How Profitable are Dental Practices? Break-even & Profits

Learn all about dental practices

If you are planning to open a dental practice, you need to understand how you can turn your revenues into profits. In other words, you must know much revenues you must generate to reach break-even and make profits.

According to CloudDentistry, a single dentist dental practice services approximately 1,300 to 1,500 active patients. However, it can take a few years to build such a base.

What’s interesting is that a dental practice will lose approximately 10% of the patients per year and the goal of a practice should be to add 25 new patients each month for each full-time dentist.

Moreover, an average American spends approximately $290 per visit and according to American Dental Association, per capita spending on dental care is approximately $430 per year in 2020.

Let’s now look in more details how much profits you can generate with a dental practice on average in the US. Let’s dive in!

What is the average turnover for a dental practice?

Statista reports that the annual net income of all dentists in private practice is approximately $203,000 on average.

According to American Dental Association, in 2020, general dentists in private practice earned approximately $170,160 a year while specialists made $323,780 a year.

ADA also reported (downloadable XLSX file) that the annual gross billing for general dentists in 2020 was $666,000 while specialists have an average annual gross billing of $935,760.

However, do remember that the gross billing will depend on your scale of operations. For instance, your gross billing will be less for a one-dentist setup compared to a 2-dentist setup.

What is the average profit margin for a dental practice?

According to Dentistry IQ, Practice Financial Group, and GetWeave, the average profit margin for a general dental practice is between 30% to 40% of revenue.

It is interesting to note that 30% is the minimum profit margin, while 40% is the maximum profit margin for one-dentist dental practice. In general, a one-dentist dental practice has an average profit of 37.5% of total revenue.

How much does it cost to run a dental practice?

Running a dental practice attracts some recurring costs that include:

- Lab fees & other variable costs (COGS): You must pay lab fees and incur other variable costs such as local anesthetics, stationery, gypsum products & dental cements, etc.

- Salaries: You must pay salary to your staff (including yourself)

- Marketing: even if you rely on word-of-mouth recommendations, you may need to invest in marketing (paid ads, print media, etc.) to attract new patients every month

- Rent: You may pay rent for your office space (assuming that you don’t own the commercial space)

- Other expenses: You must pay for utilities, laundry, janitorial services, credit card fees, office supplies, etc.

On average, it costs $67,500 – $70,000 per month to run a 2-dentist practice with 6 chairs in the US.

For more information on how much it costs to run a dental practice, read our article here.

How to forecast profits for a dental practice?

In order to calculate profits for a dental practice, you must first forecast revenues and expenses.

Profits = Revenue – Expenses

Forecasting dental practices revenue

Revenue can easily be obtained by multiplying the number of patients by the average procedure price.

Revenue = Patients x Procedure price

For example, if you have 150 patients in a month paying on average $250 per procedure, monthly revenue is $37,500.

Forecasting dental practice expenses

There are 2 types of expenses for a dental practice:

- Variable expenses: these are the COGS as explained earlier. They grow in line with your revenue: if your turnover increases by 10%, variable expenses grow by 10% as well

- Fixed expenses: most salaries, rental costs and all the other costs listed above

Calculating dental practice profits

When we refer to profits, we usually refer to EBITDA (Earnings before interests, taxes, depreciation and amortization) as it represents the core profitability of the business, excluding things such as debt interests, non cash expenses and other non-core expenses.

In order to get to EBITDA, we use the following formula:

EBITDA = Revenue – COGS – Operating Expenses

To make it clearer, we’ve included below the profit-and-loss of a dental practice (from our financial model template for dental clinics).

Whilst gross margin (after variable costs) is ~80%, EBITDA margin can go up to 12-16% depending on the clinic.

Want to know how to build a financial projections for a dental practice? Read our complete guide here.

What is the break-even point for a dental practice?

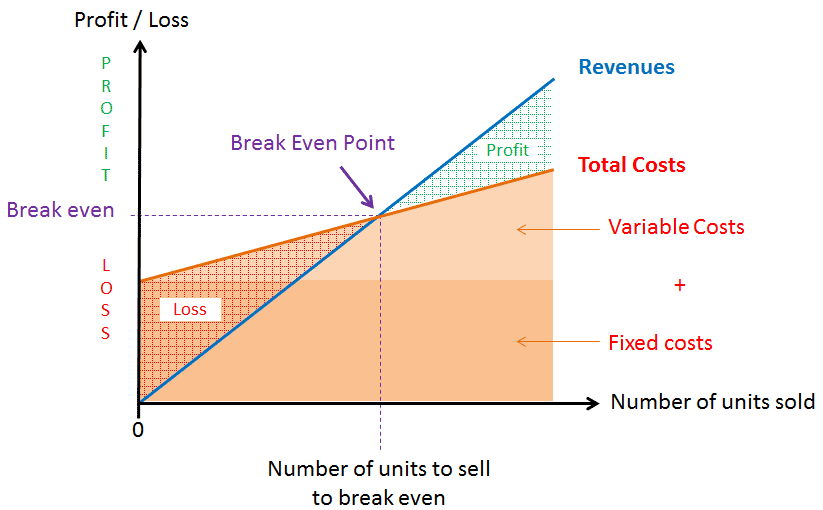

Break-even is the point at which total costs and total revenue are equal. In other words, the breakeven point is the amount of revenue you must generate to turn a profit.

Because you must at least cover all fixed costs (that aren’t a function of revenue) to turn a profit, the break-even point is at least superior to the sum of your fixed costs.

Yet, you also need to spend a certain amount for every $1 of sales to pay for the variable costs. As we just saw, dental practices have very high gross margins (80%). That’s because almost all expenses for a dental practice are fixed costs (mostly salaries, rent, marketing).

The break-even point can easily be obtained by using the following formula:

Break-even point = Fixed costs / Gross margin

Using the same example earlier, let’s assume your dental practice makes $37,500 in turnover per month and has the following cost structure:

| Operating cost | Variable vs. fixed | Amount (per month) |

|---|---|---|

| Salaries* | Fixed cost | $21,000 |

| Rent | Fixed cost | $4,000 |

| Lab fees | Variable cost | $3,000 |

| Other COGS | Variable cost | $2,000 |

| Marketing, other | Fixed cost | $4,000 |

| Total | $34,000 |

The break-even point would then be:

Break-even point = Fixed costs / Gross margin %

= $29,000 / 80% = $36,200

In other words, you need to make at least $36,200 in sales to turn a profit.

How to increase profits for a dental practice?

There are few ways to increase the profits of your dental practice and they include:

- Merchandising – selling various products like toothbrushes, teeth whitening products, etc.

- Affiliate income – partner with retailers of certain products that you prefer and sell them against a commission

- Referral program – launch a referral program and reward the clients who send new clients

- Incentivized marketing – Give incentives to leave a review on online platforms

- YouTube channel – Start your own YouTube channel

- High-profit procedures – Include procedures that bring in more profit

- Use SaaS products – Use a dental practice management program to reduce costs and improve management

- Use a membership plan – Introduce an in-house membership plan

Learn more about these profit boosting strategies in details here.