How To Create a Logistics Startup Pitch Deck (+ 4 Examples)

50 percent of the US’ largest importers still use spreadsheets to manage their complex international supply chain (source: McKinsey). It says a lot about the state of existing logistics systems today, and how big the logistics and supply chain tech industry can be tomorrow. If you are launching your Logistics startup, you will need a rock-solid pitch deck to impress investors, and stand out from the crowd.

Note: this article focuses on startups that provide logistics services, defined as a the outsourced movements or storage of goods. It includes warehousing, storage, parcel delivery, trucking, freight, shipping, rail and air cargo. We also include companies providing technological supply chain systems. We have excluded from this analysis startups that operate in the delivery of food and/or grocery.

Startups & Logistics: an introduction

Before we dive into the slides you need for your Logistics startup pitch deck, let’s first have an overview of the technology ecosystem of logistics and supply chain today, and more especially:

- How big is the Logistics technology industry today?

- What are the different segments at play?

How big is Logistics tech today?

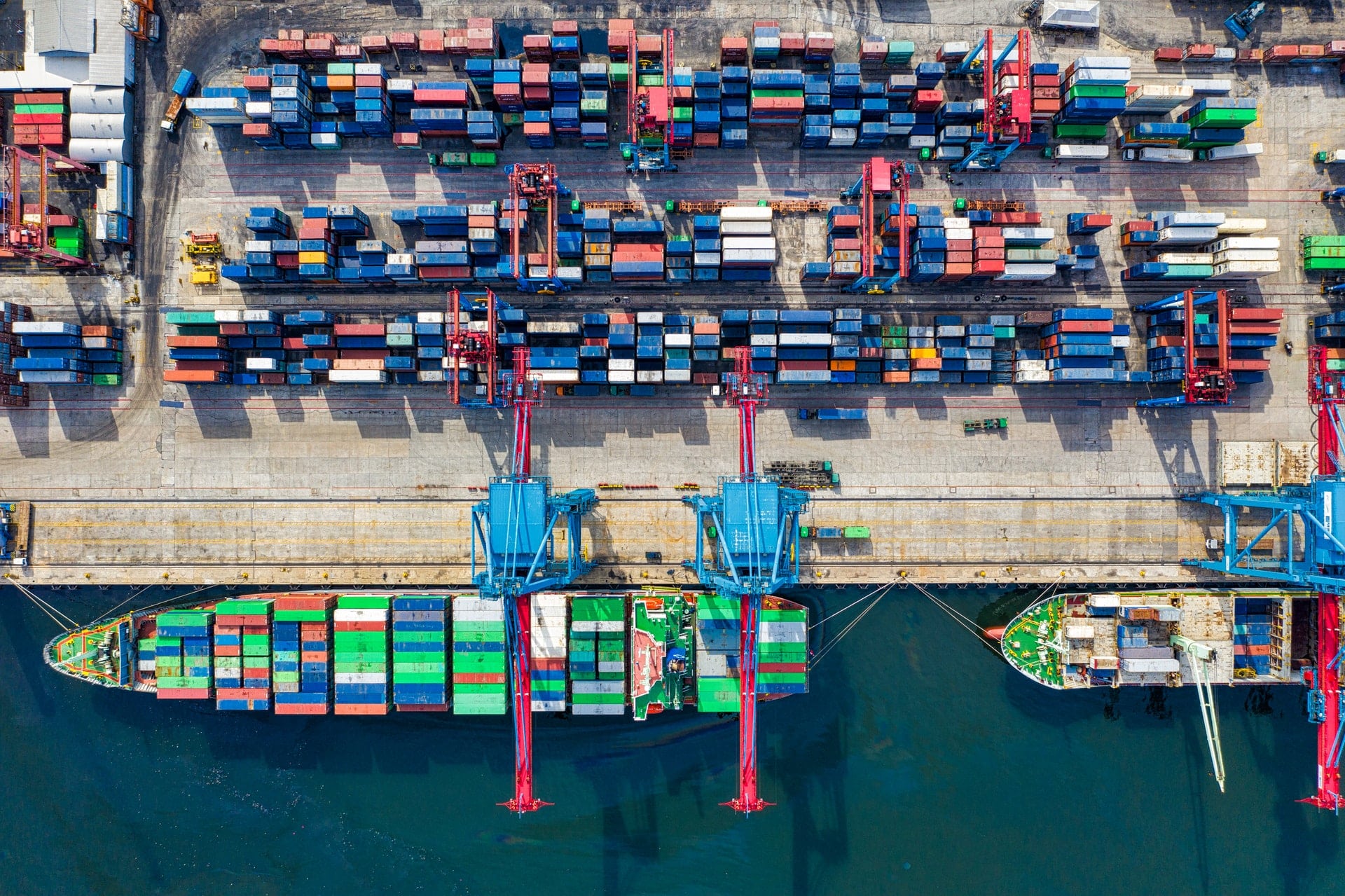

Experts estimate the global Logistics market ranges from $8 to $12 trillion. Despite its size (~12% of the entire world’s GDP), the portion attributed to logistics startups revolutionising logistics is actually incredibly small.

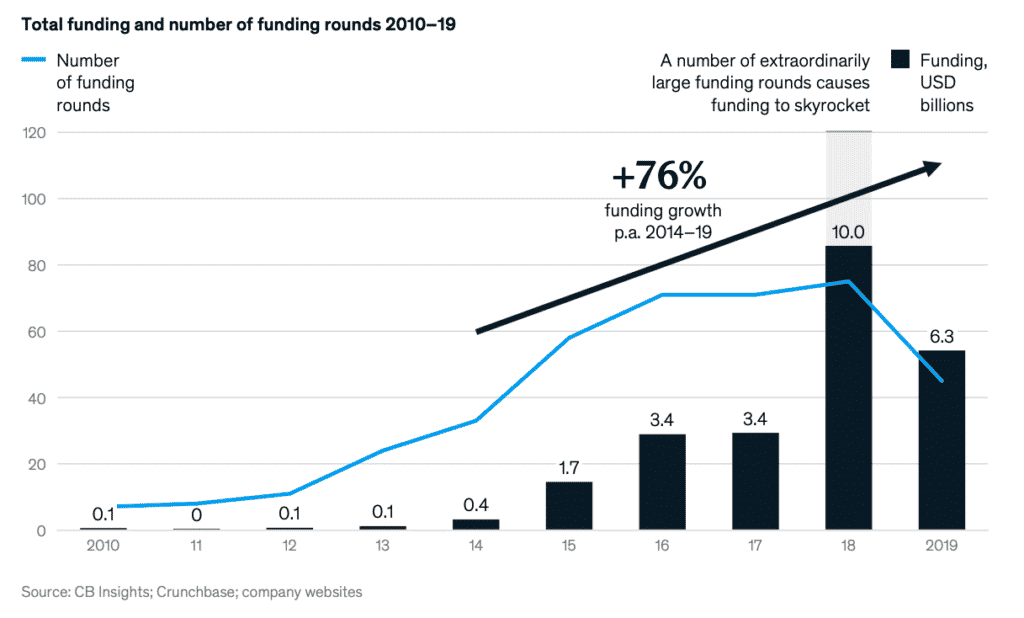

As McKinsey puts it, logistics have rather been a laggard industry in tech: venture capital started pouring capital in tech logistics startups only in 2015. Since then, approximately $28 billion have been raised in total from logistics startups (source: McKinsey).

Unsurprisingly, most funding has been attributed to last-mile and freight delivery startups. A few examples of these companies are Instacart, Manbang and Flexport.

What are the different segments at play?

There are 4 main segments within the logistics technology ecosystem, there are:

Courier, Express and Parcel Services (CEP)

CEP covers all companies operating in the the low weight and volume transport of goods. Recently, companies in the last-mile delivery industry gathered most of logistics tech VC funding with $10 billion in 2020.

Examples: New DaDa, HiveBox

Transport

In short, Transport includes all companies involved in the transport of goods (regional or international routes), effectively excluding CEP. This includes mostly:

- Road freight marketplaces and solutions: increase efficiency by connecting shippers and trucking companies via marketplaces or provide fleet management services

- Air and ocean transportation: offer booking and management of international shipment including value-added services (track and trace, customs)

Examples: Convoy, Manbang, Ontruck

Storage

Startups in the storage ecosystem mostly operate in 2 sub-sectors:

- Warehousing: develop logistics infrastructure or optimisation of storage and fulfilment of goods through robotics, self-driving vehicles, etc.

- B2B ecommerce specialists: provide a specific value-chain-focused solution to online retailers

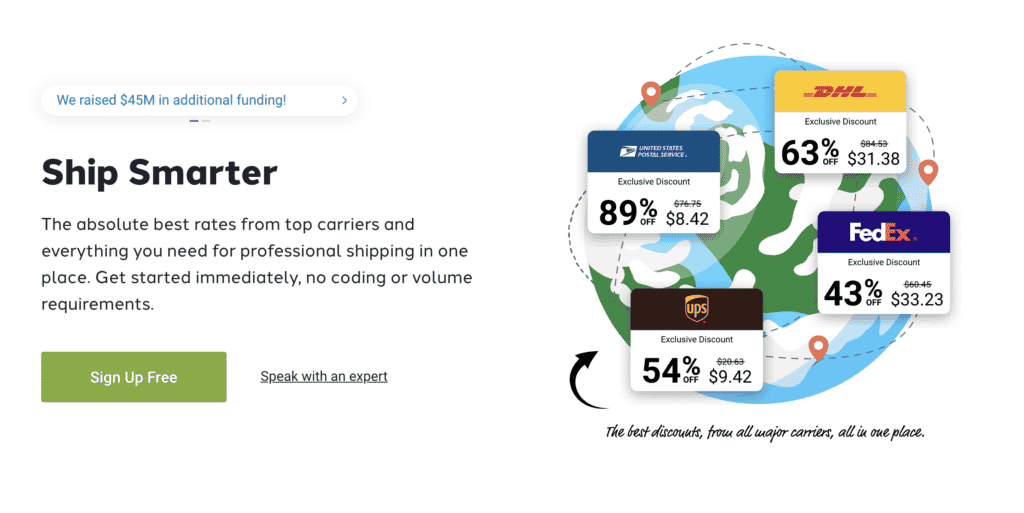

Examples: ESR, NewEase, Shippo

Technology

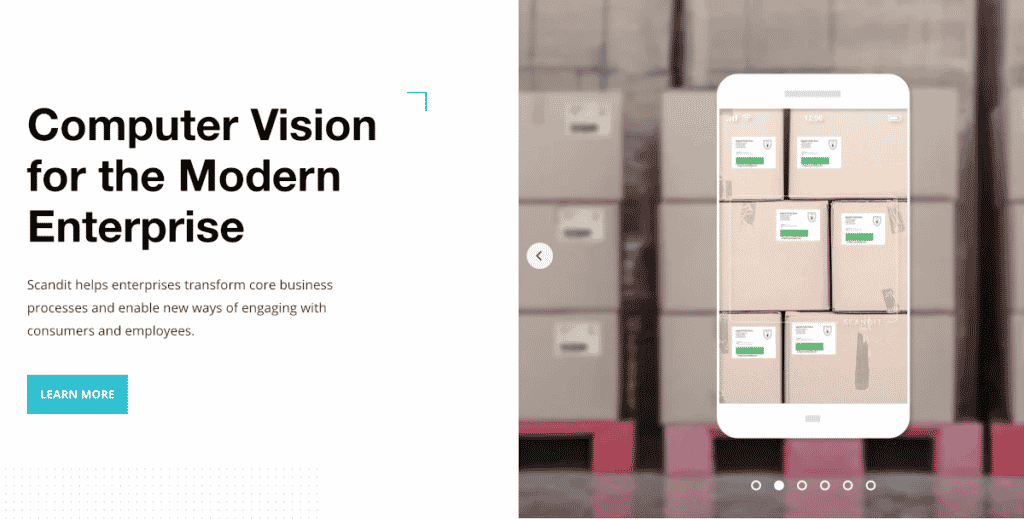

The last of the 4 main segments within logistics tech actually is pure technological solutions, ranging from:

- Asset tracking: develop and manufacture chips and sensors to enhance supply chain visibility

- Inventory/order management: optimize inventory allocation through software and analytics

- Intelligence providers: software or AI applications to provide better forecasts, optimize replenishment or increase pricing transparency

- Blockchain: implement blockchain technology in existing supply chain systems for increased transparency and security

Examples: Scandit, Optoro, Relex, Xeneta

The 14 slides you need for your Logistics pitch deck

Every business is unique. Yet, venture capital firms and investors alike all agree on a common structure which we have laid out below.

Your Logistics pitch deck will likely be slightly different depending on whether you are pre-seed, seed or Series A+. Indeed, if you are pre-revenue for instance, you might not have early traction at all.

As rule of thumb, the more advanced your startup is the more content you should have in your pitch deck. Beware of endless, repetitive presentations: have clear titles, separate slides for each different topic.

Slide 1: Title

The title slide is the front page of your presentation.

Make sure your product or value proposition is clear from the outset: use an image of your product or, better, of your end-user application or instance (a consumer using your product).

Slide 2: The Problem

The problem slide is the “why” of your business. List here the 2/3 friction points you aim to fix with your product.

Slide 3: The Solution

Your startup builds and commercialises a product and/or a service which solves the problem laid out on slide 2. The solution slide should not explain in detail your product nor how it works. Instead, focus on the benefits for your customers.

Ideally, you should compare the pain points explained on slide 2 (the problem) to the benefits your solution brings to your customers. That way, it is crystal clear to investors your solution really adds value to potential customers.

Slide 4: Market Opportunity

In the market slide, you need to clearly identify 2 very important metrics:

- Market size: how big is your market?

- Market growth: how fast does your market grow?

If you are operating in a niche market, chances are that you will face some challenges: the information might not be publicly available. In any case, you should be able to make a high-level estimation of your market. Read our article on market sizing and how to estimate TAM, SAM and SOM for your startup.

When looking for these metrics, you have multiple sources of information: public reports, specialised press, etc. Even public companies publish press releases and annual reports including some of their proprietary market estimates so be sure to look there too.

For important data points on the Logistics industry, have a look at our introduction at the beginning of this article.

Slide 5: Competition

The competition slide follows the market overview and must answer 2 key questions:

How fragmented is your market?

Are there 3 big players sharing 90% market share or thousands of small players? Here, refer to public market reports and your own understanding of the competitive landscape.

A few questions you could ask yourself, among others:

- Who are your competitors?

- Are they local, regional, national or global?

- Are there any product alternatives to your product?

- What about their IP / technological advantage?

Where do you position yourself vs. competition?

Is your solution a game changer other competitors don’t have (yet)? Do you have competitors with similar products/services?

Ideally, you would create a small table with, for each type of competitors and their main characteristics.

For instance, do they all a global presence? Do they cover all the products you offer? What is their relative price positioning (expensive vs. accessible)?

Slide 6: Revenue model

The revenue slide of your Logistics pitch deck is very important. Now that we have clearly identified the problem you are solving and the benefits of your solution, let’s have a closer look at how you generate revenue.

Most Logistics companies are SaaS businesses: they sell software (on premise or cloud) solutions to B2Bs. If your business is SaaS, be sure to include your pricing model as well.

For more information on the different SaaS pricing strategies, be sure to read our article on the 5 most popular SaaS pricing models.

Slide 7: Product

Here we need to explain clearly how your product works from a technological point-of-view. Include in your Logistics pitch deck product slide things such as:

- whether you have a white-labelled solution or a proprietary back-end / database?

- do you hold any intellectual property at all?

- how many full time front/back-end engineers you have

- how much you invested already in your tech

- Etc.

Slide 8: Go-to-market

The go-to-market slide of your Logistics pitch deck explains how you acquire your customers. Acquisition can either be online or offline (or both):

- Online acquisition: pay-per-click campaigns (e.g. Google Ads), content & SEO, social media, etc.

- Offline acquisition: print ads, events & fairs, mail, etc.

Arguably, most Logistics startups mostly use an online acquisition, and more importantly a outbound acquisition strategy (see below). Online acquisition is sub-divided into 2 main categories itself:

- Inbound acquisition: customers convert from leads, at the top of funnel, who visit your landing page or website. These visitors (also referred to as “traffic”) either come from paid ads or organic sources (SEO, content)

- Outbound acquisition: customers are acquired via a sales team who actively reach out to potential customers. Because leads do not come by themselves but you reach out to them, this is an “outbound” strategy instead. Outbound is, for example, used by many B2B businesses (Enterprise SaaS for instance)

Note: to forecast customer acquisition, have a read at our article here (+ free template)

Slide 9: Traction

Only include the traction slide if you already have some early traction. Traction can be revenues for instance, but not necessarily (e.g. if you have sign-ups, free users, etc.).

As rule of thumb, the more historical performance you have, the more details you should give. For instance, if you start generating revenues 12 months ago and experienced a steady growth until then, include a bar chart of your revenues (or customers, patients, etc.) over the past 12 months.

Instead, if you have limited financial performance and/or numbers have been quite volatile, include today’s numbers instead.

Slide 10: Team

The team slide is one of the most important: investors invest in great teams before anything else.

The slide can either include the co-founding team only, but can also include key professionals and/or advisors as well.

Include key team members if they add real value.

Also, only include advisors if they are relevant to your industry. Do you have angel investors with significant experience who advise you on strategy?

For the team members’ details, keep it simple: name, position, years of experience and/or previous companies is more than enough.

Note: add a clickable link to the respective Linkedin profiles so investors can refer to a more exhaustive resume for your team members (if relevant)

Slide 11: Roadmap

The roadmap slide tells investors where you are going and how is product going to evolve in the future. You can either keep it high-level (e.g. your long-term strategy) or more detailed (e.g. the pipeline of the near-future product features).

Investors do not just invest in your product as it is today. For example, you might only have developed a MVP with limited features for early-adopters while your product could be tweaked and serve a much larger customer base in the future.

Also, you might be broadening the type of products you offer in the future. Or you might introduce premium services such as a subscription, or premium listing fees. All of these additional features are very important to add in your investment deck.

Slide 12: Financial Plan

Along with your product and the team, the financial plan slide is highly important. Unfortunately, many startups overlook the importance of financial projections in their Logistics pitch deck.

Think about your audience: investors (venture capital firms or angel investors) are financially literate individuals. As such, they invest in your business to generate returns. Logically, they care a lot about your financials and more especially, the expected financial performance of your business.

Do not expect investors to make up their own plan for your startup if you haven’t. As CEO, founder or entrepreneur alike, you should have a clear idea of where you are going.

As rule of thumb, the more advanced your startup is, the more granularity you should include here. Pre-seed startups might keep it short (1 slide) yet we recommend seed and Series A+ startups to include 2 slides instead.

Note: when presenting your financials, we recommend for pre-seed startup to show 3 years. Instead, seed and Series A+ startups should include 5 years projections as investors will likely ask for it for their own return analyses purposes.

Slide 13: Funding Ask

All pitch decks have a clear goal: raising capital from investors. The funding ask slide is where you clearly state your ask: how much are you raising?

Read our article on how to determine how much you should raise for you startup. While raising too little creates obvious problems, raising too much isn’t necessarily better.

On top of the amount, a good practice is to include a pie chart of where you will spend that money over a given period (your runway). Will you spend the bulk of it in product development to build your MVP? Or will you use a large portion in sales & marketing to commercialise your product and find product-market fit?

Our financial model templates include a cash burn dashboard where you can easily assess how much you should raise, and where you will spend your money. We also included charts ready to be included in your pitch deck. See how to use our cash burn dashboard here.

Slide 14: Contact

The contact slide is the last slide of your presentation. It has 2 main goals, this is where:

- You open the floor to questions from your audience when you are pitching

- You provide contacts (email and telephone) for investors who would only receive the PDF version of your presentation

4 Logistics Startups Pitch Deck Examples

Cloosiv (Odeko)

Odeko empowers cafes, bakeries, and coffee shops with mobile ordering and supply chain software to streamline operations and increase efficiency.

Fundraising round details:

- 2009

- Seed round

- $1M raised

Dutchie

Dutchie provides the most comprehensive and secure technology platform for dispensaries to effectively run and manage their business.

Fundraising round details:

- 2020

- Series B round

- $35M raised

7bridges

As an end-to-end logistics optimization platform, 7bridges will automate key processes for businesses that will allow them to streamline business processes.

Fundraising round details:

- Year: 2020

- Seed round

- $3.4M raised

Uber

This is the first pitch deck of Uber when they raised their seed in 2008. Whilst it is not the best design ever, and guidelines for pitch decks have changed quite a bit since then, we are including it here for illustrative purposes given the scale Uber has acquired today.

- Year: 2008

- Seed round

- $200K

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support