How to Build a Financial Model For a Fashion Store

Every business needs a budget. Whether you want to understand what’s your breakeven, your valuation or create a financial model for your fashion store business plan, you’ve come the right way.

Whether you sell apparel, shoes, accessories or jewelry, in this article we’ll explain you how to create powerful and accurate financial projections for a single or a chain of fashion store(s).

Are you opening or running a fashion store? Have a look at our free resources below: How To Open a Fashion Store In 10 Steps 8 Strategies To Increase Fashion Store Sales & Profits How Profitable Are Fashion Online Shops? The Business Plan You Need For a Fashion Store: Complete Guide

1. Forecast customers

The first thing you need to do is to estimate the number of customers you will acquire, and retain, over time. Indeed, you will hopefully keep customers happy so they can come back to your store in the future.

The number of customers who make a purchase (each month) is the result of:

Customers = New customers + Repeat customers

Let’s start with new customers.

New Customers

New customers are a function of the visitors that enter your store, and a conversion rate. For example: 400 visitors per week x 30% = 120 transactions a week.

In order to add complexity and accuracy to your financial projections, you can set the number of customers as the function of:

- Number of stores (in case you open additional stores in the future)

- Opening days per week (e.g. 4 weekdays + Saturday & Sunday)

- The number of visitors per store per day (weekday vs. weekends)

For example you could have for January 2023:

- Number of stores: 1

- Opening days per week: 4 weekdays + 2 weekends

- The number of visitors per store per day: 150 (weekdays) + 300 (weekends)

In that case, the number of visitors in January is about 3,000 (720 per week).

Finally, the number of transactions from new customers is obtained via a conversion rate (for example 8%).

Repeat Customers

Once we have forecasted new customers, we can add repeat customers. There are multiple ways to do this.

The most accurate (and flexible) is to set a number of assumptions:

- The percentage of your customers who are repeat (those who will buy 2 or more times in their lifetime from your store)

- The purchase frequency (when they buy again, how many times a year do they do so?)

- The churn rate (they will likely not buy forever, instead they might churn in average after 10 years or so)

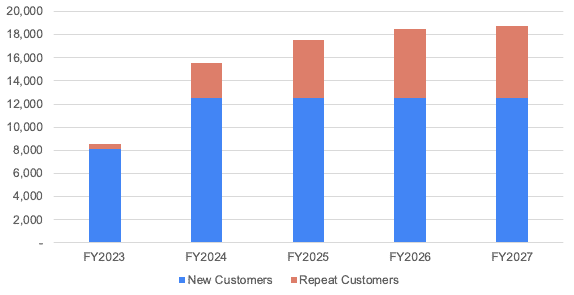

This will allow you to accurately forecast the transactions made by repeat customers in the future and obtain something like the chart below. As you can see, the number of repeat customers grow steadily over time.

2. Forecast revenue

Once you have estimated the number of transactions, both from new and repeat customers, you can calculate revenue.

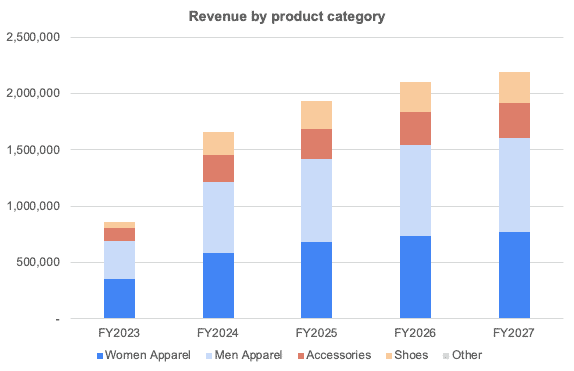

Revenue can be obtained by first segmenting transactions into different product categories (with each different prices and costs) for maximum accuracy.

You can do so by setting percentages for product sales mix as shown below. Note that in this example we’ve also added launch and end dates (if you plan to start and discontinue product lines at different times in the future.

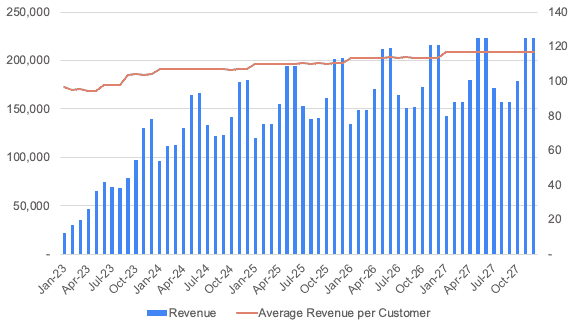

You can now obtain your revenue projections as well as important metrics such as the average revenue per customer as shown below:

Note: in the example below from our Fashion store financial model template, we have also added seasonality. That's why sales are higher over Christmas for example.

In addition to total revenue, you can also break down sales by product categories as shown below:

3. Forecast expenses

In addition to the one-off startup costs discussed here, you must also consider the total recurring cost of running a fashion store. Those expenses include:

Cost of Goods Sold (COGS)

The cost of goods sold refers to the actual expenses you need to stock your store on an ongoing basis. This is sometimes called the cost of inventory and entails all the expenses associated with stocking your fashion store.

Logically, the profit margins for a fashion store vary depending on the products themselves.

Yet, the average gross profit margin for a retail clothing store is 53%, meaning that if you sell clothes at an average price of $100, you must pay $47 to your supplier to buy the inventory first.

Using the same example earlier with 500 orders a month with an average cost of $50 per item, this represents $25,000 in COGS per month for a total monthly revenue of about $53,000.

Staff

What about the staff? Running a fashion store business isn’t the easiest task you will ever face, which is why you need a helping hand in the form of devoted employees.

A standard fashion store with 1,500 sq. ft. can do with a minimum of 2 employees at all times. Assuming you operate 1 shift (say 10am to 6pm) 6 days a week, you will need part-time employees too.

When it comes to pay, here are a few examples of average annual salary package:

So assuming you hire 2 sales associates on top of yourself (store manager), you should expect to pay anywhere around $12,000 in salary expenses per month.

Rent

The cost of renting a space for your fashion store depends on the size and location of the shop.

As we mentioned earlier, assuming $25 per sq. ft. and a store of 1,500 sq. ft. you would be paying around $3,000 in rent each month.

Utility Bills

Utility bills are the ongoing expenses associated with gas, water, and electricity bills. Because the monthly rent and utility bills are ongoing expenses, it’s always advisable to set aside a significant figure to cater to both expenses every month.

Logically, utility bills also vary based on the season and where your store is located. Whilst you may need to spend a lot of money on electricity (or gas) for heating in winter, some stores must pay significant expenses for their AC instead.

As a rule of thumb, add 20-25% on top of your rental expenses for your utility bills. So assuming you pay $3,000 in rent each month, set aside $750 to $1,000 for utility costs.

4. Build your P&L And Cash flow

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own fashion store.

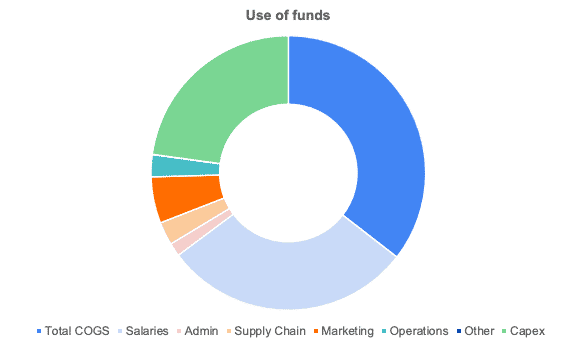

In this chart below, we’re showing you an example of a typical cost structure a fashion store would have, from marketing, capex to salaries. Unsurprisingly, whilst the cost to supply inventory represents about 30%, another 30% goes to salaries and the rest to marketing, capex and other costs.