How To Build a Financial Model For a Courier Business

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your courier & delivery company, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a small courier business with a fleet of 5 vans. Note that the numbers, charts and financials presented in this article come from our financial model template for courier businesses.

For more information on courier businesses, make sure to read our guides below: How To Start a Courier Business in 11 Steps How Much Does It Cost To Start a Courier Business? How to Write a Business Plan for a Courier Company

1. Forecast Vehicles

The first step of any courier financial model is to forecast the actual number of vehicles (vans, cars, bikes, etc.) over time. This means a few things:

- How many vehicles you will purchase (or lease) over time, and when

- How much you pay for these vehicles

- How you finance the acquisition of vehicles (leasing, debt or equity)

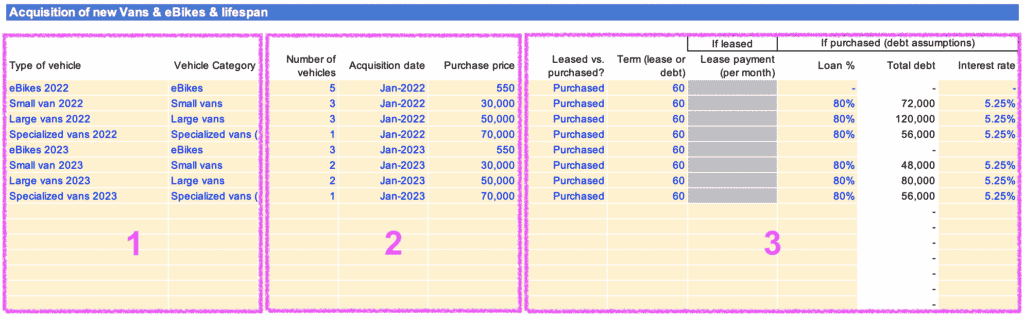

In order to do so, prepare a table like the one below, where you can list all the different vehicles, their category (bikes, light vans, large vans, specialized vans, etc.), purchase price, and all the criteria listed above.

The different sections are as follows:

- The different types of vehicles and their category (each category will have a different revenue per mile as we will see later on) for example bikes, vans, etc.

- For each category, the number of vehicles acquired, the date of acquisition and the price paid per vehicle;

- For each category, whether you lease or buy the vehicles:

- If you lease: the term of the lease (how many months will you pay back the lease) and the lease payment per month

- If you buy: the % of the purchase price that’s covered by a loan, the interest rate per year and the term of the loan

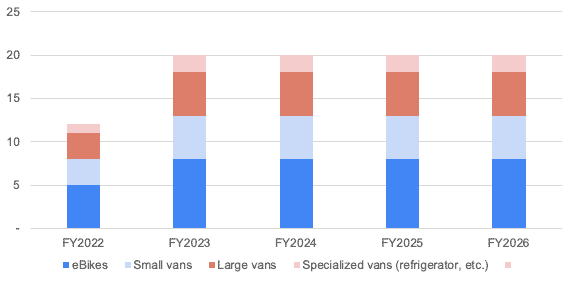

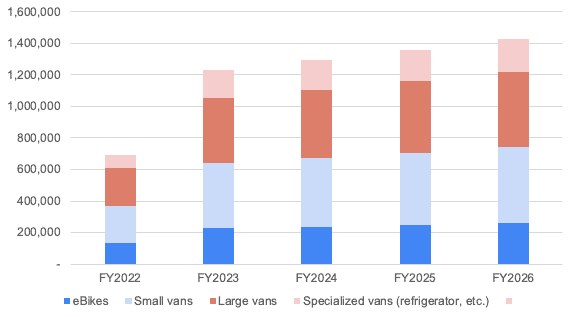

That way, you will be able to forecast accurately how many vehicles are available for you to operate:

2. Forecast Revenue

Now that we have estimated the number of available vehicles over time, the next step in our courier financial model is to forecast revenue.

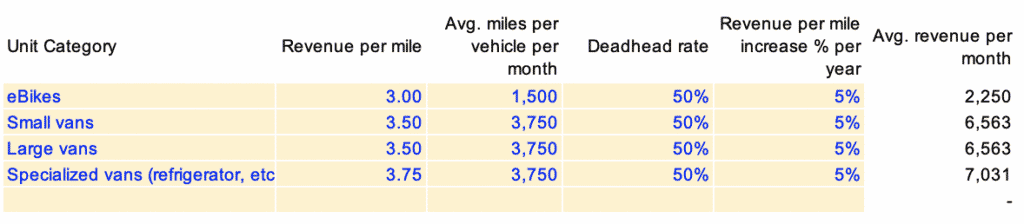

Revenue is the function of:

- Number of available vehicles (which we already calculated above)

- The number of miles per vehicle (per month)

- Deadhead rate (the percentage of the miles your vehicles drive with an empty cargo)

- The revenue per mile (how much you charge per mile in average to your customers)

Tip: best practice is to have different assumptions for each vehicle category as shown below:

Now that you have set all 4 parameters for each vehicle category, you should be able to easily calculate revenue for all your vehicles as shown below:

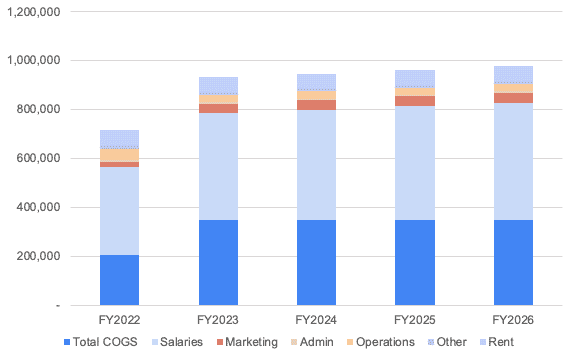

3. Calculate Expenses

In addition to the one-off startup costs discussed here, you must also budget for all the operating costs of running a courier business.

As you would expect, by far the biggest chunk of your costs are variable costs that are a function of the number of miles your vans drive each month. From fuel costs to drivers’ wages, let’s have a look at the key costs you should budget for in your business plan to run a courier business using the example of a courier business with 5 vans:

| Operating cost | Amount (per month) |

|---|---|

| Fuel | $6,500 – $8,000 |

| Repair & maintenance | $3,000 |

| Drivers’ wages | $26,000 |

| Leasing or debt repayment | $3,500 – $4,000 |

| Rent & utility bills | $1,500 |

| Total | $40,500 – $42,500 |

Fuel

One of the most important expense for courier delivery companies is fuel.

For example, a 4-wheel drive pick-up van use around 21 to 26 litres of diesel per 100 kms. So assuming that a van drives on average 150 miles per day, that’s a total of $50 to $60 per day for fuel costs alone.

This represents an average of $0.35 to $0.40 in fuel costs per mile for courier delivery vans.

Assuming you operate 5 vans 6 days a week, that’s a total of $6,500 – $8,000 per month.

Repair & Maintenance

In addition to fuel, you should also budget for the regular checkup and maintenance cost for your vans. On average, it costs $0.14 per mile and varies based on the vehicle’s model and condition.

Using the same example above, assuming 5 vans driving 150 miles per day 6 days a week, that’s a total of $3,000 for repair and maintenance costs.

Drivers Wages

The largest expense for courier businesses is the cost of drivers’ wages.

Courier delivery is an intense job as you constantly are on the go and must combine both driving with handling of the parcel boxes themselves.

That’s why courier delivery salaries typically are higher vs. other types of transport jobs salaries (e.g. taxis, truck drivers, etc.). As a reference point, the average gross salary for a delivery driver in the US is $44,000 per year.

As you need to hire full-time and part-time employees to cover 6 days a week with 5 vans, you would need about $26,000 for salaries (including 20% taxes and benefits).

Leasing or Debt Repayment

Whether you decided to purchase the vans with a bank loan or to lease them instead, you will need to pay back the loan or the lessor each month.

Now, let’s assume as explained earlier you purchased 5 vans worth $35,000 each with 85% of debt and a 5.50% SBA loan over 8 years, you would be paying back around $3,500 – $4,000 in debt repayment and interest each month.

Rent & Utility Bills

As explained above, you will need a warehouse for fulfilment and potentially a separate office for administrative and support functions (finance, HR, etc.).

Assuming you rent a 2,500 sq. ft. commercial space for a small office and a warehouse for 5 vans in an industrial area at $6.5 per sq. ft., rent should cost you around $1,500 per month (including utility bills).

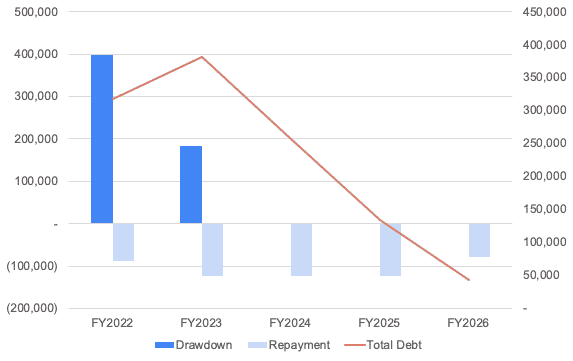

4. Calculate Lease / Debt Interest

Another important part of any courier financial model is to forecast your balance sheet, and more especially:

- Your assets (if you own the vehicles); and

- The debt

Doing so will allow you to do 2 important things:

- Calculate debt interest expenses. Indeed, if you purchase some of the vehicles with debt, another important expense will be the financial interest on the loan which you must forecast accurately

- Forecast your cash flow statement. Indeed, as we will see in the next section, one of the most important impact on your cash flow are debt repayments (not the interest itself but the principal repayments instead).

Therefore, make sure you calculate, each month:

- Any debt drawdown (if you acquire new vehicles with debt in the future)

- Debt repayment (the actual loan repayments)

In the end, you should be able to obtain something like the chart below:

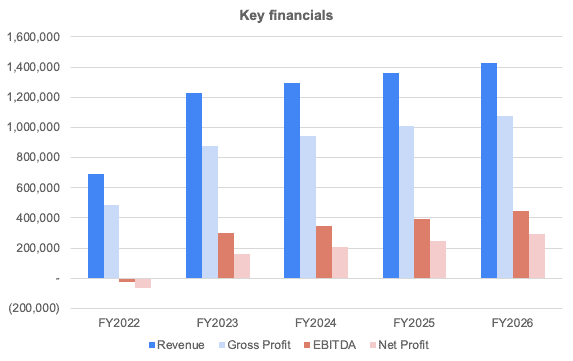

5. Build your P&L And Cash flow

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

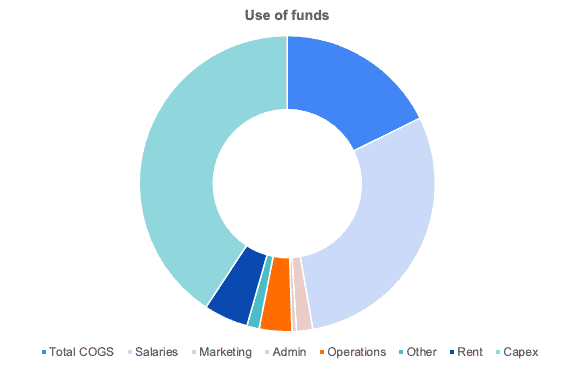

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own courier business, which we do in our financial model template with the use of funds chart (see below).

In this chart below, we're showing you the example of a cost structure a 5-vans fleet courier business over the first 12 months. Unsurprisingly, over 85% of total expenses are the cost of acquisition of the vehicles (of which the large part is covered by debt) plus the COGS (fuel, repair, etc.) and the drivers' wages.