How to Build a Financial Model for a Cleaning Business

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your commercial (or residential) cleaning business, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a commercial cleaning company with 15 employees.

Also note that the charts and examples presented in this article come from our cleaning business financial model template.

1. Forecast the Number of Contracts

Like any other service business, the first thing you must do when building financial projections for a commercial cleaning business is to forecast the number of contracts over time.

This is arguably the most challenging part of your financial model, as you will need to forecast customer retention (contracts from repeat customers).

A contract is defined as one cleaning job. Therefore, it can be as simple as a 3 hour carpet cleaning cleaning job, or a 2 days industrial cleaning job.

There are 2 types of contracts: new and repeat contracts:

- New contracts are jobs you are providing only once for a customer (for example, a one-time carpet cleaning for an individual, i.e. 1 new contract)

- Repeat contracts, instead, are jobs that you provide a number of times for the same customer. For example, you could have signed an agreement with a corporate office to provide them cleaning services 3 days a week (3 repeat contracts per week)

Total Contracts = New Contracts + Repeat Contracts

Naturally, the number of contracts you can perform is constrained by your capacity: the number of cleaning workers you have and the length of each contract (short vs. long-term cleaning jobs).

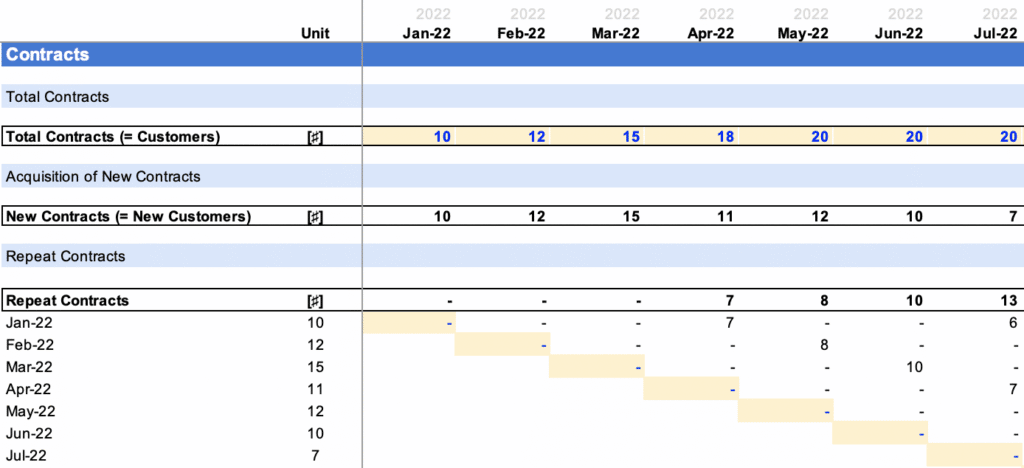

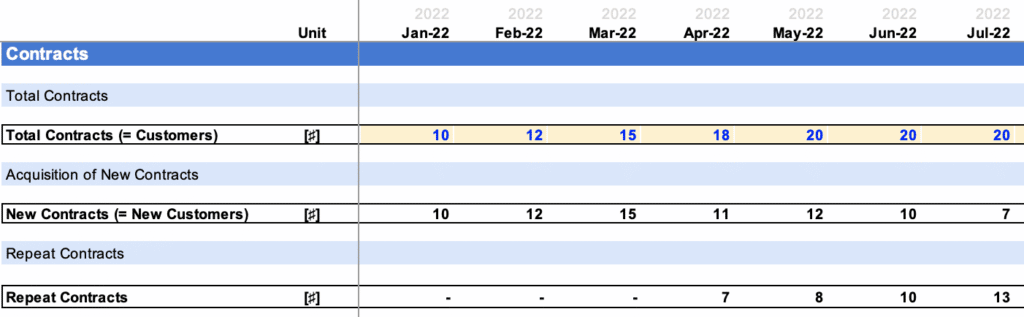

Total Contracts

The first thing you must do is set the number of contracts you expect to do over time. We suggest you do this month by month. For example, you could have:

- January 2023: 10 contracts

- February 2023: 12 contracts

- March 2023: 15 contracts; etc.

Note: we assume here you start your business in January and increase the number of contracts over time as you acquire new customers

Repeat Contracts

Now that we have set the number of contracts you can perform over time, let’s forecast New vs. Repeat Contracts, starting with the latter.

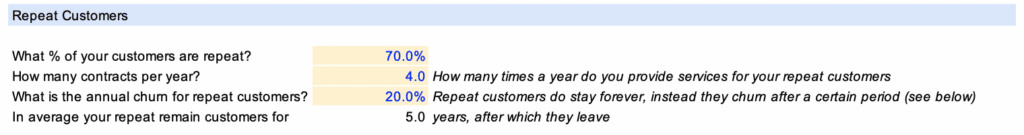

In order to forecast repeat contracts, you will need to set 3 assumptions:

- The percentage of customers that are repeat. For example 70% of your customers ask for periodical cleaning jobs

- The number of contracts per year per repeat customer. For example, you provide on average 4 contracts per year for each repeat customer i.e. every quarter

- The annual churn of repeat customers. Unfortunately repeat customers will churn over time (for example, a customer leaving after 5 years churn at 20% per year)

This will allow you to forecast repeat contracts over time as shown below (note we are using a cohort model as explained here):

New Contracts

Now that we have calculated Repeat Contracts over time, and set Total Contracts, New Contracts can easily be obtained using the following equation:

New Contracts = Total Contracts – Repeat Contracts

Finally, you can show the number of contracts over time, both from new and repeat customers (see chart below).

Note that the number of new customers’ contracts is much lower vs. repeat customers as you are constrained by your capacity. In other words, you can’t take on more new customers contracts unless you hire more employees..!

2. Calculate Revenue

Now that we have forecasted the number of contracts over time, we can now calculate revenue.

This can be done by segmenting the number of contracts by different type of jobs. Each job will have different rates and associated costs. Indeed, we will set the number of man hours per job so that we can calculate how many employees we need to perform these jobs.

We recommend setting a table like the one below:

In the example above, we assume that, if we have 100 contracts (in a month for example), we will perform:

- 75 stripping & waxing jobs priced at $3,000 each (7,500 x $0.40 per sq. ft.)

- 75 buffing & burnishing jobs priced at $800 each (10,000 x $0.08 per sq. ft.)

- 25 window cleaning jobs priced at $1,100 each (2,000 x $0.55 per sq. ft.)

- etc.

That way, you can obtain revenue projections by the type of contract as shown below:

3. Forecast Expenses

The 3rd step of our commercial cleaning financial model is forecasting expenses.

In addition to the startup costs discussed here, there are a number of recurring (or “operating”) costs that any commercial cleaning business must budget for.

We have laid out below an example of operating expenses for a standard commercial cleaning business with 15 employees: you would pay around $23,500 to $30,000 per month to run the business.

| Operating cost | Amount (per month) |

|---|---|

| Equipment and cleaning supplies | $3,000 – $8,000 |

| Rent | $5,000 |

| Staff | $35,000 – $42,000 |

| Marketing | $2,000 – $5,000 |

| Other (utility bills, gas, etc.) | $5,000 – $10,000 |

| Total | $52,000 – $70,000 |

Equipment and Cleaning Supplies

Depending on the size and kind of the company, the typical monthly cost of cleaning products can vary substantially.

While a huge warehouse or industrial plant would require materials costing several thousand dollars, a small office might just require a few hundred bucks.

You should also be aware that some equipment and supplies will only be purchased once. A vacuum cleaner or carpet blower, for instance, will only need to be purchased once. However, regular replenishment of the cleaning products will be required.

For example, the monthly cost of the replenishment of the equipment and cleaning supplies is around $1,000 for a residential cleaning business.

Instead, commercial cleaning services will cost significantly more to replenish cleaning supplies. The amount will depend on the size of your business.

Rent

The size of your activities will significantly impact how much office space you need.

Assuming you rent a 2,500 sq. ft. space at $30 per sq. ft. per year, you would pay about $5,000 per month in rent.

Staff

Depending on the hourly rate you intend to pay and the number of staff you’ll start with, labor costs can vary significantly.

The average janitorial worker earns $25,000 per year. So assuming you operate a commercial business with 15 employees, including support staff and managers’ and/or owners’ salaries, you would pay about $35,000 – $40,000 per month in salaries (including taxes and benefits).

Marketing

Like any other new business, you will need to incur marketing and advertising expenses to attract customers.

Typically, marketing expenses will often be higher during the first six months of business. Indeed, in the beginning you will need to attract new customers, before you can rely on organic growth (word-of-mouth) later on.

For a new business with 10 cleaners (5 teams of 2), you can expect to spend $2,000 to $5,000 in marketing expenses the first few months / years.

4. Build P&L and Cash Flow

Once we have estimated revenues, expenses and debt, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

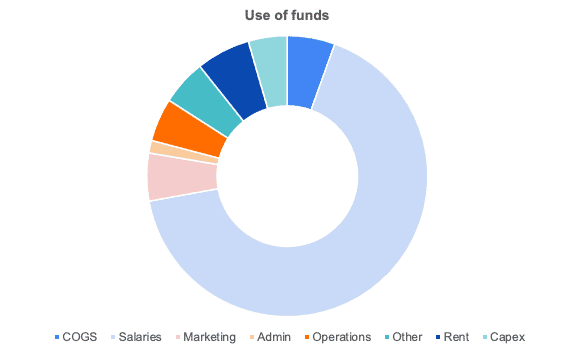

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own commercial cleaning business, which we do in our financial model template with the use of funds chart (see below).

In this chart, we’re showing you the example of a cost structure a typical cleaning business would have (including the upfront costs, for example, to purchase the cleaning equipment).

Unsurprisingly, salaries make up ~65% of total expenses: like any other service business, cleaning companies have indeed very little fixed costs apart from payroll.