How To Create a Robotics Pitch Deck: Full Guide (+2 Examples)

The Boston Consulting Group (BCG) estimates the global robotics market to climb from $25 billion today (2021) to a whopping $160 billion by 2030. No wonder that robotics is one the fastest growing sectors globally, and presents endless growth opportunities for startups.

In this article, we show you how to build a unique pitch deck to impress investors and raise capital for your robotics startup.

Robotics in 2021: A Bref Overview

Before we dive into the slides you need for your robotics startup pitch deck, let’s first have a glance at the global robotics market today, and more especially:

- How big is the global robotics market?

- What are the key growth drivers?

How big is the global robotics market?

Robotics is a very diverse sector with many end-applications. From car manufacturing, warehousing, surgical assistants, personal assistants, autonomous vehicles and delivery vehicles, robots are reshaping many industries globally.

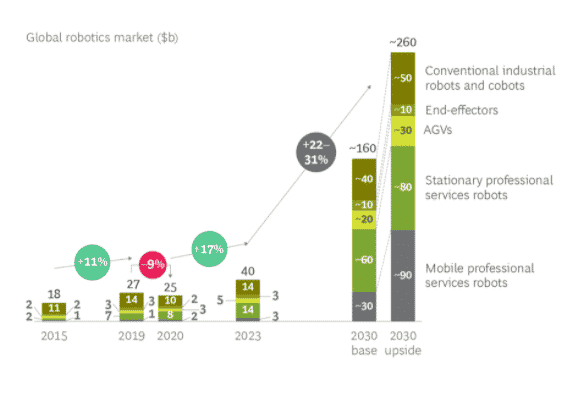

BCG offers an interesting view of the robotics market with 4 separate categories:

- Conventional industrial robots (e.g. car manufacturing)

- Stationary professional services (e.g. medical robot assistants)

- Mobile professional services (e.g. cleaning, construction)

- Automated guided vehicles or “AVGs” (e.g. warehousing, logistics)

As per BCG’s report, the global robotics market is estimated at $25 billion today (2021). What’s more impressive is the expected market growth of the robotics sector: from $25 billion, it is estimated to reach between $160 to $260 billion by 2030.

Interestingly, growth will mostly be driven by the recent professional services robots sub-sectors: the market will represent anywhere between 55% and 65% of the global robotics market.

What are the key growth drivers?

There are a number of underlying factors fuelling this impressive market growth of 20-25% annually over 2021-2030. They are:

- Changing consumer preferences

Consumers are increasingly asking for fast(er) deliveries of new products. This will lead to the development of new robot capabilities customized for specific manufacturing and logitiscs applications.

The pandemic also acted as a catalyzer: consumers increasingly prefer to shop online, fuelling growth in the robotics logistics and fulfillment sectors. The global warehouse robotics market alone is expected to grow from $5 billion today to $10 billion by 2026.

- Ageing population

The global population is getting older every day. This calls for a greater need for mobile robot applications, from medical to health (exercise, hygiene) and delivery (e.g. meals).

- Wages increase

The increase of wages, especially in lower-wage countries that historically benefitted from industrial globalization, will lead to a shortage of low-income, manual workers. This, in turn, will trigger a replacement of the same jobs with robots instead. BCG notes that factory wages in China have doubled since 2007 and increased by more than 50% in India.

- Artifical intelligence

Artificial intelligence offers many exciting (and worrying) innovations in various sectors worldwide. Robotics is undeniably one of them.

AI indeed allows for simplified human-to-robot interactions which will dramatically expand robot capabilities. The rollout of 5G will also allow for increased bandwidth and operational radius, maximizing robots’ scope.

14 Slides For Your Robotics Pitch Deck

Every business is unique. Yet, venture capital firms and investors alike all agree on a common structure which we have laid out below.

Your robotics tech pitch deck will likely be slightly different depending on whether you are pre-seed, seed, or Series A+. Indeed, if you are pre-revenue for instance, you might not have early traction at all.

As a rule of thumb, the more advanced your startup is the more content you should have in your robotics tech pitch deck. Beware of endless, repetitive presentations: have clear titles, separate slides for each different topic.

Slide 1: Title

The title slide is the front page of your presentation.

Make sure your product or value proposition is clear from the outset: use an image of your product or, better, of your end-user application or instance (a consumer using your product).

Slide 2: The Problem

The problem slide is the “why” of your business. List here the 2/3 friction points you aim to fix with your product.

Slide 3: The Solution

Your startup builds and commercializes a product and/or a service which solves the problem laid out on slide 2. The solution slide should not explain in detail your product nor how it works. Instead, focus on the benefits for your customers.

Ideally, you should compare the pain points explained on slide 2 (the problem) to the benefits your solution brings to your customers. That way, it is crystal clear to investors your solution really adds value to potential customers.

Slide 4: Market Opportunity

In the market slide, you need to clearly identify 2 very important metrics:

- Market size: how big is your market?

- Market growth: how fast does your market grow?

If you are operating in a niche market, chances are that you will face some challenges: the information might not be publicly available. In any case, you should be able to make a high-level estimation of your market. Read our article on market sizing and how to estimate TAM, SAM and SOM for your startup.

When looking for these metrics, you have multiple sources of information: public reports, specialized press, etc. Even public companies publish press releases and annual reports including some of their proprietary market estimates so be sure to look there too.

For important data points on the robotics tech industry, have a look at our introduction at the beginning of this article.

Slide 5: Competition

The competition slide follows the market overview and must answer 2 key questions:

How fragmented is your market?

Are there 3 big players sharing 90% market share or thousands of small players? Here, refer to public market reports and your own understanding of the competitive landscape.

A few questions you could ask yourself, among others:

- Who are your competitors?

- Are they local, regional, national or global?

- Are there any product alternatives to your product?

- What about their IP / technological advantage?

Where do you position yourself vs. competition?

Is your solution a game changer other competitors don’t have (yet)? Do you have competitors with similar products/services?

Ideally, you would create a small table with each type of competitor and their main characteristics.

For instance, do they all have a global presence? Do they cover all the products you offer? What is their relative price positioning (expensive vs. accessible)?

Slide 6: Revenue model

The revenue slide of your robotics tech pitch deck is very important. Now that we have clearly identified the problem you are solving and the benefits of your solution, let’s have a closer look at how you generate revenue.

Robotics tech companies have different business models. Most often, they either fall into the transaction-based or subscription revenue model categories. If you aren’t sure what is your startup’s revenue model, make sure to read our article on the 8 most popular revenue models explained.

Slide 7: Product

Here we need to explain clearly how your product works from a technological point-of-view. Include in your robotics tech pitch deck product slide things such as:

- whether you have a white-labelled solution or a proprietary back-end / database?

- do you hold any intellectual property at all?

- how many full time front/back-end engineers you have

- how much you invested already in your tech

- Etc.

Slide 8: Go-to-market

The go-to-market slide of your robotics tech pitch deck explains how you acquire your customers. Acquisition can either be online or offline (or both):

- Online acquisition: pay-per-click campaigns (e.g. Google Ads), content & SEO, social media, etc.

- Offline acquisition: print ads, events & fairs, mail, etc.

Arguably, most robotics tech startups mostly use an online acquisition, and more importantly an outbound acquisition strategy (see below). Online acquisition is sub-divided into 2 main categories itself:

- Inbound acquisition: customers convert from leads, at the top of funnel, who visit your landing page or website. These visitors (also referred to as “traffic”) either come from paid ads or organic sources (SEO, content)

- Outbound acquisition: customers are acquired via a sales team who actively reach out to potential customers. Because leads do not come by themselves but you reach out to them, this is an “outbound” strategy instead. Outbound is, for example, used by many B2B businesses (Enterprise SaaS for instance)

Note: to forecast customer acquisition, have a read at our article here (+ free template)

Slide 9: Traction

Only include the traction slide if you already have some early traction. Traction can be revenues for instance, but not necessarily (e.g. if you have sign-ups, free users, etc.).

As rule of thumb, the more historical performance you have, the more details you should give. For instance, if you start generating revenues 12 months ago and experienced a steady growth until then, include a bar chart of your revenues (or customers, patients, etc.) over the past 12 months.

Instead, if you have limited financial performance and/or numbers have been quite volatile, include today’s numbers instead.

Slide 10: Team

The team slide is one of the most important: investors invest in great teams before anything else.

The slide can either include the co-founding team only, but can also include key professionals and/or advisors as well.

Include key team members if they add real value.

Also, only include advisors if they are relevant to your industry. Do you have angel investors with significant experience who advise you on strategy?

For the team members’ details, keep it simple: name, position, years of experience and/or previous companies is more than enough.

Note: add a clickable link to the respective Linkedin profiles so investors can refer to a more exhaustive resume for your team members (if relevant)

Slide 11: Roadmap

The roadmap slide tells investors where you are going and how is product going to evolve in the future. You can either keep it high-level (e.g. your long-term strategy) or more detailed (e.g. the pipeline of the near-future product features).

Investors do not just invest in your product as it is today. For example, you might only have developed a MVP with limited features for early adopters while your product could be tweaked and serve a much larger customer base in the future.

Also, you might be broadening the type of products you offer in the future. Or you might introduce premium services such as a subscription, or premium listing fees. All of these additional features are very important to add to your investment deck.

Slide 12: Financial Plan

Along with your product and the team, the financial plan slide is highly important. Unfortunately, many startups overlook the importance of financial projections in their robotics pitch deck.

Think about your audience: investors (venture capital firms or angel investors) are financially literate individuals. As such, they invest in your business to generate returns. Logically, they care a lot about your financials and more especially, the expected financial performance of your business.

Do not expect investors to make up their own plan for your startup if you haven’t. As CEO, founder or entrepreneur alike, you should have a clear idea of where you are going.

As a rule of thumb, the more advanced your startup is, the more granularity you should include here. Pre-seed startups might keep it short (1 slide) yet we recommend seed and Series A+ startups to include 2 slides instead.

Note: when presenting your financials, we recommend for pre-seed startup to show 3 years. Instead, seed and Series A+ startups should include 5 years projections as investors will likely ask for it for their own return analyses purposes.

Slide 13: Funding Ask

All pitch decks have a clear goal: raising capital from investors. The funding ask slide is where you clearly state your ask: how much are you raising?

Read our article on how to determine how much you should raise for you startup. While raising too little creates obvious problems, raising too much isn’t necessarily better.

On top of the amount, a good practice is to include a pie chart of where you will spend that money over a given period (your runway). Will you spend the bulk of it in product development to build your MVP? Or will you use a large portion in sales & marketing to commercialize your product and find product-market fit?

Our financial model templates include a cash burn dashboard where you can easily assess how much you should raise, and where you will spend your money. We also included charts ready to be included in your pitch deck. See how to use our cash burn dashboard here.

Slide 14: Contact

The contact slide is the last slide of your presentation. It has 2 main goals, this is where:

- You open the floor to questions from your audience when you are pitching

- You provide contacts (email and telephone) for investors who would only receive the PDF version of your presentation

2 Robotics Tech Pitch Deck Examples

Butlr

Butlr offers a mix of wireless, battery-powered robots and artificial intelligence to track people’s movements indoors without violating their privacy for retail and commercial applications.

Fundraising round details:

- 2020

- Seed

- $1.2m in convertible notes

- See TechCrunch’s article

Mero Technologies

Originally an analytics platform that helps property managers improve the performance of their buildings, Mero has pivoted during the pandemic. It now provides sensors on consumables like soap, sanitizer, and monitoring of high traffic to reduce crowding.

Fundraising round details:

- 2020

- Seed

- $800k

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support