles below:

- How To Use Our SaaS Financial Model Template: Full Guide

- The 8 Most Important SaaS Metrics You Should Know

- What Is A Good Churn Rate For SaaS And Subscription Businesses?

- What Is A Good CAC For SaaS? Understanding LTV:CAC

- How To Build A SaaS Revenue Model [Free Template]