20 Best Practices for Rock-Solid Startup Financial Projections

When preparing their financial projections, entrepreneurs often fall into the same traps, which can be easily be avoided. In this article we focus on the key rules you should follow to ace your startup financial projections.

In this article we’re listing out the most important best practices and mistakes to avoid to create rock-solid financial projections for your startup.

We will cover:

The 5 most common mistakes people make when building financial projections

Many entrepreneurs overlook their financial plan when preparing their business plan or their investor pitch. They often see it as a tick-the-box requirement more than a must to better manage their business’ finances and strategy in the future.

Financial planning is not just for you to manage your business. Clumsy budgets and financial plans are often turned down by investors and are of the main reasons why great startups don’t get the funding they deserve.

Luckily, 90% of all mistakes can be summed up in the list below. Let’s see, one by one, what are the 5 most important mistakes you should avoid when making projections for your business.

1. Overestimating revenues

Revenues are often the most overlooked part of any financial plan for a number of reasons:

- Product development phase is too short. Especially with tech engineering (e.g. building a MVP), problems might arise down the road and you might have to experience delays before you actually launch

- Expected market share penetration is too high. Startups often fail to acquire market shares from existing competitors for a number of reasons such as: high switching costs, low brand awareness, lower than expected network effects and virality, etc. If you haven’t considered all these risk factors when assessing your revenues, we strong recommend you do.

- Conversion rate and / or efficiency is too high. If your revenues are a function of sales people or paid acquisition (paid ads), you might be too optimistic when it comes to the efficiency of your sales force (the number of deals they can close in a month) and/or the return on investment of your marketing campaigns (high conversion rate and/or low cost-per-clicks)

If you are not sure how to project realistic revenues for your startup or established business, read our article here. Also, you should always back up your revenues estimates using a bottom-up and a top-down approach to make sure they make sense. See here an article on how to project revenues using bottom-up and top-down methodologies.

2. Underestimating expenses

Whilst the scale of overestimated revenues is often more important than underestimated expenses, the impact is very much the same. Indeed, if you have $1.5m in the bank and expect a $150k monthly cash burn whilst it turns out to be $215k instead, your runway isn’t 10 months but 7 instead. This is a really big difference, especially as it usually takes several weeks for a startup to raise equity.

Expenses are often overlooked and they can as varied as:

- Cost of sales. Example: your supplier quotes $100 unit cost incl. transport but you forgot $10 custom taxes

- Salaries. Gross salary isn’t unfortunately only what you need to pay. Instead, read all about taxes and benefits you will have to incur as well

- Other operating expenses. Whilst they can be minimal (e.g. a $200 phone subscription), they can easily add up to a few thousands a month.

- Consulting & legal expenses. Startups don’t rely heavily on third-party consultants yet you only need to set up a legal entity or even a minor lawsuit to cost you several thousands.

Examples are legion and the ones above only are for illustration. Consider all expenses that applies to your business to make sure you haven’t forgotten any.

3. Lack of sources

Any financial forecast is calculated using 2 distinct variables: your assumptions and verified sources.

Assumptions are by definition the numbers and/or metrics you expect. They can be anything such as pricing (if you haven’t launched yet), conversion rate, churn rate, etc.

Instead, verified sources are numbers which cannot be discussed. For instance, the payment processing fees you will have to pay, the salaries of your existing team, the fulfilment cost per order of your third-party fulfilment provider, etc.

The more verified sources you have in your financial model, the more accurate your projections will be. Of course, you can’t build a financial plan without making assumptions. Whilst there are good public sources out there to find benchmarks to accurately estimate your ecommerce conversion rates or your cost-per-click, you can’t assume your business will perform as better as the average.

By using too many assumptions, your financials may turn out to be very different. You think you can achieve 5% conversion rate for your online shop? Well think twice: average ecommerce conversion rates are in the 1-2% range.

4. Errors

This mistake is self-explanatory. You do not need to be a financial wizard to make a great financial forecast for your business plan. Still, you need to understand some basics of financial modelling, corporate finance and accounting too.

If you aren’t sure how you should build projections and if they are good enough, get help. You have 2 options:

- Find an expert who will build it for you. It can be a financial modelling freelance expert, startup consultant or even your accountant.

- Get a template: and all the relevant calculations are already pre-built so you only have to plug your assumptions

5. Missing the big picture

You have worked out your financial projections backed up with verified sources, made sure you didn’t forget any expenses and you sense-checked it all for potential errors. Now is time to take a step back and see if they make sense.

Let’s see together 3 examples below:

- You realise your business is so profitable that you only need to raise $300k to get started and be profitable, why asking for $1m? Read our article to understand how much you should raise for your startup to understand how to effectively assess the amount you should ask from investors.

- You expect that 50% of your funding goes to cost of sales to finance your ecommerce inventory. Well, that’s something you could potentially fund with something else than equity. Read more in our article on what is ecommerce financing and why you should use it. If, as explained in this article, debt makes more sense from a ownership dilution point-of-view, you should take into account debt interest in your projections as well.

- Your projected metrics show a 10x LTV:CAC ratio. You sense-checked all your calculations and assumptions and you are quite impressed by such a figure (see an article here for more information on CAC, LTV and how to assess LTV:CAC). The problem might be that you are simply underinvesting in customer acquisition: you are potentially missing on many customers and/or focusing on the most profitable customers only.

Those are only a few examples. They show us that taking a step back may help you tweak your assumptions to improve your financial plan, and ultimately your strategy too.

10 must dos for your startup financial projections

1. State clearly your assumptions

Financial projections need a great deal of assumptions. Whether you are using your historical data or some industry benchmark, make it clear what you are using to investors and any reader of your financial projections.

It is absolutely fine not to have the information, nor the historical data. If you cannot find the information online for instance (market size, customer acquisition costs, etc.), clearly footnote and be ready to voice over your assumptions behind the numbers you are using.

A few examples where you should clearly state which assumptions you are using:

- Your user growth has been growing 10% month-over-month historically, yet you expect 20% going forward (maybe you’re hiring more sales? or you’re investing into content)

- You are just starting off your new SaaS startup, and you are not sure which CAC you should use (use public sources and industry benchmarks)

- You expect a $30 CPA for your new ecommerce store but have no historical data yet (again, use benchmarks)

2. Use a bottom-up approach

We’ve covered in great depth in our article what is a bottom-up approach (vs. top-down). In short, estimate revenues “from the bottom up”.

For example, for a ecommerce business, start by the traffic on your website for instance, then your conversion rate, finally the average order value.

You should never project revenues only with top-down assumptions. Using our ecommerce example, you should never for instance assume revenues will be $20 million next year as you’ll capture 10% of the $200 million market.

Bottom-up sales forecasting is the best approach for 2 main reasons:

- It allows us to relate revenues to another metric (for instance, traffic in our example above), helping us making sense of the projections

- Top-down approach requires us to make assumptions on the market size, which is often inaccurate for lack of publicly available data. Instead, bottom-up uses your own business’ historical data or competitors’ metrics data (which is far more accurate)

3. Use drivers

Following-up on our bottom-up approach point earlier, revenues should always using non financial metrics as the main driver. You should never just assume revenues will grow by 10% next month because they have grown by 10% last month for example.

Revenues are impacted by revenue drivers (or sales drivers) as explained in our article here.

Sales drivers are non financial metrics that drive, up or down, revenue, through sales volume. Whether you sell clothes in a retail store or software subscriptions, the number of clothes or software subscriptions you sell are a function of a non-financial metric.

For example, the clothing store will project sales based on the number of people who enter the store, which itself is a function of the street traffic and the opening hours.

In comparison, the software company will project sales based on the number of sales representatives they employ and their efficiency (how many deals they can close in a month for instance).

For examples of popular revenues drivers for the 3 most common business models, read our article here.

4. Sanity check with ratios

When you build financial projections, always calculate ratios which will help you making sense of the forecasts, and whether they are realistic or not.

The most common ratios are: revenue growth, gross profit and EBITDA margin, ARPU, etc. Yet the ratios should not be limited to the most common. Instead, they are specific to your business.

A few examples of ratios you can calculate to make sense of your startup financial projections are:

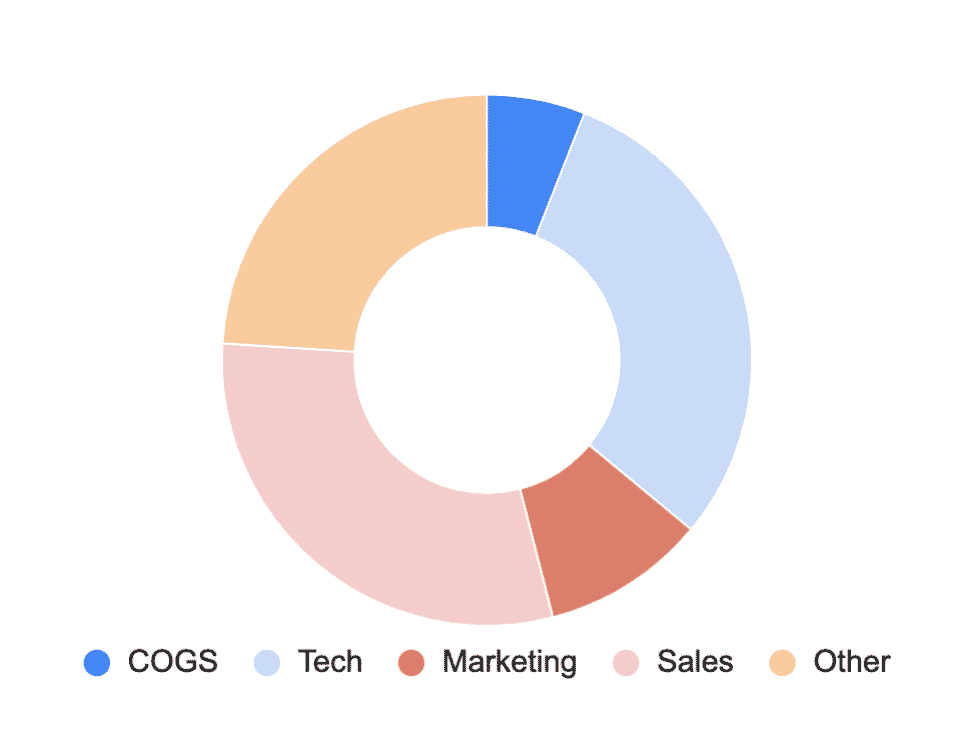

- Expense categories as a percentage of revenues (e.g. salaries, COGS, marketing, tech, etc.)

- The number of new B2B customers acquired per month per sales representative (e.g. SaaS businesses)

- Customer success expenses divided by the number of customers (customer success is likely a variable expense, like sales team expenses)

- Operations/fulfilment expenses divided by the number of orders per month (e.g. ecommerce)

5. Create different scenarios

Great financial projections are flexible. They allow to change a few parameters (user growth, pricing, etc.) and see the impact on your financials.

When creating your financial projections, you should only present one case (the “base case”). Yet, it’s always good practice to have prepared a few other cases for your own benefit.

What if your business would look like if your customers are more price sensitive than you thought? Prepare a “worst case” for that.

What if you would shoot to the moon and get real viral growth? Prepare a “best case” for that.

Creating different scenarios will help you make better decisions and answer all the questions investors might ask you later on. We recommend you use 3: a worst, base and best case.

6. Paid marketing: use keyword traffic and CPC

Are you spending money in marketing, more especially paid marketing (social media, Google Ads, etc.)? You better have solid assumptions behind your forecasts, as paid marketing often represents a significant part of startups’ budget today.

Instead of assuming things like “we will spend $10,000 each month to acquire 500 customers”, identify a clear conversion funnel instead. How do you acquire customers from leads? How much does it cost you?

For example, if you are using pay-per-click (PPC) campaigns on Google Ads, use their free Keyword Planner tool. It allows you to estimate the traffic you will receive, and how much it will actually cost you.

7. Use historical data whenever possible

Projections should always be based on your historical data, if you have any. Of course, new startups will not be able to make much of it. But remember, historical data isn’t necessarily financial: if you have accumulated free users over the past 6 months with little or no revenue yet, you already have a pretty good idea of user growth which you can use for the future.

You should especially use historical data as investors will inevitably look into your past performance to justify your financial projections. Demonstrating to investors your forecast tie into your historical data will give you a major head start in due diligence and be seen positively.

9. Look into industry benchmarks

Even if you have substantial historical performance to back up your financial projections, it always good practice to sense check it all by comparing them against industry benchmarks.

Industry benchmarks are metrics from existing companies that have been averaged per industry (e.g. retail, SaaS, ecommerce, etc.) to serve as a guidance for investors and companies themselves.

There are many metrics, financial and operational, that have been compiled and averaged across various industries. Whether you are looking for average software engineers salaries in tech in Europe or the average gross margin of ecommerce companies, there are benchmarks out there you can use.

Benchmarks are very important as they are also used by investors to judge 2 things:

- How you compare vs. competitors

- Whether you financial forecasts are realistic and achievable

10. Sense check revenue using a top-down approach

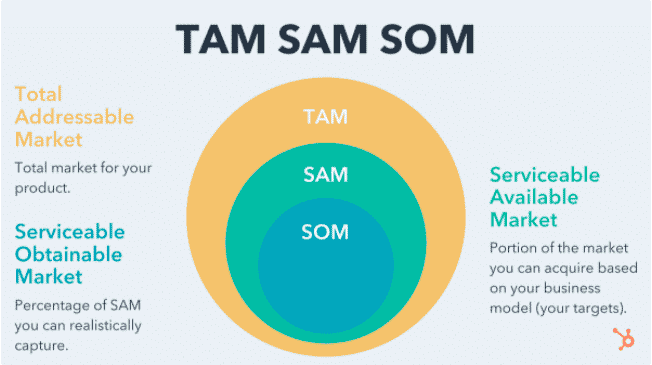

Although you should always build revenue projections using a bottom-up approach, ideally you would use a top-down approach to make sure they are realistic.

Unlike bottom-up, in a top-down approach we estimate revenues assuming we will capture a certain percentage of a market. For example, let’s assume a market which we estimate at $500 million from verified sources. If we would assume a business would capture 10% by year 3, this means its revenues would be $50 million, right?

Whilst this approach is very popular because of its simplicity, it is often inaccurate. Indeed, it is based on market size assumptions which aren’t always fully accurate themselves.

Therefore, one should always use top-down to sense check revenues instead of forecasting revenues.

Using our same example above, if your bottom-up revenue projections result in $100 million in year 3, are you confident you can capture 20% of the total market?

10 things to avoid for your startup financial projections

When preparing their financial projections, entrepreneurs often fall into the same traps. Luckily, these can easily avoided. In this article we go through the top 10 Don’ts you must avoid to build great financial projections for your startup.

1. Don’t be too optimistic

It’s ok to be daring and optimistic. We wouldn’t build businesses out of nothing otherwise right?

Yet, financial projections shouldn’t be too optimistic either. By too optimistic we mean they shouldn’t be unrealistic or far-fetched. It’s important to present a compelling and attractive case to potential investors to raise capital, yet do not fall into the trap of being naive either.

Remember, even if you succeed in selling an overly optimistic plan for your startup and raise a lot money from it, you will run into bigger problems down the road as explained here.

Investors aren’t candid either: they have likely reviewed dozens, if not hundreds of pitch decks before yours. As such, they are very well suited to see what’s realistic vs. what isn’t.

You might have a great product and great team, don’t burn your chances in front of investors by being more optimistic than you should.

2. Don’t throw numbers out of thin air

Entrepreneurs often make the mistake of overlooking the financial projections section of their pitch deck or business plan. Instead, they sometimes include large numbers to fill the blanks on the page, whilst there isn’t any reasoning behind.

Let’s make something clear here: all the numbers in your pitch deck, business plan or financial projections spreadsheet need a source. They are either calculated from another input, or an assumption (an input) from you.

Whenever you show something like $10 million revenue in 3 years, back it up and be prepared to show the numbers behind it. Your $10 million sales should be clearly visible in your Excel financial plan, and be substantiated by assumptions behind volume and pricing.

3. Don’t make assumptions without a source

When you make assumptions, always include the source (either in the spreadsheet, or a footnote on your investor presentation).

The source can either be a number:

- Sourced from an industry benchmark (include the link to the benchmark as a footnote)

- Extrapolated from your historical data. If your average selling price is $100 historically, you can reasonably it will remain $100 (assuming other things being equal)

Note: you can also very well deviate from historical performance. For example, if your conversion rate historically is 2% but expect to increase to 3% as you are improving your conversion funnel

- Calculated from other verified sources. For example, if you do not know your market size as the information isn’t publicly available, you can estimate it with a series of assumptions and calculations. Be prepared to explain your reasoning clearly and support your assumptions with verified sources

4. Don’t just ask money without explaining where you will spend it

Let’s be clear: if you want to raise $5 million but you have no clear idea on where you will spend it, you will likely not find any investor. Also, raising $ X million to spend it in customer acquisition costs and product development costs isn’t good either.

Instead, you should be able to estimate the amount you will spend in each category. Will the $5 million be spent in salaries for 50%, marketing for 25%, other expense for 15% and another 10% for customer success? Good answer.

Of course, we all know these forecasts will likely turn out not to be fully accurate. Numbers might vary a bit in the end (or significantly if you change your strategy down the road for instance). Yet this isn’t a reason not to create solid financial forecasts when you are raising capital.

5. Don’t raise money if your business is profitable

Sometimes, entrepreneurs are trying raising capital with a financial plan that shows their business generates positive cash flow. If you expect your business to be profitable tomorrow, why would you raise capital at all today then?

This is a more general note: your financial projections should be in line with what you are asking investors. If you are raising $5 million today, you should be able to show investors you need these $5 million in the future as your business isn’t yet profitable. As simple as that.

6. Don’t assume customer acquisition costs are cheap

This is a very common mistake we often see at SharpSheets. Entrepreneurs and startups often find it difficult to quantify how much it cost to acquire one customer. For lack of trying, or simple ignorance, startup financial projections often result in unrealistic customer acquisition costs.

Customers almost never come for free (one exception is virality): you will either spend money in sales or marketing. This might be immediate (e.g. paid ads) or a long term investment (e.g. SEO, B2B partnerships, etc.) yet you will likely spend money for each new customer you “acquire”.

If you aren’t sure whether your assumptions are realistic, simply sum all marketing and sales expenses of your budget by the number of new customers you acquire. Do it every month, and see the evolution over time.

If you are spending $200 per customer historically yet this goes to $50 in 2 years, there might be a problem. And if you can’t do the math, you probably haven’t built a solid financial model. Read these articles to see how you can improve your financial projections instead:

7. Don’t have revenue projections uncorrelated with market size

As we have explained in our previous article here, you should ideally use a top down approach when sense checking your revenue projections.

You might have build a solid financial plan for your startup, yet you might be missing the big picture: what market share does it represent? If you can’t answer that question, you should have a closer look at market sizing to assess how big is your market, and which percentage are you capturing (market share)?

You should sense check your revenue assumptions simply because investors will likely do the same to make sure your projections aren’t unrealistic.

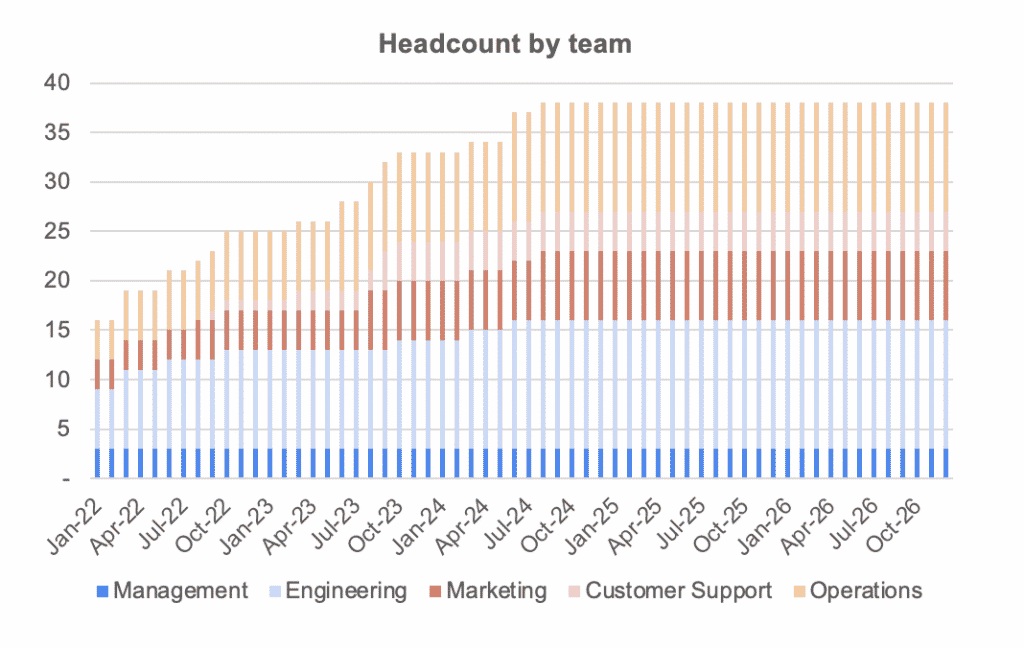

8. Don’t have unrealistic team sizes and salaries

When building a financial plan, it’s often challenging to forecast fixed expenses (those that aren’t a direct function of your revenue for example). Among fixed expenses, salaries are always the most challenging part.

If you are 10 full-time employees today, how many people will you need when you will scale up from $100k revenue to $5 million revenue instead? Well, some teams are mostly variable (sales team, customer success team) as they are correlated with the number of customers you have (and therefore revenues). Other teams instead (e.g. engineering, admin functions) aren’t really variable, yet they will increase over time.

If you aren’t sure, look at how many employees comparable companies have. You can also use some ratios as simple as the number of customers divided by the total team (or specific teams e.g. sales) to make sure you aren’t forecasting teams smaller than they should be.

For example, if your tech team has 10 developers today supporting 1,000 customers, you will likely hire more as you scale up to 5,000 instead. By how many? It depends how scalable your tech stack is. If unsure, ask your CFO.

9. Don’t forget other expenses

When building financial forecasts, we often focus about the obvious, meaning revenues and the biggest expenses categories. Yet, other expenses, from subscriptions to accounting fees and miscellaneous can quickly add up and increase your cash burn.

10. Don’t underestimate working capital

For those who need a refresher, working capital is the difference between current assets (such as your customers receivables or your inventory) and current liabilities (e.g. current payables from your suppliers). The change in working capital, each month, impact cash flow.

These changes in working capital sometimes have significant impact on cash flow, and ultimately your cash balance. A common example is when you need to purchase your inventory 2 months before you can sell it: you need to front the cash outflow today which we eventually be repaid 2 months from now.

For some businesses, this is insignificant and can be left out, at least for the purpose of a pitch deck or a business plan. For others, this need to be taken into account. A few examples of businesses that need to include working capital movements are:

- Ecommerce and retail: inventory and suppliers payable terms impact cash flow significantly (as per the example above)

- Subscription and Enterprise SaaS businesses have a deferred revenue element which impact cash flow (see our article here on the subject)