How to Build a Financial Model for your Dental Practice

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a budget for your dental practice business plan, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a dental practice.

For more information on dental practices, make sure to read our guides below: How Much Does It Cost To Start a Dental Practice? How To Open a Dental Practice In 8 Steps 8 Strategies To Increase Profits For Your Dental Practice How to Write a Dental Practice Business Plan: Complete Guide

1. Forecast patients

The first thing you’ll need to do is to forecast the number of patients you can expect to receive in your dental practice. Naturally, do this month over month. The number of patients is the sum of 2 types of patients:

Patients = New Patients + Repeat Patients

New Patients

These are the new patients who come for the first time. Unless you take over an existing practice, the number of new patients will likely be low in the early months and increase progressively.

Repeat Patients

To go a step further, you should forecast repeat patients: the patients who will come back at least twice in the future.

Repeat patients are very important as they don’t cost you a dime to attract (they come back because of the great care they had the first time, and not because of some ad you had to pay for). Also, repeat patients are more engaged and therefore likely to spend more (in regular checkups for example).

To forecast repeat patients, you should use a cohort model with a few assumptions:

- What % of your new patients who will become repeat

- How often the repeat patients come back (e.g. 2x a year for example)

- The annual churn (you can’t reasonably assume repeat patients will come back forever)

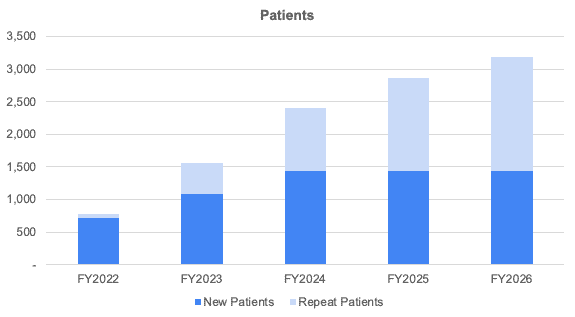

In the end, you should obtain something like the chart below. As you can see, whilst the number of new patients come to a plateau (you are capped by a certain number of total patients and you can't welcome all the new patients out there as you already take care of an increasing number of repeat patients). Instead, the portion of repeat patients increase progressively over time.

2. Forecast revenue

Now that we have the number of patients, we can calculate revenue.

Yet, before we do so, we must break down the number of patients into the different procedures a dental practice may offer. Indeed, you might focus more on general checkups & cleanings, or instead orthodontics and surgery.

It’s very important to break it down right. Indeed, as you know all these procedures have very different unit economics (prices and profit margins) you need to forecast accurately. Let’s see now how.

First, break down the services into a percentage of your total patients. For example, 80% of the patients go through a general exam, another 20% come for dental cleaning, 5% for a whitening, and so on..

That way, you can now multiply the number of patients for each service by their respective price.

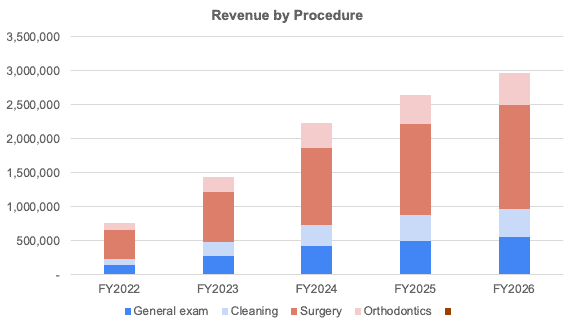

Now you can obtain your revenue projections broken down by the type of procedure as shown below:

3. Forecast expenses

In addition to the one-off startup costs discussed here, you must also budget for all the operating costs of running a dental practice.

We have laid out below the key expenses you can expect as well as their amount. Please note that these costs are for illustrative purposes, correspond to a hypothetical dental clinic with 2 dentists, and depend on a number of factors which may not fully be relevant to you.

| Operating cost | Amount (per month) |

|---|---|

| Salaries | $45,000 |

| Rent | $2,500 to $5,000 |

| Lab fees | $7,000 |

| Variable costs | $5,000 |

| Other costs | $8,000 |

| Total | $67,500 – $70,000 |

Salaries

The main expense by far you will incur is payroll.

Logically, the total cost will depend on the size of your clinic, and the number of part-time and full-time employees you need.

Assuming the same 2 dentists, 6-chair dental practice example above, you may need to pay for:

- 2x dentists (including yourself): average annual gross salary of $180,000

- 2x dental assistants: average gross salary of $40,000

- 1x dental hygienist: average gross salary of $77,000

- 1x receptionist: average gross salary of $32,000

In total, you should set aside $45,000 in salary expenses each month.

Rent

Assuming you rent the office space where you have set up your 1,600 square foot dental practice, you should expect to pay anywhere from $20 to $40 per square foot per year.

In total, you could spend approximately $2,500 to $5,000 per month in rent for a 1,600 square foot practice.

Lab fees and variable costs

Another significant expense for dental practices are the outsourcing of certain services to laboratories. For example, an orthodontist would ask a laboratory to work on custom dental prostheses.

In addition to lab fees, there are variable costs associated to the procedures themselves. Indeed, even a regular checkup requires a number of expendable supplies. These expendable supplies are single-use items such as: stationery, local anesthetics, dental cements and gypsum products.

According to Dental Economics, you must try to stick to the following benchmarks:

- Lab fees – 8% of total revenues

- Variable dental costs – 6% of total revenues

Assuming 2 dentists with 4 patients each in the first few months per day, this represents 160 patients per month. Assuming an average procedure of $540 (with some procedures like surgery and dentures costing up to $5,000), the monthly revenue stands at $90,000. Therefore we could reasonably assume $7,000 in lab fees and $5,000 in variable costs.

Other expenses

In addition to the expenses discussed above, there are a number of other operating expenses you should budget for. These expenses include for example: advertising, marketing, office supplies, professional fees, uniforms, laundry, telephone, electricity, etc.

Make sure to budget ~10% of your total revenues for these other operating expenses.

4. Build your P&L And Cash flow

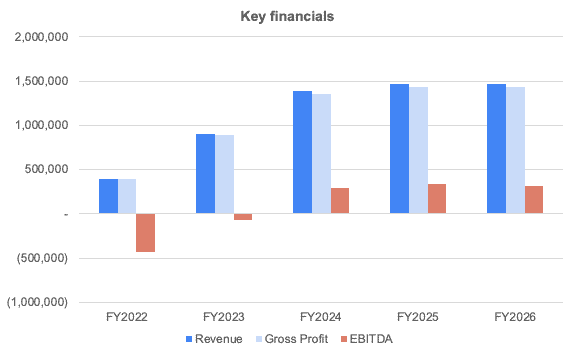

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own dental practice.

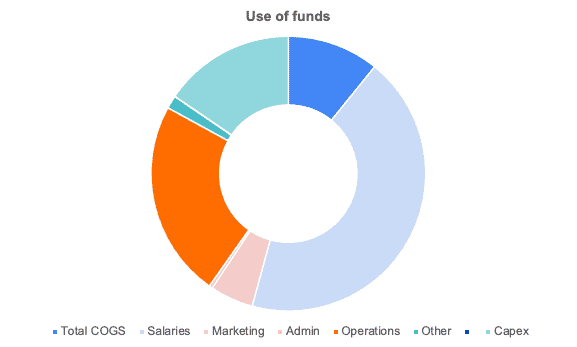

In this chart below, we're showing you an example of a typical cost structure a dental practice business would incur. Unsurprisingly, salaries and operations (rent, equipment) represent ~75% of total expenses.