Restaurant Profit and Loss: Complete Guide [Free template]

If you’re running a restaurant, you might have heard of the profit and loss statement (or “income statement”). Undeniably the most important financial statement of all, your profit and loss (P&L) gives a clear overview of the profitability of your restaurant by listing all your sales and expenses.

But what exactly is a profit and loss? What is included in a profit and loss for a restaurant? How should you analyse the profit and loss for a restaurant?

Whether you’re preparing financial projections for the business plan of a restaurant or you’re simply curious to understand your restaurant’s finances, in this article we’ll tell you everything you should know about the profit and loss statement. Let’s dive in!

What is a Profit and Loss Statement?

A profit and loss (P&L), also referred to as “income statement”, is one of the 3 financial statements a company must prepare and update regularly. The 3 financial statements are:

- Profit and loss (P&L)

- Balance sheet

- Cash flow statement

The profit and loss is undeniably the most important of all financial statements as it shows the company’s revenues and expenses over a period of time (a month, a quarter or a year).

Therefore, we use P&L to understand a company’s ability to generate profits and, more generally, to assess its financial health. We would, for example, increase a restaurant’s profits by either increasing revenues or reducing its expenses.

What is included in a restaurant profit and loss?

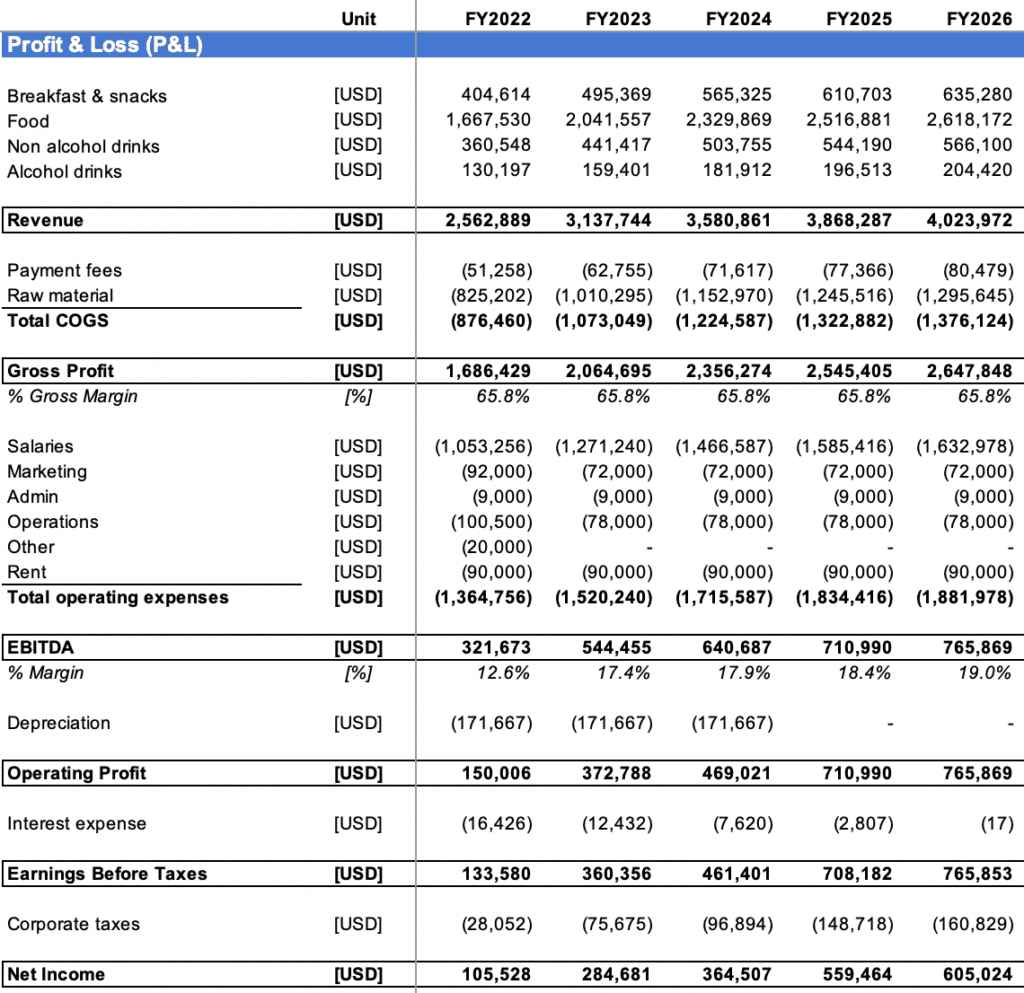

A restaurant P&L, like any other business, includes all revenues and expenses over a specific time period. To build a P&L we first add all revenues at the top (total revenues) deduct all expenses (COGS, labor costs, rent, etc.) down to net profit.

Here are all the elements you will find in your profit and loss:

Sales

This section will include all your restaurant’s sales. Therefore, you should add all your customer payment receipts and any other revenues you might have earned over the period.

We recommend you segment sales into different categories for a more transparence on your restaurant’s top revenue streams. For example, you could segment sales by product (food vs. drinks). If you operate a takeaway restaurant, you could also differentiate dine-in vs. takeaway sales.

Cost of Goods Sold (COGS)

The sum of the variable costs you must pay for to prepare the food and drinks you serve to your customers. For a restaurant, this includes food supplies from restaurant suppliers, drinks (bottles, beer, soda, etc.).

COGS also include variable costs like card payment processing fees (the 2-3% you pay to Visa, Mastercard, Amex, etc.) when your customers pay by card.

Labor costs

This includes all your restaurant staff costs: salaries, taxes and benefits (social security) as well as any bonuses. Labor costs can also be differentiated between the different teams (e.g. servers, kitchen, management).

Operating costs

Operating expenses for a restaurant include all the costs you must incur to run your restaurant’s daily operations. This can include marketing, rent, leasing expenses, bookkeeping, insurance, waste removal, etc.

In this section you should segment operating costs within a number of categories.

There is no good or wrong structure here: choose the presentation that makes most sense for you to analyse your restaurant’s financial health. You could for example have: operations (waste removal, janitorial services, etc.), marketing, rent (mortgage payment and utility bills) and other (insurance, bookkeeping, etc.)

Non-operating costs

Non-operating costs are expenses that aren’t part of your business daily operations. For a restaurant, non-operating costs mostly include: depreciation & amortization expenses, debt interest expenses and corporate taxes.

How to read a Profit and Loss for a restaurant?

A restaurant P&L statement can take different forms. For example, your accountant might prepare a simplified version of your profit and loss to submit to the IRS as part of your annual tax return filing obligations.

In addition to the mandatory annual tax return filing any business must comply with, you should also prepare and update regularly a more detailed version profit and loss for your restaurant to assess your business’ financial health and ability to generate profits.

Here are the most important financial metrics and ratios you should understand when analysing your restaurant’s profit and loss (see the full list here):

Gross Profit

Gross profit is the sum of your sales minus all your variable costs (the COGS).

EBITDA

EBITDA is the sum of your sales minus all variable, labor and operating costs.

Operating Profit

Also referred to as EBIT (Earnings before Interest and Taxes), operating profit is the sum of your sales minus all variable, labor, operating costs as well as depreciation & amortization expenses.

Net Profit (or loss)

It is the sum of all sales minus all operating and non-operating expenses. It it is positive, your restaurant is profitable. Instead, it’s called a net loss if it is negative (your restaurant is unprofitable ie. you are spending more than what you earn).

Free restaurant P&L template

Download our free restaurant profit and loss Excel template below:

Any questions? We’d love to hear from you. Contact us here.

Do you want to create rock-solid financial projections for a restaurant? Are you preparing pro forma financial statements for your business plan? Whether you’re pitching investors or applying for a SBA loan, download our financial model template for restaurants below: