How To Build a Financial Model For a Restaurant

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a budget for your restaurant business plan, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a typical 120 seats restaurant.

1. Forecast Customers

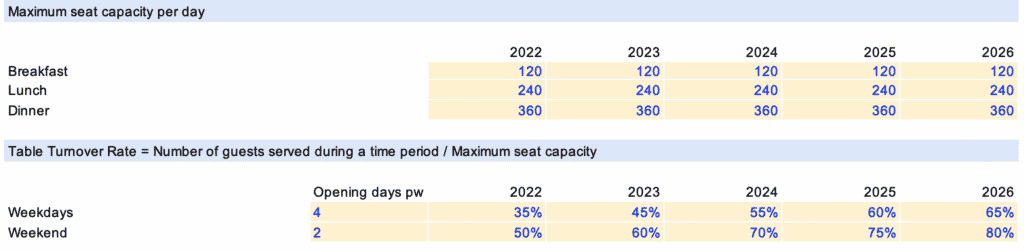

The first thing you must do to create a financial model for your restaurant is to forecast the number of customers you will serve over time. You can do it the easy way or make it more complex based on your requirements. The guidelines below are our recommendations to create accurate and flexible customer projections for any restaurant:

Forecasting customers can be done as follows. You must set the number of:

- Customers you expect to serve on average on a weekday (breakfast, lunch and dinner)

- Customers on a weekend day instead (breakfast, lunch and dinner)

- Days you are open in a week on average (for example 3 weekdays and 2 weekend days if you are open Wednesday to Sunday)

Tip: the values you enter can be set over time, for example for each year as shown in the example below.

That way, you will be able to forecast accurately the number of customers you can serve over time, as well as the revenues which we will now see in the next section.

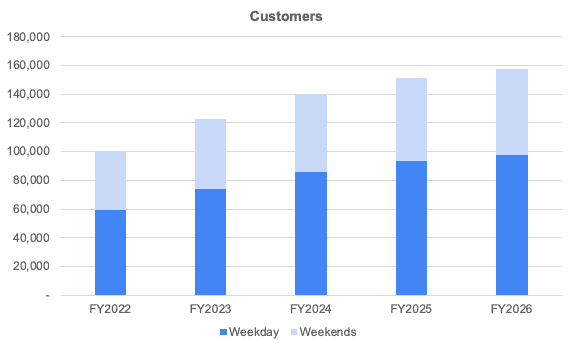

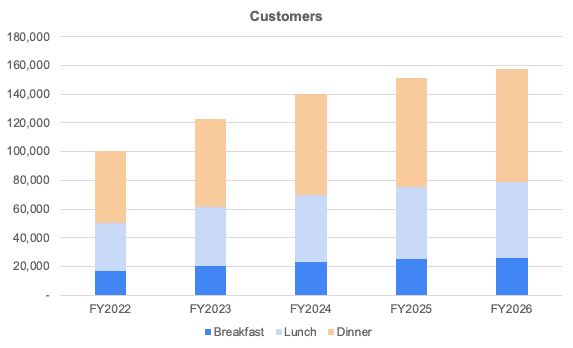

Customers can be represented under different formats: either between weekday and weekends or between breakfast, lunch and dinner as shown in the examples below.

2. Forecast Revenue

Now that we have estimated the number of customers over time, we can calculate revenue.

Yet, before we do so, we must break down the number of customers into the different products they may buy. Indeed, most of you customers may buy a main at an average price of $20.00, yet some may also buy other products such as starter for $12.00, desserts for $7.00 or even alcoholic drinks for $6.50 on average.

It’s very important to break it down right. Indeed, as you know all these products have very different unit economics (prices and profit margins) you need to forecast accurately. Let’s see now how.

First, break down the products into a percentage of your total customers. For example:

- 30% of the customers may choose to get a starter at an average price of $12.00;

- another 60% buy a main at an average price of $20.00;

- 15% buy a dessert for $6.50, and so on..

That way, you can now multiply the number of customers for each product by their respective price to obtain revenue.

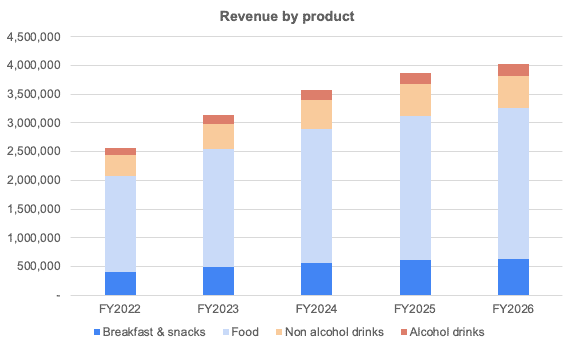

Now you can obtain your revenue projections broken down by the type of product categories as shown below. Instead of using separate menu items, we recommend to group them under categories instead (e.g. breakfast & snacks, food, drinks, etc.).

3. Forecast Expenses

In addition to startup costs, there are also a number of operating costs to run a restaurant.

So, we have decided to give you below a clear overview of all the key expenses you can expect for starting a casual restaurant with 120 seats. Note that these costs are for illustrative purposes and depend on a number of factors as explained earlier.

| Operating cost | Amount |

|---|---|

| COGS | $35,000 |

| Rent or mortgage payments | $7,000 (rent) – $10,000 (mortgage) |

| Staff costs | $30,000 – $40,000 |

| Utilities | $2,500 |

| Marketing | $2,000 – $4,000 |

| Software costs & insurance | $1,500 – $2,500 |

| Other (maintenance, tableware, etc.) | $1,000 – $2,000 |

| Total | $79,000 – $96,000 |

COGS

The Cost of Goods Sold is perhaps the most important operating cost you must account for when operating a restaurant.

The COGS for restaurants is usually between 28% and 35% of monthly revenue, but it can be as high as 40%. Of course, the cost will depend on the type of food you serve. For instance, a steakhouse will usually have a COGS of 40%, while an Italian restaurant will have COGS of 28%.

For example, if 80 people eat at your restaurant on average in a day (65% occupancy rate based on a 120-seat restaurant, this results in 2,500 people a month (assuming 6 days a week). With an average order value of $50, the total monthly revenue would be $100,000. The COGS in that case will be around $35,000 (assuming casual restaurant).

Do not forget that this percentage can significantly fluctuate depending on factors like local & international supply and demand, international trade restrictions, weather and more.

Rent/Mortgage Payment

If you leased a restaurant space, you will need to pay monthly rent. On the other hand, if you took a loan to buy the restaurant space, there will be monthly mortgage repayment. However, the amount you pay per month will depend on a number of factors including the size of the space, location, lease or purchase, and more.

Assuming an average $40 per square foot per year in a premium location of a city like Portland, you would be paying around $7,000 per month in rent for a 2,000 square foot space.

Employee Salaries

COGS and employee salaries are the most important costs to operate a restaurant. This cost is also a variable cost and depends on the location and various other factors.

Here is a quick list of hourly salaries that you must consider:

- Head Chef: Average annual salary: $50,145

- Prep Cooks: Average hourly salary: $14.74

- Restaurant Manager: Average annual salary: $51,180

- Server: Average hourly salary: $15.72

Whilst fast-food restaurants can achieve staff costs as low as 25% of sales, table-service restaurants typically spend 30-40% of their revenues in staff expenses instead. Assuming a $100,000 monthly revenue in our restaurant example above, this would require anywhere between $30,000 in $40,000 in staff costs.

Utilities

You have to keep water, lights, gas, and music in a restaurant. Therefore, you have to budget for the utility bills appropriately. You can expect to pay approximately $2,500 per month on utility bills, depending on the size of your restaurant.

Marketing

You need to ensure proper marketing to attract reliable customers to your restaurant. Therefore, make sure you set aside a marketing and advertising budget. The marketing costs to promote your restaurant will depend on the medium used and the target audience.

Typically, marketing and paid advertising will cost more in the first 6 months of operation. Indeed, as you’re opening up the business, you’ll need a significant budget to promote your coffee shop before you can rely on organic growth (word-of-mouth).

Because coffee shops are local businesses, marketing will mostly be offline (posters, billboards, etc.) but should also include some online spending (especially on social media).

For PPC advertisements and social media ad campaigns, you can set a monthly budget. It is totally your choice and budget. Some people spend up to $500, while others can spend up to $2,000 or more.

If you want to run radio campaigns, it can cost you anywhere between $20 and $80 per ad spot. For TV ads, it will be expensive, and it can cost you $104,700 for a 30-second ad on a national network. But you must also spend on ad production.

Software Costs

There will be several recurring software costs* that include:

- POS software: starting at $60 a month (see above)

- Employee scheduling and management software: Free with limited usage or starting at $29.99 a month with advanced features

- Reservation tool and table management software: Free with limited usage or starting at $49 a month with advanced features

- Loyalty program software: $399 a month to $1,500 a month

* These costs can vary depending on the software you select.

Insurance

It is a must to have insurance in place. According to Insureon, the median annual premium for a BOP or Business Owner’s Policy is $2,080.

If you are going for a workers’ compensation policy, you can expect to pay an average annual premium of $1,480.

You can also go for liquor liability insurance, which will cost you $545 a year on average.

Plus, if you also go for general liability insurance, there will be another $805 average annual premium.

Collectively, that will be $4,910 per year. Interestingly, you don’t need to opt for all types of policies you choose. It will all depend on your specific needs.

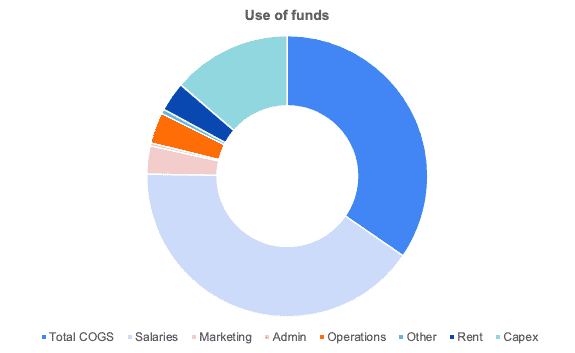

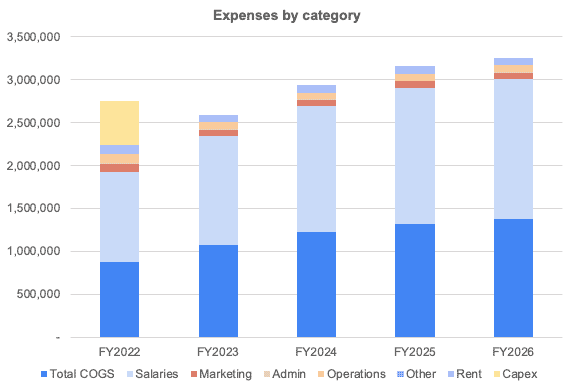

Tip: we recommend to forecast expenses either as a recurring fixed value (that can increase over time i.e. 5% per year for example) or a percentage of revenue. This is the approach we use in our restaurant financial model template of which we are including a summary chart of the expenses below:

4. Build your Restaurant P&L And Cash Flow

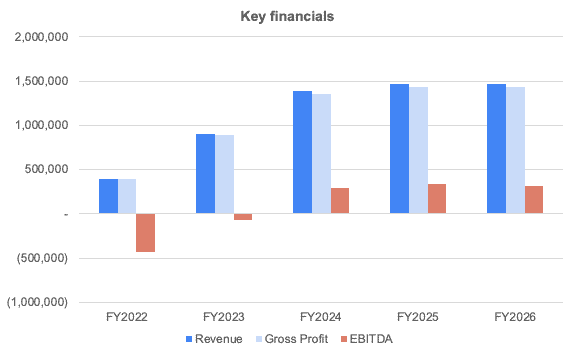

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key restaurant financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own restaurant.

In this chart below, we're showing you an example of a typical cost structure a 120-seats casual restaurant business would incur. Unsurprisingly, salaries and COGS represent ~75% of total expenses.