How Profitable are Coworking Spaces: Costs, Profits & Breakeven

👇 Check all our resources on coworking spaces 👇

When you plan on opening a coworking space business, you must understand how to turn your revenues into profits. In simpler terms, you need to understand how much you will need to run a coworking space and how to break even.

According to the Global Coworking Survey, 90% of coworking spaces that are profitable have at least 200+ members and have been operational for more than a year. Additionally, 1/3 of coworking spaces operate a break-even and a further 1/4 are operating at a loss

In this article we’re looking at how much you can realistically make with a coworking business, how profitable this business really is and whether it’s a good investment. Let’s dive in!

How do coworking businesses make profits?

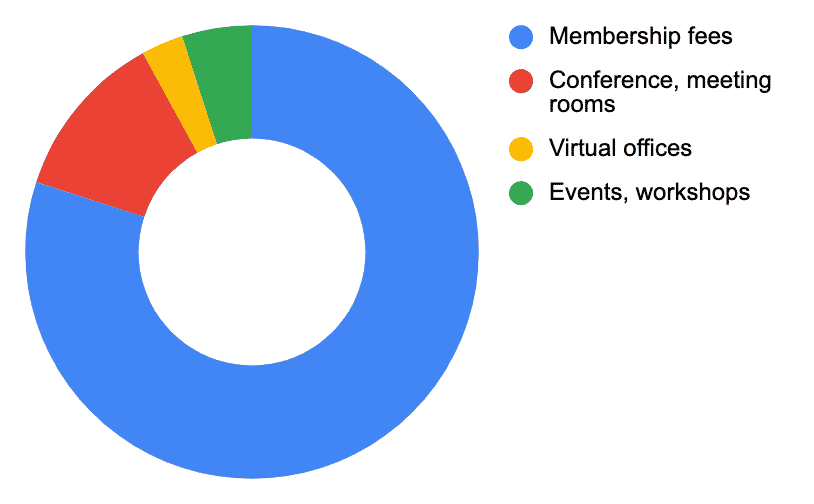

Unlike other businesses, coworking spaces feature a unique business model, and so are the revenue streams. If you intend to start a coworking space and hoping to maximize your business profits, here are examples of revenue streams to factor in.

Membership fees & desk rental

Almost all coworking spaces typically charge membership fees which give coworkers access to the amenities. The membership fees can be monthly, quarterly, or even annual, allowing the coworkers access to primary and advanced amenities depending on the fees paid.

In addition to membership, many coworking spaces also give customers the ability to rent out desks by the day or a week. Although not a primary source of revenue, and less attractive than locked-in monthly memberships, desk rental fees provide coworking owners with extra revenue, especially when the coworking space isn’t at maximum capacity.

Typically membership fees and one-time desk rental account for 80% of coworking spaces revenue. The rest come from additional revenue streams as described below.

Renting conference and meeting rooms

Coworking spaces provide the coworkers access to fully-furnished meeting rooms and conference rooms. Depending on the membership, the meeting facilities may feature private audio or video call booths, printers, soundproofing, and other amenities. This can either be included in a membership fee, or sold as an additional service.

Virtual offices

Coworking spaces add virtual office offerings to their business models. Typically, a virtual office gives entrepreneurs a premium address and access to office-related services, enabling them to have a primary address for their businesses and avoid the need for employing administrative staff.

Events & workshops

The diversity in terms of companies, work structure, and employees in coworking spaces enables the owners to use them for promotional activities. Therefore, workshops or training events at these coworking spaces serve as opportunities to promote products and services at a fee.

See below an illustrative revenue breakdown of a typical coworking space. Membership fees are by far the most important revenue stream (typically 80%).

What’s the average turnover for a coworking?

According to Zippia, the average annual revenue of a coworking building is $505,200.

What’s the average profit margin for a coworking?

According to Levels.io, the profit margins of coworking spaces are pretty tight and they usually maintain a 10% profit margin.

However, the figure is based on assumptions. The actual profit margins will depend on factors like:

- The size of the coworking space

- Building rent

- Number of staff

- Total members using the space, etc.

In comparison, Denswap says that the average profit of coworking spaces is $4 per square feet. Now, as the average size of a coworking in the US is 9,799 square feet, that’s an average profit of about $40,000. This seems about right compared to the average annual revenue above: that’s an average profit margin of 8%.

As per our own analysis, we found out the most successful car wash businesses reach net profit margins of about 10-20%.

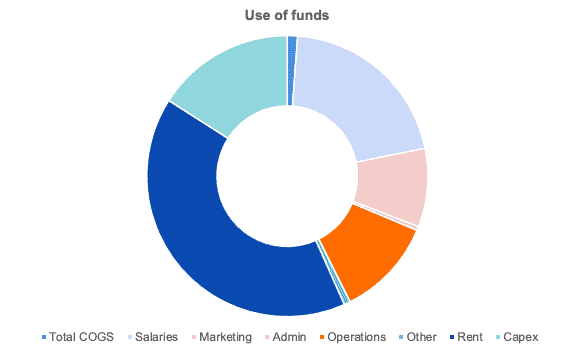

How much does it cost to run a coworking space?

On average, it costs $32,000 – $36,500 per month to run a 3,000 SF, 100 desks coworking space.

Note these numbers are only for illustrative purpose and will depend on various factors like: the location of your coworking, its size (square feet) as well as the amenities and services you offer.

Here’s a breakdown of the different costs you can expect for a 3,000 square feet coworking space with 100 desks:

| Operating costs | Amount (per month) |

|---|---|

| Rent | $10,000 |

| Salaries | $10,000 |

| Utility bills | $1,000 – $2,000 |

| Marketing & advertising | $3,000 – $6,000 |

| Cleaning services | $5,000 – $7,500 |

| Bookkeeping, legal & admin. | $1,000 |

| Total | $32,000 – $36,500 |

How much profits does a coworking generate?

Based on our own analysis, coworking spaces can reach profit margin (EBITDA margin) of around 10-20% once they manage to reach full capacity, typically 12-16 months after opening.

The expenses, expressed as a % of revenue, can be divided between:

- Rent (30-40%) depending on the location and surface. Prime locations will likely spend 40% or more whilst tier 2 locations spend 30% or less

- Salaries (25-30%). Salaries vary depending on the type of services you offer. For example, a community manager may be a great addition for large coworking offices with workshops and events, yet cost anywhere from $50,000 to $75,000 per year

- Marketing (5-10%)

- Operations and other (15%): includes janitorial services, maintenance, etc.

- Capex: these are capital investments incurred at the start of operations (e.g. refurbishment of the building, equipment and workstations, etc.). Although significant, the amount varies a lot depending on the size of the coworking and the quality of the amenities.

See below an illustrative cost breakdown of a coworking space. Unsurprisingly, rent, salaries and marketing represent ~75% of total expenses.

Yet, you shouldn’t expect to realise profits in the first year of operation. The initial investments (capex) and the likelihood that your coworking space will not be a full capacity at the beginning may result in an operating loss instead.

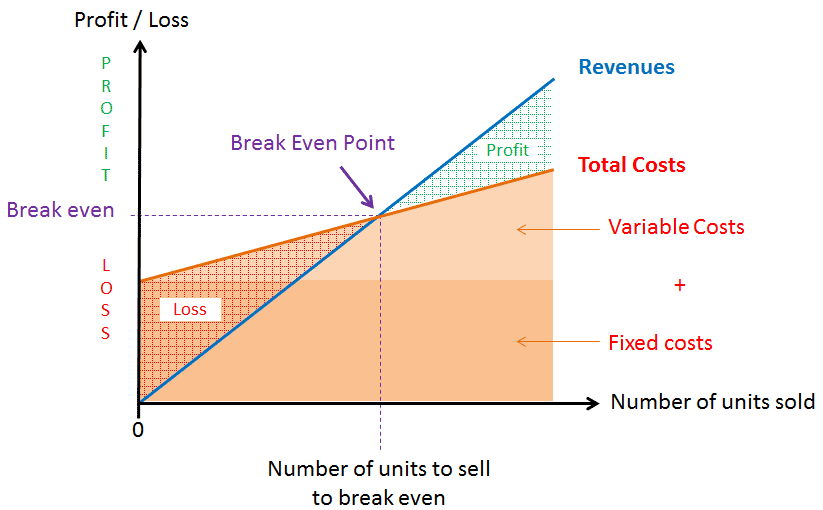

What is the break-even point for a coworking?

Break-even is the point at which total costs and total revenue are equal. In other words, the breakeven point is the amount of revenue you must generate to turn a profit.

Because you must at least cover all fixed costs (that aren’t a function of revenue) to turn a profit, the break-even point is at least superior to the sum of your fixed costs.

Yet, you also need to spend a certain amount for every $1 of sales to pay for the variable costs.

Luckily, coworking have very high gross margins. That’s because almost all expenses are fixed costs (mostly salaries and rent).

The break-even point can easily be obtained by using the following formula:

Break-even point = Fixed costs / Gross margin

Using the same example earlier, let’s assume your coworking has 200 members paying each $200 per month. That’s a monthly turnover of $40,000.

Now, assuming the cost structure below:

| Operating cost | Variable vs. fixed | Amount |

|---|---|---|

| Rent, utility bills | Fixed cost | $12,000 |

| Staff | Fixed cost | $12,000 |

| Marketing | Fixed cost | $4,000 |

| Utility, janitorial services | Fixed cost | $5,000 |

| Bookkeeping, other | Fixed cost | $2,000 |

| Total | $35,000 |

In this case, because all costs are fixed, the break-even point equals fixed costs:

Break-even point = Fixed costs = $35,000

In other words, you need to generate at least $35,000 in revenues to turn a profit.

When can you expect to break even?

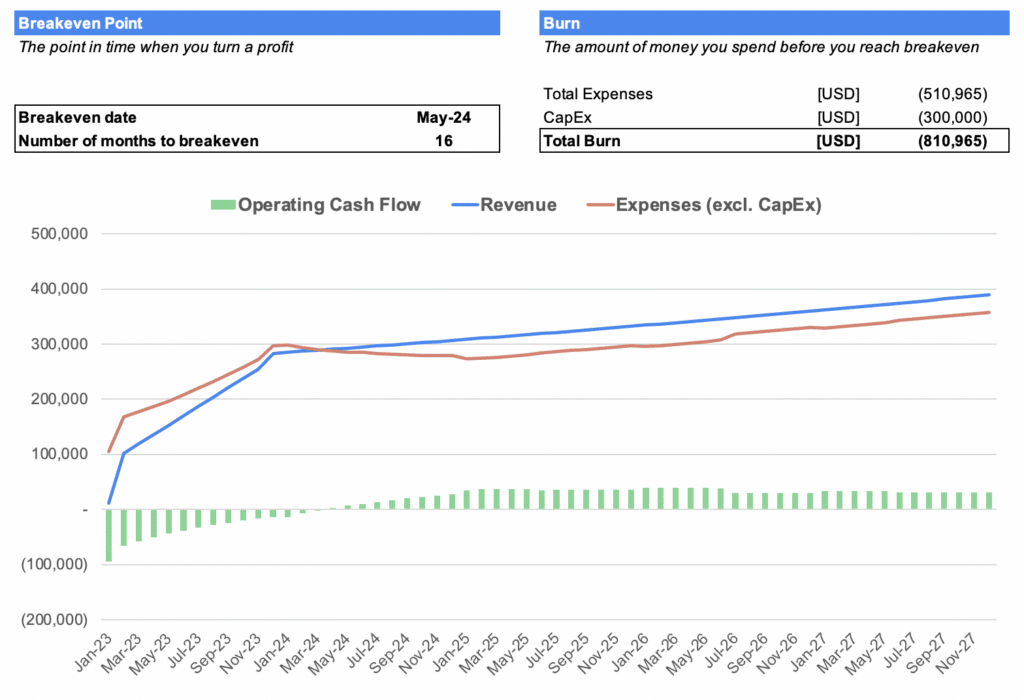

The breakeven point represents both the amount of revenue you need to generate to cover your costs, as well as the date when it happens. That’s one the coworking KPIs we calculate automatically in our financial model template.

In the example below, it takes 16 months to break even. The amount of money you need to spend to get there is $810,000.

Unfortunately, coworking businesses’ profits are capped

On the other end, due to their business model, coworking spaces cannot easily increase their revenue past a maximum point.

Indeed, as they’re constrained by capacity (the maximum number of members you can have), there are only 2 ways to increase revenue once you get to full capacity:

- Increase prices (e.g. membership fees)

- Offer additional services (e.g. virtual offices, etc.)

Yet, these 2 levers have their limitations. For example, you won’t be able to increase prices by 15% without losing some customers to competition.

Is opening a coworking business a good investment?

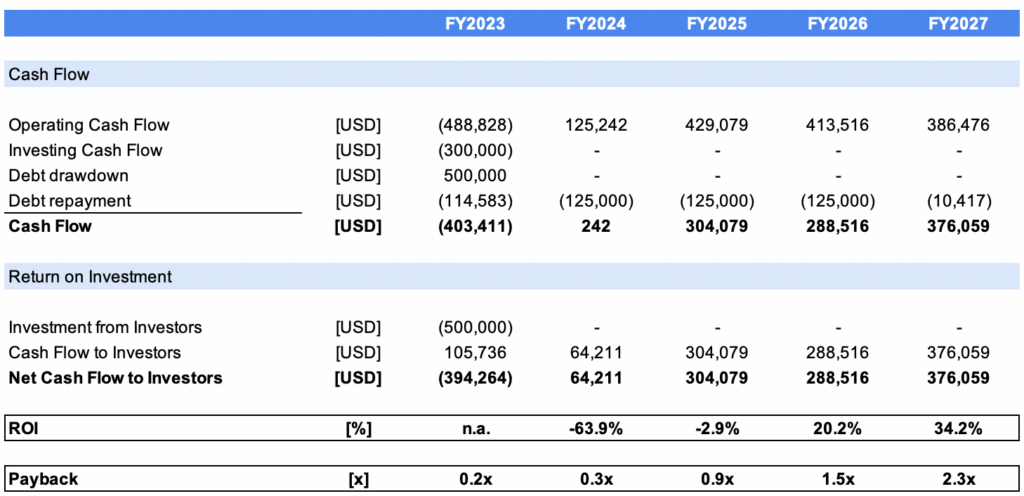

In order to answer this question, we need to look at the return on investment (ROI). In layman terms, ROI compares the initial investment against the expected future positive cash flows.

Therefore, to figure out whether a coworking is a good investment, we need to look at 2 separate things:

- Startup cost: the total investment to open a coworking space

- The future cash flows you expect from this business

We saw earlier coworking spaces can reach 10-20% EBITDA margins. This can be used to estimate future cash flows. In other words, if your coworking business makes $100 in sales, you earn $10-20 cash flow: that’s what we will compare to the startup costs (see below).

Startup costs for a coworking business

Before launch, there are a number of startup costs owners of coworking spaces must take into account when they create their startup budget. Logically, the cost to start a coworking business depends on the location and size of the facilities as well as the amenities themselves (restaurant, coffee bar, game room, etc.).

On average, it costs $94,000 to $126,500 to start a 3,000 square foot coworking business with 100 desks. Here’s the full breakdown:

| Startup cost | Amount |

|---|---|

| Equipment & office furniture | $65,000 (100 desks, 20 workstations) |

| Building refurbishment | $20,000 – $50,000 |

| Connectivity setup | $500 – $1,000 |

| License | $500 |

| Legal fees | $2,000 – $4,000 |

| Insurance | $6,000 (per year) |

| Total | $94,000 – $126,500 |

What’s your Coworking ROI?

Now that we can estimate the startup costs, it’s easy to understand whether investing (or starting) a coworking business is a good investment, from a pure financial standpoint.

Indeed, assuming our 100-desks coworking space makes $40,000 in sales per month, that’s 10% profit margin at scale as we earlier right? So that’s $48,000 in profits per year (after all expenses have been paid).

So if we were to assume that your coworking would make $48,000 per year from day 1 (which it probably won’t), the ROI over 5 years would be simple to calculate.

Indeed, we would have $240,000 profits over 5 years vs. $126,500 startup costs (using the high-end point) which gives us:

- 1.53x payback: you make 1.53x your initial investment (the startup costs)

- 25% return on investment over 5 years (using a 10% discount rate)

Problem is, in reality you will probably not reach breakeven day 1 (in our example here you won’t make $48k in profits the first year).

That’s why you need to prepare a realistic financial plan that takes into consideration the fact that you’ll probably run into losses the first few months before you can reach breakeven.

We include ROI and payback as part of our financial plan template so you don’t have to worry about the nitty gritty details.