Pure Barre Franchise FDD, Profits & Costs (2025)

Pure Barre, recognized as a prominent lifestyle brand beyond just a barre workout, fosters a community where both women and men are inspired and empowered to achieve their fitness and lifestyle goals.

Pure Barre was founded in 2001 and began its journey into franchising in 2009. The concept quickly expanded, particularly along the West Coast initially, as the founder had relocated to California.

Established as the largest and most seasoned barre franchise, Pure Barre has cultivated a strong following, with a client base that enjoys low-impact, small movement exercises designed to enhance strength, cardio, and flexibility across various fitness levels.

Initial Investment

How much does it cost to start a Pure Barre franchise? It costs on average between $314,000 – $629,000 to start a Pure Barre franchised location.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of facility you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount Range |

|---|---|

| Initial Franchise Fee | $60,000 to $60,000 |

| Sourcing Fee | $0 to $28,000 |

| Travel & Living Expenses While Training | $0 to $3,000 |

| Real Estate/Lease and Professional Fees | $17,500 to $36,500 |

| Net Leasehold Improvements | $103,500 to $279,500 |

| Signage | $9,000 to $22,000 |

| Insurance | $3,872 to $8,056 |

| Fitness Equipment & Initial FF&E Package | $23,900 to $51,500 |

| Pre-Sales and Soft Opening Retail Inventory | $14,000 to $18,000 |

| Computer System, A/V Equipment, Components | $19,500 to $22,500 |

| Initial Marketing & Advertising Spend | $30,650 to $39,900 |

| Initial Instructor Training Fees | $8,850 to $13,750 |

| Technology and Software Fees | $3,639 to $3,639 |

| Additional Funds – 3 Months | $20,000 to $43,000 |

| Total Estimated Initial Investment | $314,411 to $629,345 |

Average Revenue (AUV)

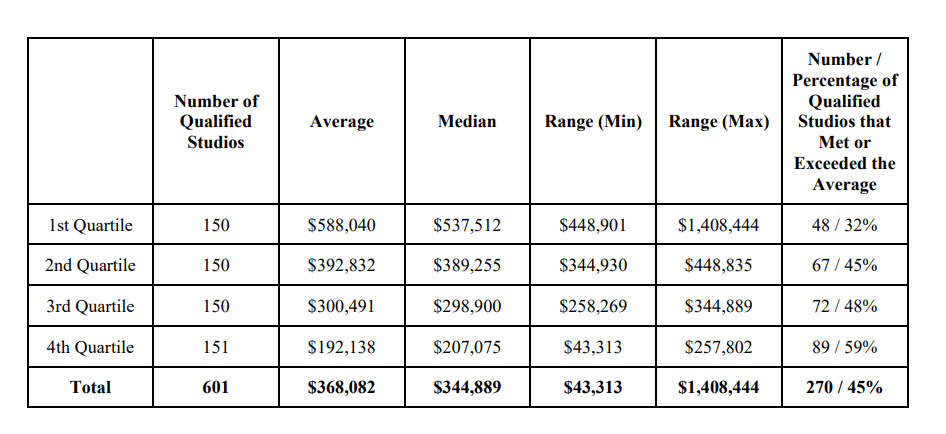

How much revenue can you make with a Pure Barre franchise? A Pure Barre franchised studio makes on average $345,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

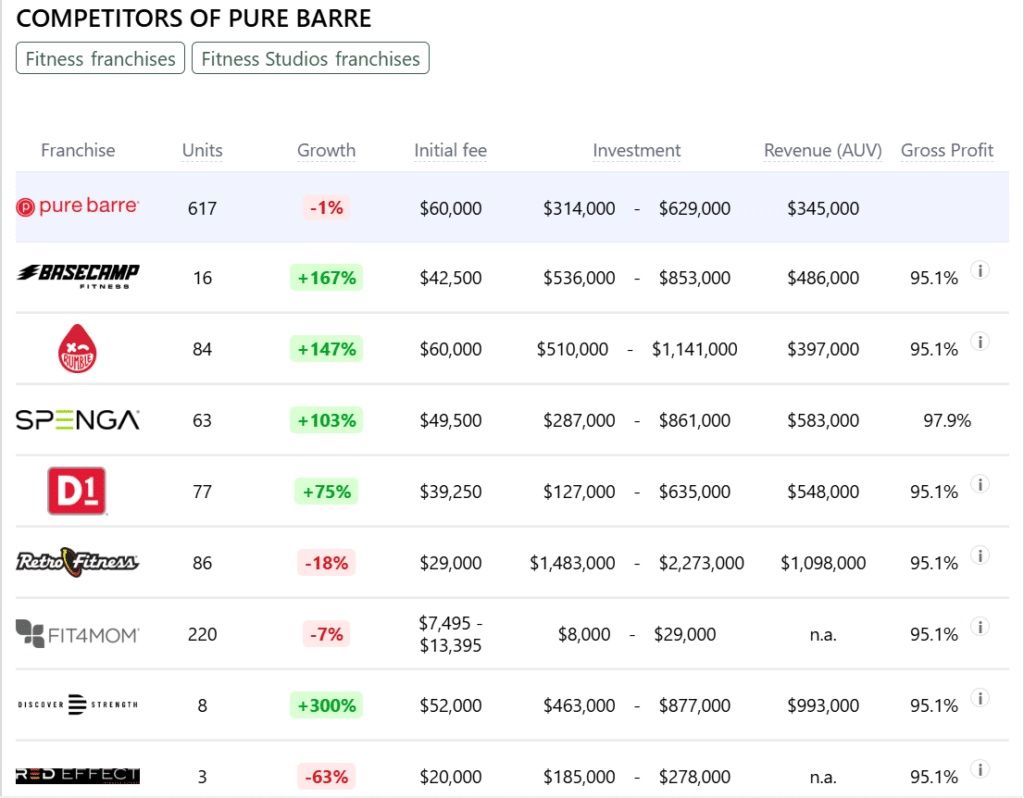

This compares to $401,000 yearly revenue for fitness studio franchises. Below are 10 Pure Barre competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Pure Barre locations are there?

As of the latest data, Pure Barre operates 617 franchised locations across the United States. The company does not have any company-owned locations, as it focuses entirely on franchising its studios.

Pure Barre has grown to become one of the largest boutique fitness brands under the Xponential Fitness umbrella, with studios in 48 states. This expansion highlights the brand’s strong presence in the fitness industry.

What is the total investment required to open a Pure Barre franchise?

The total investment required to open a Pure Barre franchise ranges from $314,000 to $629,000.

What are the ongoing fees for a Pure Barre franchise?

For a Pure Barre franchise, the ongoing fees include a royalty fee of 7% of gross revenues. Additionally, franchisees are required to contribute 2% of gross revenues towards marketing fees.

These fees support the brand’s ongoing operations, including system-wide marketing initiatives, advertising campaigns, and other support services designed to drive membership growth and maintain brand recognition.

What are the financial requirements to become a Pure Barre franchisee?

To become a Pure Barre franchisee, applicants must meet specific financial requirements. This includes having a minimum net worth of $500,000 and liquid capital of at least $100,000.

These financial benchmarks ensure that potential franchisees have the necessary resources to cover startup costs, ongoing operational expenses, and any unforeseen challenges that may arise in the early stages of the business.

How much can a Pure Barre franchise owner expect to earn?

The average gross sales for a Pure Barre franchise are approximately $0.35 million per location. Assuming a 15% operating profit margin, $0.35 million yearly revenue can result in $53,000 EBITDA annually.

Who owns Pure Barre?

Pure Barre is owned by Xponential Fitness, a leading franchisor of boutique fitness brands. Xponential Fitness acquired Pure Barre in 2018 as part of its portfolio of fitness brands, which includes other well-known names such as Club Pilates, CycleBar, and Row House.

Xponential Fitness specializes in managing and growing fitness brands across various exercise modalities, making Pure Barre one of its key franchises in the barre fitness space.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.