How To Build a Financial Model For a Car Rental Business

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your car rental business, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a car rental business with a fleet of 100 vehicles. Note that the numbers, charts and financials presented in this article come from our financial model template for car rental businesses.

1. Forecast Vehicles Acquisition & Lifespan

The first step of any car rental financial model is to forecast the actual number of vehicles over time. This means a few things:

- How many vehicles you will acquire over time, and when

- How much you pay for these vehicles

- How you finance the acquisition of vehicle (leasing, debt or equity)

- How long you expect to use these vehicles

- Whether you plan to sell the vehicles at a salvage value in the future (or not)

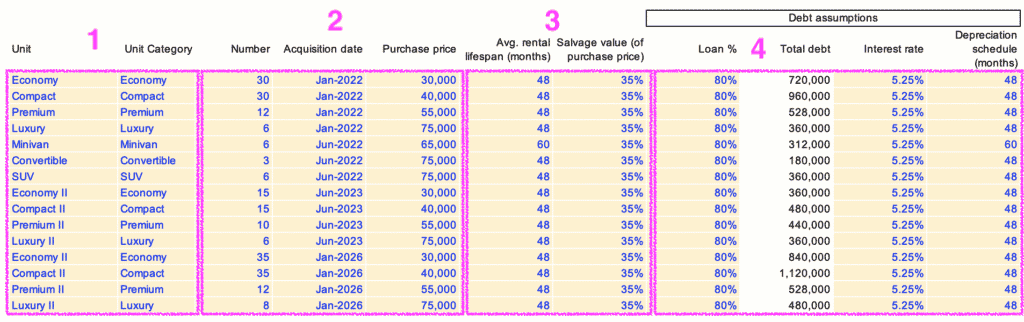

In order to do so, prepare a table like the one below, where you can list all the different vehicles, their category (economy, premium, SUV, etc.), purchase price, and all the criteria listed above.

The different sections are as follows:

- The different types of vehicles and their category (each category will have a different pricing as we will see later on). For each type of vehicle:

- The number of vehicles acquired, the date of acquisition and the price paid per vehicle;

- The average rental lifespan (how many months do you use their vehicles?) and their salvage value (the value at which you will sell them back at the end of the rental lifespan;

- Debt assumptions: the % of the purchase price that’s covered by a loan (as you will likely have to pay some of it yourself), the interest rate per year and the term of the loan

That way, you will be able to forecast accurately how many vehicles are available. In other words, how many vehicles you can use to rent to customers before you need to sell them back at the end of their rental lifespan.

2. Forecast Revenue

Now that we have estimated the number of available vehicles over time, the next step in our car rental financial model is to forecast revenue.

Revenue is the function of:

- Number of available vehicles

- Utilization rate (unfortunately not all vehicles will be rented at all times, due to seasonality for example)

- Rental price (per day or per month)

1. Number of available vehicles

We already have that (see section 1)

2. Utilization rate

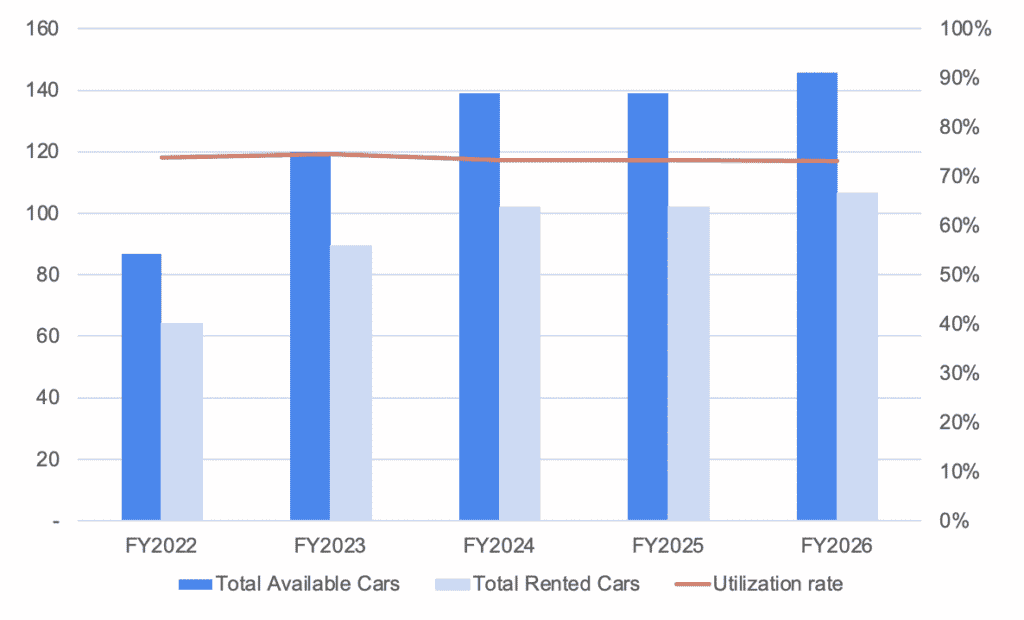

Utilization rate can either be set at category level or for all vehicles. Make sure to set utilization rate month by month to take into account seasonality. For example, utilization can peak at 90% in summer, but stay at 50-60% from February to April (low season).

In the end, you'll be able to forecast accurately the number of rented cars vs. the total number of available cars over time, as shown below.

3. Rental price

Pricing can be set by vehicle category. For example:

- Economy cars will have an average daily rental fee of $80 and a monthly rental fee of $1,440

- Premium cars will have an average daily rental fee of $130 and a monthly rental fee of $2,340

- and so on..

Note: if you have both a daily and a monthly pricing, you will need to set an assumption on how many rentals are monthly vs. daily. For example, you could assume 90% of your rentals are paid on a daily rate, and another 10% are long-term rentals with monthly rates.

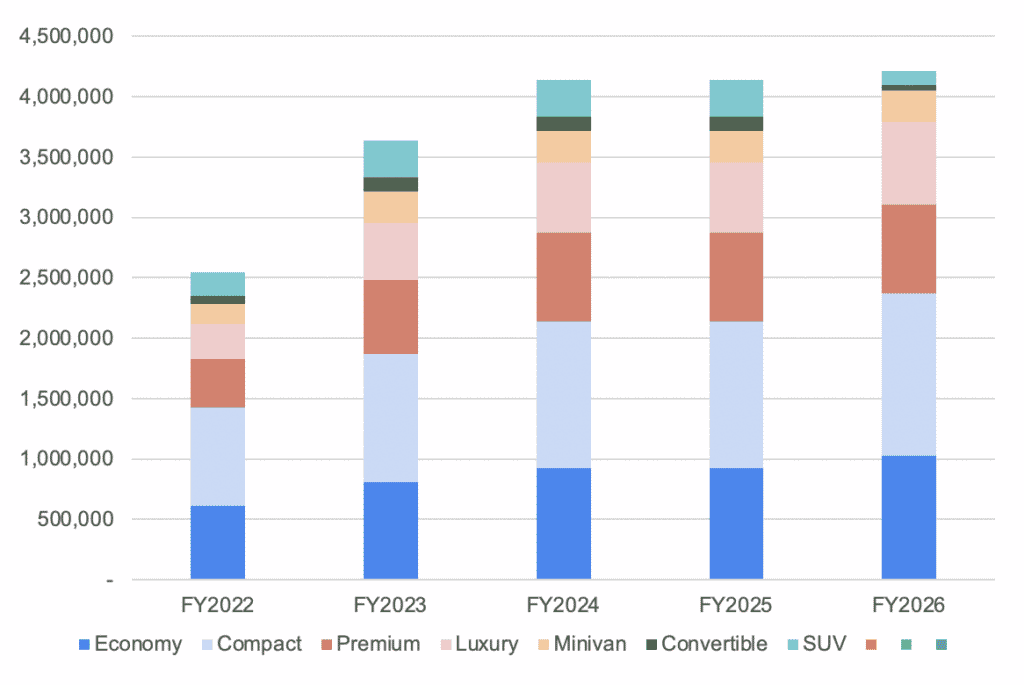

Now that you have set all 3 parameters for each vehicle category, you should be able to easily calculate revenue for all vehicles as shown below.

3. Calculate Expenses

In addition to the one-off startup costs discussed here, you must also budget for all the operating costs of running a car rental business.

We have laid out below a clear overview of all the key expenses you can expect to operate a car rental business with 100 vehicles. Yet, note that the amounts are purely for illustrative purposes and depend on a number of factors which may not fully apply to you.

| Operating cost | Amount (per month) | % total |

|---|---|---|

| Rent | $33,000 | 22% |

| Fleet maintenance | $45,000 | 30% |

| Staff | $58,000 | 38% |

| Marketing | $11,000 | 7% |

| Utility bills | $5,000 | 3% |

| Total | $152,000 | 100% |

Rent

Assuming you set up your car rental business on a 12,000 sq. foot space (100 vehicles), you will pay about $33,000 per month using Los Angeles’ average cost of renting commercial space of $33.40 per square foot.

Fleet Maintenance (under COGS)

As part of the ongoing maintenance, always service your fleet of cars in time. This will help your vehicles last longer while saving you a lot of money that would go into the actual repair.

Depending on the size of your business, you can employ an on-site mechanic to help with frequent vehicle maintenance and servicing. Alternatively, you can frequently contact an external team to handle everything related to car repair and maintenance.

A 2020 study by AAA showed that, on average, a new car regular checkups and maintenance costs averaged $0.09 per mile. Now, assuming each car does 200 miles per day on average (25 days a month), this comes to 5,000 miles per month.

Based on these assumptions, you should spend on average $450 in maintenance and servicing per month and per car. Using the same 100-vehicle car rental fleet example above, this comes down to $45,000 total costs a month.

Staff costs

Assuming you run a fleet of 100 cars, you will require at least 10 employees at all times for the smooth running of business operations.

That way, you can have:

- 4 personnel dedicated to offering client support (booking, reception); and

- 3 personnel to clean the cars between each rental; and

- 3 specialist, on-site mechanic to help with frequent servicing and fleet maintenance

A typical mechanic earns an average base salary of $23.63 per hour, translating to about $57,158 per year. On the other hand, the other employees will command minimum base salaries of between $31,370 and $39,105 per year.

So, in total, you should set aside around $58,000 per month to cover their monthly wages (including 20% taxes and benefits). This also assumes you run a 7/7 car rental business (so 1.4x 5-day shifts full time equivalents).

Marketing

You may already know that marketing is important to help show your business to the world when getting started. However, ongoing marketing and advertising are just as important to help you stand out from the competition by targeting a specific audience.

Fortunately, you have plenty of options to effectively market your car rental business, depending on your preferences.

Marketing gets costlier if you work with an agency. So, the best alternative would be to market your business alone, taking advantage of numerous tools like the popular social media platforms such as Facebook as well as the television, newspapers, radio, magazines, and much more.

For paid marketing campaigns (Google Ads, Facebook, Instagram), the average cost-per-click in the US for car rental businesses is $1.10. Therefore, assuming you convert 10% of the visitors of your site coming from paid marketing campaigns, the total cost of acquisition is around $10 per customer (1.10 / 10%).

As you can see, marketing costs can quickly be expensive and depend on your acquisition strategy. Assuming you get 60 customers a day and 30% come from paid marketing, this means you’ll spend $360 a day in paid marketing, and $11,000 per month.

Utility Bills

The utility bills associated with the car rental business come in the form of stable internet connection, electricity, water, and gas. As a guiding principle, always budget for the utility bills together with the monthly rent.

As a rule of thumb, add another 15-20% to your rent to cover for utility bills. This translates to around $5,000 per month.

4. Calculate Lease / Debt Interest

Another important part of any car rental financial model is to forecast your balance sheet, and more especially:

- Your assets (if you own the vehicles); and

- The debt

Doing so will allow you to do 2 important things:

- Calculate debt interest expenses. Indeed, if you purchase some of the vehicle with debt, another important expense will be the financial interest on the loan which you must forecast accurately

- Forecast your cash flow statement. Indeed, as we will see in the next section, one of the most important impact on your cash flow are debt repayments (not the interest itself but the principal repayments instead).

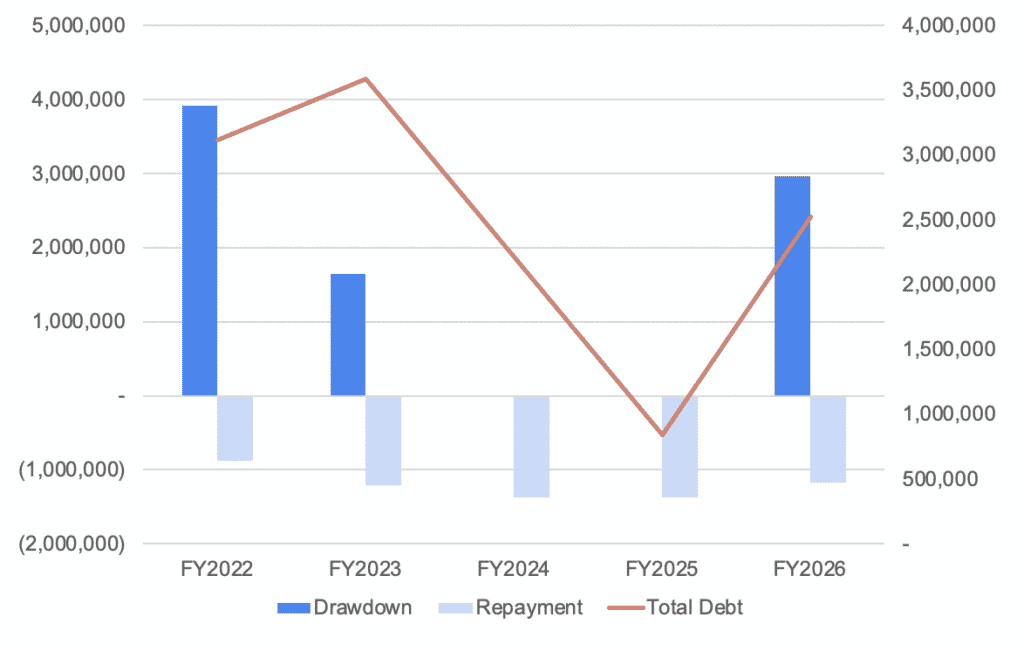

Therefore, make sure you calculate, each mont:

- Any debt drawdown (if you acquire new vehicles with debt in the future)

- Debt repayment (the actual loan repayments)

- Debt interest (the interest expenses that will appear on your profit-and-loss)

In the end, you should be able to obtain something like the chart below:

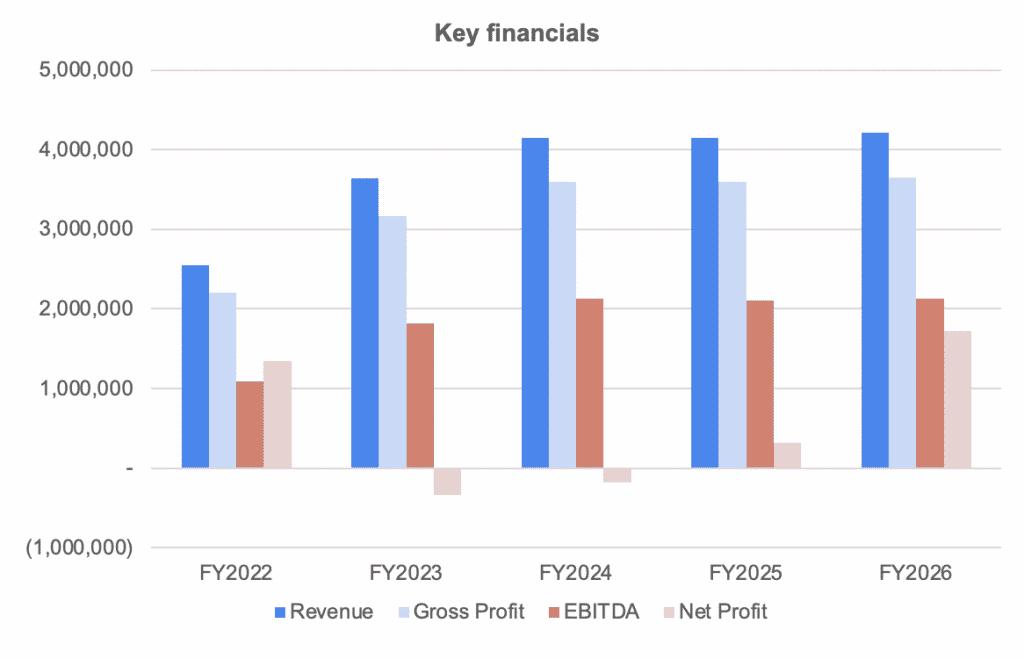

5. Build your P&L And Cash flow

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

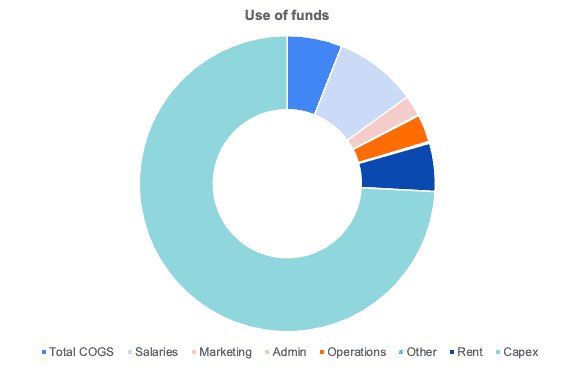

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own car rental business, which we do in our financial model template with the use of funds chart (see below).

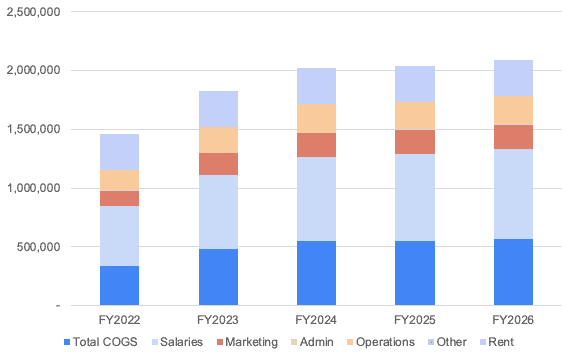

In this chart below, we're showing you an example of a cost structure a 100-vehicle fleet car rental business. Unsurprisingly, 70% of total expenses are the actual cost of acquisition of the vehicles, of which the large part will be covered by debt.