How Profitable is a Bar? Profits & Break-even

If you are planning to open a bar, you may want to know how much profits you can make with this business. In other words, you must know how much revenue you must generate to reach break-even and make profits.

According to IBIS World, the US bar industry grossed $26.7 billion in sales in 2022 and counted over 73,000 businesses employing 392,900 people..!

Despite being a huge industry in the US, it’s also a very competitive one with high operating costs. If you’re wondering how much profits you can make with a bar, you’d have to consider first all the costs you must pay for to run such a business. Let’s dive in!

What is the average turnover for a bar?

7Shifts reports that the average monthly revenue for a bar is between $20,000 and $30,000. These numbers are based on the assumption that the average price for drinks is $8, for appetizers it is $6, and for main courses it is $13.

According to Binwise, bars have average monthly revenue of $27,500 ($330,000 a year). Binwise also reports that an average bar owner makes approximately $40,000 a year assuming that the owner doesn’t go for reinvestments from the net profit.

However, ZipRecruiter states that bar owners make $75,266 a year on an average. If you want to see state wise breakdown, you can follow this link.

Now, you must understand that these numbers are averages based on a small sample size. The actual revenue or turnover for your bar will depend on many factors like the overall size (square footage) of the bar, types of drinks you are selling, number of customers you receive every day, etc.

What is the average profit margin for bar?

The average net profit margin, according to Binwise, is between 10$ and 15%. As stated earlier, the profit margin for your bar business can differ depending on various factors, among others: the location of your bar, its concept, your pricing strategy and menu.

What are the typical startup costs for a bar?

Here are a few estimates of the key expenses you can expect for a 80 seats hard liquor bar in a premium location within a city like Portland. Note that these costs are for illustrative purposes and depend on a number of factors like the location of your bar, its size, etc.

| Startup cost | Amount |

|---|---|

| Refurbishment & branding | $50,000 – $100,000 |

| Equipment | $92,000 – $123,000 |

| Insurance, Licenses & permits | $500 – $3,000 |

| Initial inventory | $6,000 – $13,000 |

| Total | $148,500 – $239,000 |

Bar refurbishment costs

Opening a new bar involves the cost of renovating the space to reflect your brand and concept. A typical renovation involves new fixtures, lighting, and other architectural redesigns. Depending on the extent of the renovation, expect to pay between $50,000 – $100,000.

Bar equipment costs

To open a bar, you will need different types of equipment, including stools, wine racks and cabinets, refrigerators, counter height tables, and chairs. If you plan to serve food, you will need some kitchen and serving equipment as well.

Let’s start with the obvious: the bar equipment.

To put things into perspective, the average cost for underbar stainless steel bar equipment is about $900 per linear foot. For example, the cost of a 2-station bar with stainless steel drink rail, one glass washer and one ice machine is about $47,000.

However, the pricing fluctuates depending on the location and the equipment type. Many high-end bars (e.g. wine bars, cocktail bars) can easily spend around $2,000 per linear foot instead.

In addition to the bar equipment itself, you’ll have spend money to purchase, among others:

- POS systems: expect to pay anywhere from $2,000 to $8,000 for a complete POS system

- Counter height tables, chairs: here the cost vary significantly based on the number of seats as well as the quality. For example, a bar stool ranges anywhere from $150 to $1,300 a piece. Assuming 80 seats at $400 a piece plus tables, you’ll be spending $40,000 to $60,000

- Glassware: as rule of thumb, multiply the number of seats by 2. Assuming 80 seats, you should have at least 160 glasses. Here again, the cost vary on the quality you choose, expect to pay between $3,000 to $8,000 for 200 glasses

In total, you should budget on average between $92,000 to $123,000 based on our estimations above.

Initial inventory costs

You want to make sure the bar is well-stocked before opening it to the customers. For food, soft and alcoholic drinks, expect to spend between $6,000 to $13,000 or more, depending on the bar type and size.

How much does it cost to run a bar?

In addition to startup costs incurred at the start, there are a number of recurring costs (also known as operating cost) to run the bar the first few months. Here is an overview of the bar operating costs for the same hypothetical 80 seats premium bar:

| Operating cost | Amount (per month) |

|---|---|

| Rent | $4,000 – $5,000 |

| Salaries | $7,000 – $10,000 |

| Inventory (COGS) | $5,500 |

| Utility bills | $2,500 |

| Admin & other | $1,000 – $2,000 |

| Total | $20,000 – $25,000 |

- COGS: You must acquire inventory which includes alcohol and all other consumables

- Staff: You must pay salary to bartenders, manager, and other staff

- Rent: You will most likely be renting the bar space, and hence, pay a monthly rent

- Insurance: You will need business insurance and workers’ compensation insurance

- Utility bills: You must pay utility bills to cover expenses for gas, light, music, water, refrigeration, etc.

- Marketing: You need to spend money to advertise your bar to attract new customers (offline and online marketing)

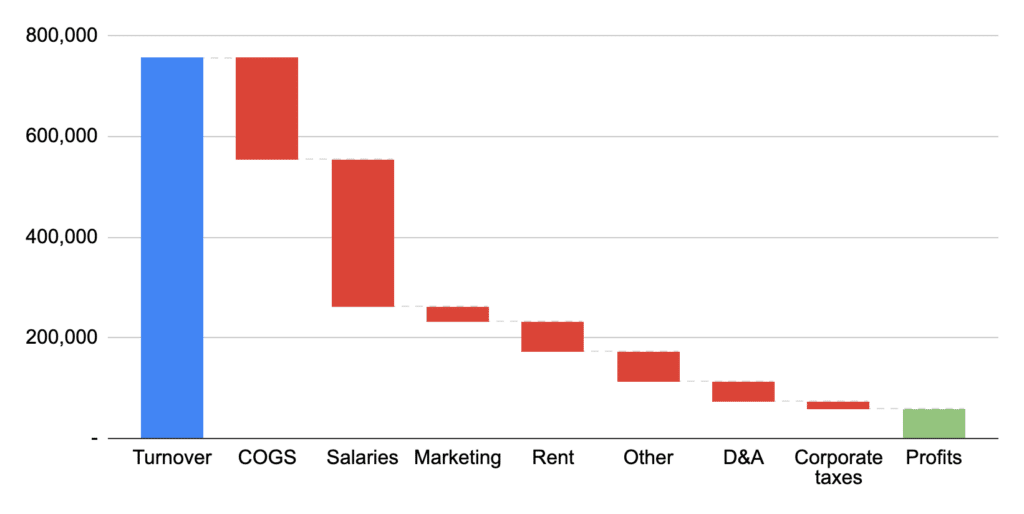

We’re including below the revenue to profits breakdown chart of what it looks like over a year for a casual bar generating over $700,000 in sales per year (~$2,000 per day). The most important expenses by far are COGS (alcohol and beverage supplies) as well as labor (staff salaries).

How to forecast profits for a bar?

In order to calculate profits for a bar, you must first forecast revenues and expenses.

Profits = Revenue – Expenses

Forecasting revenue for a bar

Revenue can easily be obtained by multiplying the number of customers by the average order value (AOV).

Revenue = Customers x Average Order Value

For example, if you have 120 customers in a day spending on average $10 each, monthly revenue is about $30,000 (assuming you’re open 6/7).

Forecasting expenses for a bar

There are 2 types of expenses for a bar:

- Variable expenses: these are the COGS as explained earlier. They grow in line with your revenue: if your turnover increases by 10%, variable expenses grow by 10% as well

- Fixed expenses: most salaries, rent, marketing and all the other operating costs listed above

Calculating profits for a bar

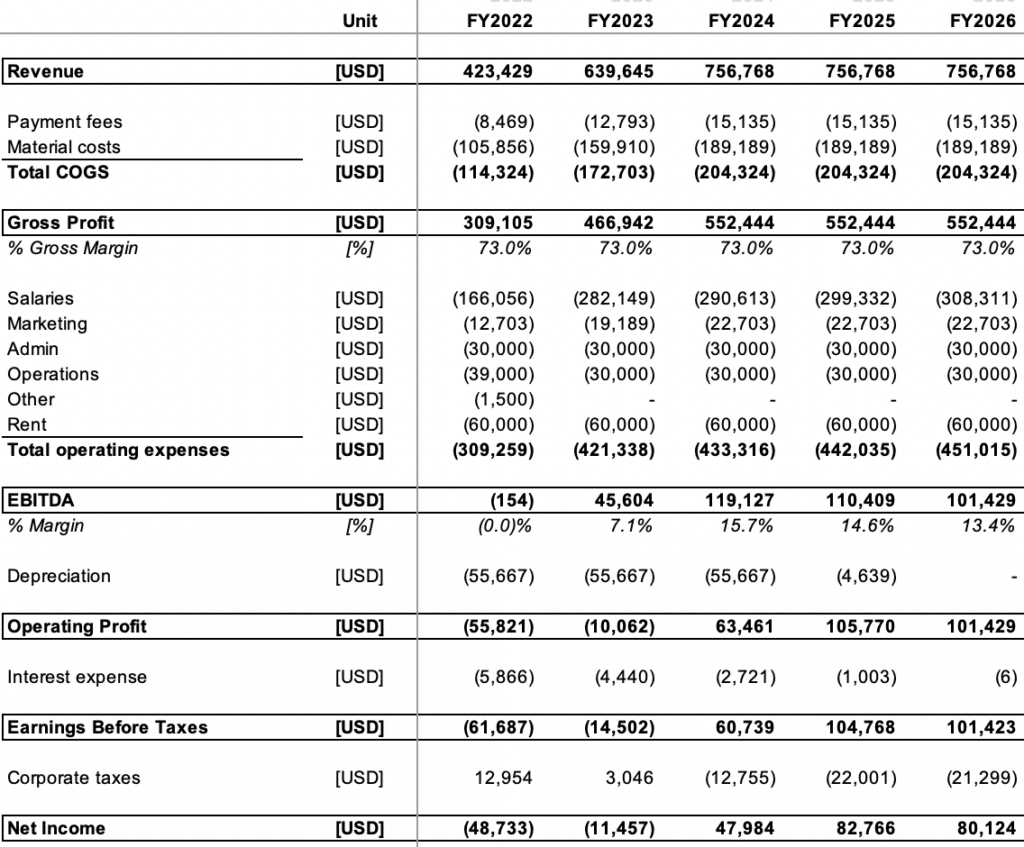

When we refer to profits, we usually refer to EBITDA (Earnings before interests, taxes, depreciation and amortization) as it represents the core profitability of the business, excluding things such as debt interests, non cash expenses and other non-core expenses.

In order to get to EBITDA, we use the following formula:

EBITDA = Revenue – COGS – Operating Expenses

To make it clearer, we’ve included below the profit-and-loss of a bar (from our financial model template for bars).

Whilst gross margin (after variable costs) is rather high (~70-75%) as explained earlier, EBITDA margin can go up to 10-15% depending on the bar, and net profit margin up to 5-10% for the most profitable bars.

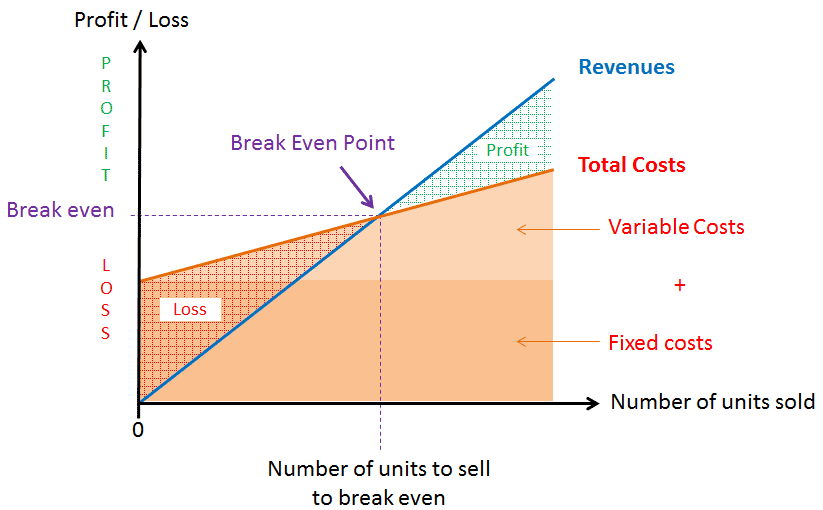

What is the break-even point for a bar?

Break-even is the point at which total costs and total revenue are equal. In other words, the breakeven point is the amount of revenue you must generate to turn a profit.

Because you must at least cover all fixed costs (that aren’t a function of revenue) to turn a profit, the break-even point is at least superior to the sum of your fixed costs.

Yet, you also need to spend a certain amount for every $1 of sales to pay for the variable costs. As we just saw, bars typically have rather high gross margins (75%). Indeed, most expenses are fixed costs (salaries, rent, etc.).

The break-even point can easily be obtained by using the following formula:

Break-even point = Fixed costs / Gross margin

Using the same example earlier, let’s assume your bar generates $30,000 in turnover per month and has the following cost structure:

| Operating Costs | Variable vs. fixed | Amount (per month) |

|---|---|---|

| COGS | Variable cost | $4,500 |

| Staff salaries | Fixed cost | $12,000 |

| Rent | Fixed cost | $5,000 |

| Marketing | Fixed cost | $2,000 |

| Admin, bookkeeping & other | Fixed cost | $2,000 |

| Total | $30,000 |

The break-even point would then be:

Break-even point = Fixed costs / Gross margin %

= $21,000 / 75% = $28,000

In other words, you need to make at least $28,000 in sales per month to turn a profit. Assuming a customer spends $10 on average, your break-even is 2,800 customers per month. In other words, you make profits once your bar serves 109 customers per day (assuming you’re open 6 days a week).

How to increase profits for a bar?

It is possible to increase the profits of a coffee shop using various strategies and they include:

- Upselling & Cross-selling: Teach your staff to upsell and cross-sell

- Free Tasting: Free tasting increases sales conversions

- Word of Mouth: Use your existing customer base to attract new customers through word of mouth

- Happy Hours: Happy hours create value for customers and boost sales

- Update Cocktail Menu: Keep cocktail menu updated to keep up with new trends

- Atmosphere: Provide a proper mood-setting atmosphere

- Track Inventory: Adapt to customers’ demands by tracking inventory

- Inventory Automation: Use software to track costs and sales. Also, use technology to allow customers to place orders conveniently

- Reduce Spillage: Spillage can lead to 18% inventory loss, and hence, reduce spillage to maximize profits

- Track Waste: Waste tracking can help you to minimize wastage and hence, losses

- Flexible Staffing: Avoid overstaffing and hire people on hourly basis

- Upgrade Equipment: Upgraded bar equipment with modern tech can help you to quickly sell high-priced products, reduce waste, and maximize efficiency

To learn more about these strategies, read our post here.